Competition Law: Understanding Regulations For Fair Market Practices

The term “competition law” refers to a body of laws and regulations that have been enacted to encourage and safeguard market behaviors that are just and open to all participants. Competition law is referred to as antitrust laws, competition regulation, or the law of competition. Its purpose is to ensure that markets remain open, competitive, and conducive to innovation while preventing anti-competitive behavior that harms consumers, competitors, or the entire market.

The purpose of competition law is to foster and maintain a competitive environment. It’s done through a set of principles, including merger control. Merger control under competition law involves scrutinizing and regulating mergers and acquisitions to prevent the creation of monopolies or the abuse of market power by dominant firms. The goal of competition law is to maintain a level playing field in markets and stop the concentration of economic power.

Competition law offers several benefits to society. Competition law motivates companies to develop and release cutting-edge goods and services to stand out from the competition, which in turn benefits customers by providing them with more options of higher quality. Competition law helps prevent price-fixing, bid-rigging, and other collusive practices that inflate prices, ensuring fair pricing for consumers.

Competition law has its limitations. Enforcing it is challenging, especially in international markets, where regulatory authorities have limited jurisdiction. The law’s effectiveness relies on the ability of regulators to detect and penalize anti-competitive behavior, which sometimes isn’t straightforward. The main disadvantage of competition regulations is that they limit a company’s expansion. The most prosperous firm, which affords the most expansion, struggles with its development, causing a halt in technological progress.

The goal of the state aid rules is to stop the government from getting in the way so much when giving certain businesses or industries special treatment that distorts or is likely to distort competition and hurts trade between Member States. The goal here is to ensure a level playing field for all market participants, preventing unfair advantages that harm competition.

Antitrust enforcers and the courts use the consumer welfare standard to figure out how a business practice or merger affects the customer. The overarching goal of competition law is to protect and promote the interests of consumers. Competition law’s ultimate goal is to improve consumers’ lives by providing them with more and better market options, lower prices, and higher quality goods and services. The global application and enforcement of competition law are based on a consumer-centric approach.

Table of Contents

- What Is Competition Law?

- Key Objectives of Competition Law

- What Is The Purpose Of Competition Law?

- What Are The Principles Of Merger Control Under Competition Law?

- What Are The Benefits Of Competition Law?

- What Are The Limitations Of Competition Law?

- Types Of Anti-Competitive Practices

- Merger Control Regulations

- What Are The Goals Of State Aid Regulations In The Context Of Competition Law?

- What Role Does Consumer Welfare Play In Shaping Competition Law Outcomes?

What Is Competition Law?

The Competition Law, known as the Antitrust Law in Canada, the US, and the European Union, is a body of legislation that seeks to eliminate market distortion resulting from business conduct that is anti-competitive. It is designed to guarantee that economies function fairly and competitively, benefiting consumers, competitors, and the economy.

Competition law encompasses a set of rules and regulations that are enacted at the national and international levels to maintain market competition, protect consumer interests, and foster economic growth. The laws are crucial for preventing monopolistic behavior, price-fixing conspiracies, bid-rigging, and other actions that undermine fair competition.

Competition is a cornerstone of commercial law and intersects with constitutional law in some legal systems, such as Canada, the US, and the European Union. It means that the rules of competition and the control of unfair competition practices are deeply ingrained in the foundational legal frameworks of these regions. The constitutional integration underscores the significance of competition law in ensuring that economic power remains dispersed and markets remain open and vibrant. Competition law plays a significant role in upholding the principles of democracy and free-market economics.

Key Objectives of Competition Law

The key objectives of competition law are listed below:

- Promoting Fair Competition: Competition law ensures that markets remain competitive by preventing monopolies and anti-competitive behaviors like collusion or cartel formation. This creates an environment where businesses can compete fairly based on the quality, price, and innovation of their products or services. By promoting fair competition, the law helps maintain market dynamism, ensuring that no company gains unfair advantages through unethical practices or excessive market control.

- Protecting Consumer Welfare: One of the primary objectives of competition law is to protect consumers from harmful business practices. These include price-fixing, product shortages, or reduced quality caused by limited competition. When markets are competitive, consumers benefit from a wider variety of choices, fair pricing, and better quality products and services. By preventing firms from engaging in anti-competitive actions, competition law safeguards consumer interests and promotes market efficiency.

- Encouraging Innovation: Healthy competition pushes businesses to innovate continuously. When companies must compete to attract customers, they are more likely to invest in research and development to create better products and services. Competition law plays a crucial role in fostering this environment by preventing anti-competitive practices that could discourage innovation. In markets where competition is strong, companies strive to outperform each other, leading to technological advancements and improvements in consumer experiences.

- Preventing Abuse of Market Power: Competition law is designed to prevent dominant firms from abusing their market position to unfairly harm competitors or exploit consumers. Dominant firms might engage in practices like predatory pricing, where they lower prices to drive competitors out of business, or exclusive agreements, which block competitors’ access to vital resources. By preventing these actions, competition law ensures that no single company can leverage its dominance to undermine competition or harm market dynamics.

- Ensuring Market Access: Another key objective of competition law is to maintain open markets where new and smaller businesses can compete effectively. Without regulation, dominant players might create barriers to entry that prevent other firms from entering the market. These barriers could include high startup costs, control over essential infrastructure, or exclusive agreements with suppliers. By reducing these obstacles, competition law ensures that markets are accessible to all, fostering innovation and diversity.

- Controlling Mergers and Acquisitions: Mergers and acquisitions can lead to excessive market concentration if not properly regulated. Competition law seeks to control these transactions to ensure they do not harm competition. Authorities review mergers to assess whether the new entity would dominate the market, reduce competition, or harm consumers by raising prices or lowering quality. This regulatory control ensures that mergers and acquisitions benefit the market rather than creating monopolistic conditions that stifle competition.

What Is The Purpose Of Competition Law?

The purpose of competition law is to maintain the integrity of the competition process in business. Its primary aim is to protect and preserve free and fair markets by addressing and preventing anti-competitive practices undertaken by companies. A body of laws is put in place to ensure that market dynamics remain conducive to fostering consumer welfare and promoting marketplace efficiencies.

The law of competition is designed to protect a broad spectrum of stakeholders. It aims to shield consumers from unfair pricing, limited choices, and poor-quality products or services that result from anti-competitive behavior. The laws ultimately benefit consumers by ensuring access to a variety of high-quality, reasonably priced goods and services and by promoting fair competition.

Market competitors are protected by competition laws as well. They prevent dominant firms from engaging in practices that unfairly stifle competition or drive smaller competitors out of business. The protection is critical for maintaining a level playing field for all businesses, allowing them to compete on merit rather than market power.

Competition laws contribute to the entire economic health of a nation by encouraging innovation, efficiency, and productivity. Competitive markets fuel economic expansion because they promote efficiency and innovation.

The fundamental principles of competition law are similar worldwide, but they aren’t uniform internationally. Each jurisdiction customizes its competition laws to address the specific economic and legal context of that region. The customization is evident when comparing competition laws in the EU, the US, Japan, China, South Korea, and other jurisdictions.

When Was Competition Law First Implemented?

Competition law was first implemented in the Lex Julia de Annona during the Roman Republic around 50 BC. The ancient regulation aimed to protect the corn trade by imposing heavy fines on individuals who intentionally and maliciously obstructed the supply of grain through ships. The objectives behind the early competition law were multifaceted, primarily driven by economic and social concerns.

The Lex Julia de Annona, enacted during the Roman Republic around 50 BC, had three primary objectives at its core. The law aimed to ensure economic stability by guaranteeing a consistent and affordable grain supply to the Roman population. It was a crucial recognition that disruptions in the grain trade lead to food scarcity and result in volatile and exorbitant prices, possibly causing unrest and instability in society.

The regulation sought to protect the integrity of the grain market itself. Actively discouraging collusion, hoarding, and any other behavior that artificially inflates grain prices or grants unfair advantages to particular people or groups in the market helps achieve it. Safeguarding the market’s transparency and fairness.

The Lex Julia de Annona was designed to promote fair competition among participants in the grain trade. The law imposed penalties on those who engaged in anti-competitive practices aimed at stifling competition or manipulating market conditions. The regulation aimed to ensure that the benefits of a well-functioning grain market were widely distributed by fostering an environment of fair competition, benefiting both producers and consumers alike. The three objectives underscore the early recognition of the importance of regulation in maintaining economic stability, market integrity, and fair competition in the ancient grain trade.

The Lex Julia de Annona was an early recognition of the need to regulate economic activities to protect consumers, maintain market integrity, and promote competition. It bears little resemblance to contemporary competition regulations in terms of complexity and scope. The guiding ideas laid the groundwork for the more robust and nuanced competition controls and antitrust legislation of today’s legal systems.

What Is The Role Of Cartels In Competition Law?

The role of cartels in competition law is to govern the supply of that product or service and to regulate or manipulate its prices. A cartel is an organization formed through a formal agreement among a group of producers of a particular good or service. The cartels consist of independent businesses or countries that, instead of competing, collaborate to achieve their collective objectives at the expense of market competition and consumer interests. Cartels are structured through formal agreements among their member entities, employing various strategies to manipulate markets to their advantage. The strategies include price fixing, market share allocation, bid-rigging, and output restriction.

One of the hallmark tactics of cartels is price fixing, where members conspire to establish and maintain specific price levels for their products or services. The practice eliminates price competition, leading to artificially inflated prices that benefit the cartel. Cartel members divide markets, customers, or regions among themselves. Each member assumes responsibility for serving a designated portion of the market. It reduces competitive pressures and secures specific market segments for each member, allowing them to maintain control.

Cartel participants engage in bid-rigging in situations involving procurement or project contracts. They coordinate their bids to manipulate the selection process, ensuring that one of the cartel members secures the contract. The corrupt practice undermines fair competition in the bidding process. Cartels impose strict limits on the production or supply of goods or services. They increase prices and profits by driving up demand through the use of artificial scarcity. The goal of these production quotas is to increase the profits of the cartel members.

The tactics collectively allow cartels to exert control over markets, diminish competition, and enhance their profitability at the expense of consumers and fair market practices. Regulatory bodies actively target and dismantle cartels to mitigate these harmful effects and promote a level playing field in the marketplace.

Cartels are considered illegal and are subject to regulatory enforcement, especially under antitrust laws such as the Sherman Act and the Clayton Act in the United States. The reason for their illegality is their adverse impact on consumers and market competition.

Cartels harm consumers by raising prices above competitive levels, restricting supply, and reducing choices. The lack of competition leads to a lack of innovation and higher prices for consumers. Regulatory bodies, such as the Organization for Economic Cooperation and Development (OECD), actively pursue cartels when they find evidence of anti-competitive practices, including price-fixing, output restrictions, market allocation, bid-rigging, or collusion in tenders.

Cartels help their members by giving them economies of scale, monopoly-like power, and higher margins on products and services they offer, but the favorable conditions come at the cost of competition and customer satisfaction. Cartels negatively impact market efficiency, innovation, and consumer welfare, making them a focal point of regulatory scrutiny and enforcement.

What Constitutes Abuse Of Dominance In Competition Law?

Abuse of dominance in competition law involves a range of practices deemed anticompetitive, typically exhibited by dominant companies to exploit their market power, thus harming competition, consumers, or other market participants. The practices are subject to scrutiny and legal action. Laws in the United States tend to penalize actions that help firms obtain or keep monopolies. The way it hurts or helps competition determines whether a behavior is “predatory” or “exclusionary.” It is important to differentiate between conduct that enhances efficiency, such as introducing superior or lower-cost products, and conduct that harms competition as a whole.

Harm to competition as a whole, not just to a single competitor, must be shown to prove illegal monopolization. The types of conduct that constitute monopolization include predatory pricing, exclusive dealing, loyalty discounts, tying or bundling, refusals to deal, and abuses of governmental processes.

Defendants facing allegations of abuse of dominance assert various defenses, including demonstrating pro-competitive effects such as cost reduction, higher-quality products, increased investment, or preventing free-riding. The plaintiff in a monopolization case has the burden of proving anticompetitive effects, while the defendant has the burden of proving procompetitive justifications, and the plaintiff has the burden of proving that the anticompetitive effects outweigh the procompetitive benefits.

Specific forms of abuse include rebate schemes, tying and bundling, exclusive dealing, predatory pricing, price or margin squeezes, refusals to deal, denied access to essential facilities, predatory product design, failure to disclose new technology, price discrimination, exploitative prices or terms of supply, abuse of administrative or government processes, and mergers and acquisitions as exclusionary practices. Practices have varying pro-competitive and anticompetitive effects, and their legality depends on factors such as market share, foreclosure levels, and competitive impact. The legal framework aims to promote competition, prevent monopolistic practices, and protect consumers and competitors by ensuring fair business conduct among dominant firms.

What Are The Principles Of Merger Control Under Competition Law?

The principles of merger control under competition law are listed below.

- Thresholds for Notification: Not all acquisitions and mergers need to be reported under the HSR Act (Hart-Scott-Rodino Act). Businesses are required to meet certain financial thresholds to trigger the notification requirement. The thresholds are updated annually. Parties must submit a premerger report and notification form to the FTC (Federal Trade Commission) and the DOJ (Department of Justice) if the agreement meets these thresholds.

- Waiting Periods: There’s a statutory waiting period during which the antitrust agencies evaluate the merger proposal once the notification is filed. The length of the waiting period varies depending on the complexity of the transaction, but it generally lasts 30 days for most transactions.

- Antitrust Review: The FTC and the DOJ review mergers to assess whether they’re likely to greatly decrease competition in violation of antitrust laws. Market concentration, anticompetitive effects, and mitigation strategies are going to be assessed as part of the investigation.

- Horizontal and Vertical Mergers: The agencies differentiate between horizontal mergers (mergers of competitors) and vertical mergers (mergers of firms in different stages of the supply chain). Horizontal mergers are closely scrutinized because they have a more direct impact on market competition, while vertical mergers are assessed for potential anticompetitive effects.

- Market Definition: Merger reviews involve defining relevant product and geographic markets to assess market concentration. The analysis helps determine the potential impact on competition.

- Remedies: The antitrust agencies are able to collaborate with the merging parties to reach a consent decree that provides remedies to address anti-competitive issues if they have reason to believe the merger is going to diminish competition. Common remedies include divestitures or behavioral commitments.

- Challenges: The FTC or DOJ challenges a merger in court to block it in some cases. The agencies have the burden of proving that the merger substantially lessens competition.

- Cooperation with International Authorities: The FTC and DOJ cooperate with international antitrust authorities, especially for mergers with global implications. It ensures a coordinated approach to addressing anticompetitive effects.

- Penalties for Non-Compliance: Failure to follow the HSR Act’s announcement and waiting time requirements results in big civil fines. The agencies take offenses seriously and seek large fines.

- Evolving Guidelines: Merger control guidelines and policies change over time. Parties considering mergers must stay informed about the latest guidance from the FTC and DOJ.

What Is The Significance Of Market Definition In Competition Law Cases?

The market definition in competition law cases holds significance in providing the framework for assessing market dynamics, competition, and the potential for anti-competitive behavior. It helps ensure fair competition, protect consumers, and maintain a competitive marketplace. A market definition holds significant importance in competition law cases by providing the structure for evaluating market dynamics, competition, and the potential for anti-competitive behavior, with the ultimate aim of preserving fair and competitive marketplaces.

Market definition holds immense significance in competition law cases, serving as a foundational concept that underpins various critical aspects of antitrust analysis. Market definition performs the pivotal role of determining the boundaries within which competition takes place. It involves precisely identifying the specific product or service in question and delineating its geographical scope. Precision is of utmost importance as it forms the basis for scrutinizing various competition law issues.

Market definition is central to the assessment of market power, a fundamental element in competition law. Market definition triggers heightened scrutiny and necessitates the imposition of additional regulations to prevent the abuse of such market power. It aids in the identification of both existing and potential competitors within the market. Identification is vital for assessing the potential harm to competition arising from actions such as mergers or certain business practices.

Utilizing metrics such as the Herfindahl-Hirschman Index (HHI), market definition plays a crucial role in market concentration analysis. A market characterized by high concentration, where a few firms exert significant control, raises concerns about diminished competition, prompting regulatory intervention. Market definition is indispensable when evaluating instances of anti-competitive conduct, such as price-fixing or abuse of market dominance. It provides the framework for assessing whether such actions have a detrimental impact on competition within the defined market.

Market definition is a key factor in establishing entry barriers, which prevent new entrants from entering the market and encourage monopolistic practices. Identifying and analyzing these barriers is an essential aspect of antitrust analysis. Market definition guides the evaluation of the potential effects of mergers, acquisitions, and collaborations. Regulators must assess whether these transactions reduce competition within the defined market.

Competition law focuses on geographic markets in certain cases, especially in industries characterized by localized competition. Market definition aids in establishing the geographic scope of competition, which is crucial for evaluating regional monopolies or anti-competitive practices. It serves the overarching objective of safeguarding consumer welfare by ensuring the presence of competitive markets. It assists in determining whether anti-competitive behavior leads to higher prices, reduced choices, or diminished product quality, all of which are going to negatively impact consumers.

Clearly defined markets provide legal clarity for businesses, regulators, and courts alike. They create a common understanding of the competitive landscape, facilitating the assessment of compliance with competition laws. Market definition is a cornerstone in competition law, providing the structure for evaluating market dynamics, competition, and the potential for anti-competitive behavior with the ultimate aim of preserving fair and competitive marketplaces.

How Does Antitrust Regulation Impact Market Competition?

Antitrust regulation impacts market competition by enforcing regulations that forbid conduct that is harmful to consumers and the competitive landscape. Antitrust laws are designed to prohibit business practices that unreasonably deprive consumers of the benefits of competition, leading to higher prices for inferior products and services. The overarching objective is achieved through various mechanisms and impacts on market competition.

Antitrust laws foster competition by preventing monopolistic behavior and promoting a level playing field for businesses. They prohibit anti-competitive practices such as price-fixing, market allocation agreements, and monopolization. The regulations create an environment where businesses must compete fairly, leading to improved product quality, innovation, and competitive pricing.

One significant impact of antitrust regulation is the prevention of monopolies and the breakup of existing monopolies when necessary. Monopolies stifle competition by allowing a single company to dictate prices and control supply, resulting in consumer exploitation. The breakup of the Standard Oil Company in the early 20th century served as evidence that antitrust laws break up monopolies to restore competition.

Antitrust laws scrutinize mergers and acquisitions to ensure they don’t lead to anti-competitive market concentration. Regulatory bodies evaluate the potential effects of these transactions on market competition. They have the authority to impose restrictions or block mergers when it is necessary to maintain a competitive market.

Consumers benefit from antitrust regulation because it increases market transparency and discourages dishonest business tactics. Companies are compelled to provide accurate information, avoid deceptive advertising, and refrain from anti-competitive conduct that harms consumer’s interests.

Antitrust laws are a cornerstone of market competition. They prohibit practices that hinder competition, break up monopolies, scrutinize mergers, and ensure transparency and fairness. Enforcing these laws protects consumers’ interests, promotes innovation, and maintains a market where customers are rewarded with competitive pricing and superior products and services.

How Does Price Fixing Relate To Competition Law Enforcement?

Price fixing relates to competition law enforcement as it represents an anti-competitive practice that undermines fair market competition. Price fixing occurs when competitors, whether through written agreements, verbal understandings, or implied conduct, conspire to manipulate the prices or price levels of products or services.

Price fixing is a practice where competitors conspire to control prices. Price fixing is universally condemned under competition law. Price-fixing pacts of any kind, whether they establish a floor, a ceiling, or a range, are illegal under antitrust laws. Government authorities, such as the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the United States, are steadfast in their pursuit of those suspected of engaging in price-fixing activities. Criminal penalties for such conduct are severe, with individuals facing the possibility of lengthy prison sentences of up to ten years, along with substantial fines that reach up to $1 million for individuals and up to $100 million for companies. Civil enforcement by regulatory bodies is capable of increasing fines and legal consequences.

One of the challenges in combating price fixing is the secrecy associated with these agreements. Authorities uncover such conspiracies through circumstantial evidence. Similar contract terms or pricing behavior among direct competitors without legitimate, independent justifications, for instance, give rise to suspicions of illegal price fixing. Invitations by one competitor to coordinate prices, such as openly announcing intentions to raise prices if a rival does the same, are regarded as evidence of a conspiracy.

The difference between price fixing and normal market conditions must be distinguished. Not all instances of similar pricing or simultaneous price changes result from a conspiracy. Factors such as identical products or fluctuations in supply and demand lead to uniform pricing without any conspiratorial behavior. Setting prices includes more than just talking about prices. It includes talking about credit terms, shipping costs, warranties, discounts, and interest rates on loans as well.

Defendants in price-fixing cases are not allowed to use the defense that their pricing was reasonable, necessary to prevent aggressive competition, or promoted competition as a means of justification. A straightforward price-fixing agreement usually offers no legal defense. Agreements among competitors to restrict production, sales, or output are equally unlawful, as they diminish supply and artificially inflate prices, posing a significant threat to fair competition, similar to direct price fixing.

Price fixing is a blatant violation of competition law that undermines the principles of free and fair competition. Government authorities pursue and penalize it aggressively to protect consumers and maintain competitive markets. The tax implications of competition law vary by jurisdiction but are able to include fines and penalties as part of the entire legal consequences for anti-competitive behavior. Prices in competitive markets must be set by supply and demand dynamics rather than by price fixing amongst competitors.

How Do Vertical Restraints Fall Under The Purview Of Competition Law?

Vertical restraints fall under the purview of competition law because they encompass deals or practices among companies that work in many different parts of the supply chain, such as manufacturers and suppliers. The deals impact competition within markets, making them subject to regulatory scrutiny under competition laws. Competition regulators closely examine these restraints to strike a balance between promoting economic efficiency and preventing anti-competitive behavior that has the potential to harm competition within markets.

Vertical restraints involve agreements or actions that occur at various levels of production, shipment, or delivery. An example of a vertical restraint is an agreement between a manufacturer and distributor that restricts consumer choice in the market. Exclusive distribution agreements, resale price maintenance (RPM), and tie arrangements are all examples of a particular type of restriction.

Competition law exists to safeguard competitive markets and protect consumer interests. Vertical restraints have anti-competitive effects by limiting competition among downstream entities, reducing consumer choice, and potentially leading to higher prices. They fall squarely under the purview of antitrust law, given their potential for harm.

Vertical restraints are particularly concerning when they involve entities with significant market power. Abuses of market power, such as exclusionary practices that impede rivals’ entry or expansion, occur when a dominant manufacturer imposes restraints on distributors or retailers.

A central concern of competition law is ensuring consumer welfare. Vertical restraints that result in higher prices, restricted product availability, or reduced quality have the potential to harm consumers. The government closely looks at these restrictions to see how they affect consumers.

Vertical restraints are problematic for competition, but there are times when they make sense from an efficiency standpoint. They improve supply chain efficiency, uphold dependable product quality, or expand the reach of product distribution. Competition authorities weigh these pro-competitive benefits against any potential anti-competitive effects when evaluating the legality of such restraints.

The treatment of vertical restraints varies by jurisdiction. The rule of reason analysis takes into account the competitive impact, while the per se approach simply declares that certain restraints are anti-competitive. Differences in legal frameworks make it crucial for businesses to navigate vertical restraints in accordance with the specific laws of their jurisdiction.

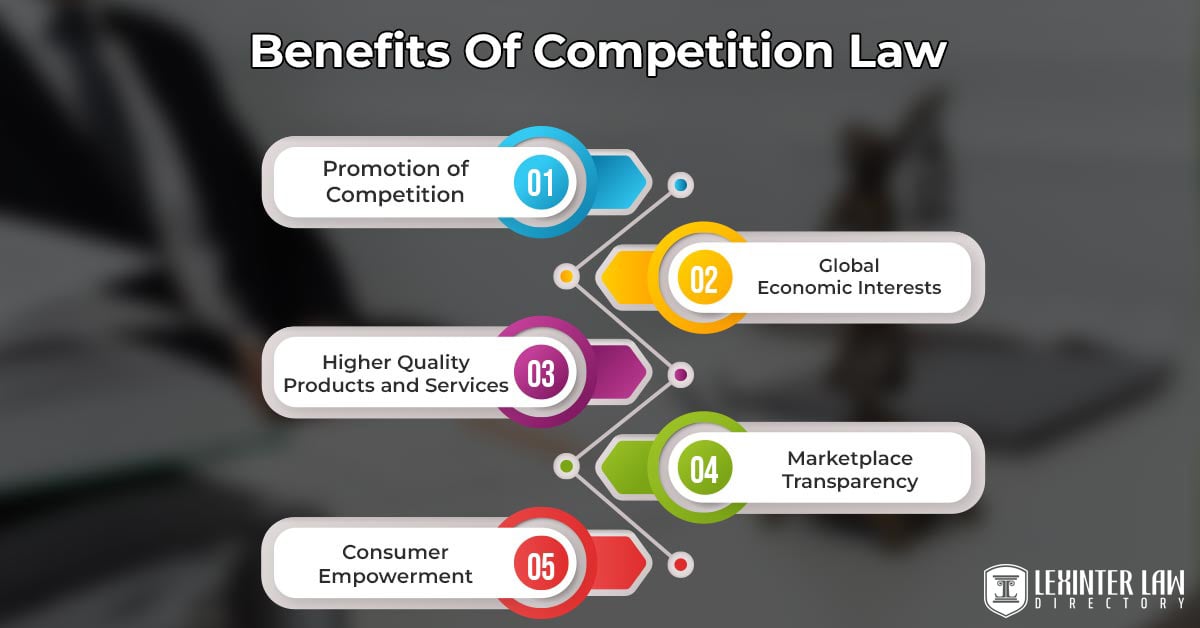

What Are The Benefits Of Competition Law?

The benefits of competition law are listed below:

- Promotion of Competition: The purpose of competition law is to both encourage and maintain a healthy level of rivalry in commercial settings. It ensures that businesses operate in an atmosphere in which there is a healthy level of competition that is protected.

- Lower Prices: Consumers benefit from lower costs when there is a healthy level of competition among sellers. Businesses implement price cuts in an effort to compete for consumer dollars and win their business.

- Higher Quality Products and Services: Competition incentivizes businesses to improve the quality of their products and services. Businesses that want to stay ahead of the competition in meeting customer needs focus on developing new and improved products and services.

- Greater Choice: Consumers benefit from a wider range of choices when competition is robust. A competitive market encourages the introduction of new products and services, giving consumers more options to select from.

- Innovation: Competition stimulates innovation as companies invest in research and development to stay ahead of their rivals. The innovation that emerges as a result has the potential to improve people’s everyday lives in many ways.

- Consumer Empowerment: Competition empowers consumers by providing them with the ability to make informed choices based on price, quality, and preferences. Consumers influence market dynamics through their purchasing decisions.

- Market Efficiency: Competition fosters market efficiency by encouraging the allocation of resources to their most productive uses. The existence of competition increases the likelihood that inefficient businesses are going to collapse, freeing up resources for more effective ones.

- Prevention of Anti-Competitive Behavior: Competition law serves as a safeguard against anti-competitive practices such as abuse of dominance, price fixing, bid rigging, and customer allocation. Consumers and businesses alike suffer as a result of such actions.

- Economic Growth: Healthy competition contributes to economic growth by driving productivity improvements, attracting investments, and creating jobs. A competitive market is associated with a vibrant and growing economy.

- Consumer Protection: Competition law protects consumers from unfair or deceptive practices that arise in monopolistic or anti-competitive markets. It guarantees that businesses treat customers fairly.

- Global Economic Interests: A robust competition framework enhances a nation’s economic and security interests on a global scale. It helps protect domestic industries and prevent foreign domination without benefiting local consumers.

- Marketplace Transparency: Competition law promotes transparency in the marketplace, making it easier for consumers to access information about products, prices, and services.

What Are The Limitations Of Competition Law?

The limitations of competition law are listed below.

- Wrong Conception of Coercive Monopolies: Competition law aims to prevent monopolies from forming, assuming that large organizations naturally lead to monopolistic behavior. The reality is that true monopolies require government regulation to maintain entry barriers. Competition prevents monopolies from emerging in free markets, making some aspects of antitrust laws seem unnecessary.

- Vague Antitrust Laws: Antitrust laws are vague and open to interpretation, which leads to uncertainty for businesses. Regulators have significant discretion in determining what constitutes antitrust violations, creating potential challenges for companies trying to comply with the law.

- Impediment to Mergers and Acquisitions: Competition law hinders the efficient growth of organizations through mergers and acquisitions. Large companies are able to get economies of scale and run their businesses more efficiently, but antitrust laws stop them from doing so, which limits the benefits to the economy.

- Reduction in Consumer Power: Free markets are the most effective way to meet consumer needs, as they allow consumers to make choices based on their preferences. Antitrust laws imply that government officials understand consumer interests better than the consumers themselves, diminishing consumer influence in the marketplace.

- Potential for Government Collusion and Corruption: Antitrust laws are manipulated to create entry barriers and suppress competition, but these actions require government intervention. Such conspiracies between businesses and government officials undermine consumer interests and create a system of favoritism and corruption.

- Inhibition of Innovation: Competition law restricts a company’s growth beyond a certain point, potentially stifling technological advancement and innovation. Companies with the most resources are prevented from expanding, causing a blockage in economic development. Innovation suffers, and industries become less competitive on a global scale.

Types Of Anti-Competitive Practices

The different types of anti-competitive practices are listed below.

- Price Fixing: Price fixing happens when the competing companies decide to set or maintain prices for the goods or the services at a certain level, rather than allowing market forces to dictate prices. This agreement can artificially inflate prices, preventing competition from driving them down. It harms consumers by reducing their ability to purchase goods at competitive prices, and it distorts the market by limiting the natural mechanisms of supply and demand.

- Market Allocation: Market allocation happens when competitors agree to divide markets among themselves, either by geographic location, product type, or customer group. Instead of competing, they agree not to encroach on each other’s assigned territory or customer base. This arrangement allows them to avoid competition and maintain higher prices or reduced service offerings, ultimately harming consumers who are denied choices and fair pricing.

- Abuse of Dominant Position: The abuse of a dominant position involves a company with significant market power using its influence to restrict competition or exploit consumers. This can involve predatory pricing, exclusive contracts, or refusal to deal with certain parties. Firms in a dominant position may use their power to engage in unfair practices that limit competition, drive out smaller competitors, or prevent new firms from entering the market, leading to a reduction in innovation and consumer choice.

Price Fixing

Price fixing is one of the most severe forms of anti-competitive behavior, where two or more competitors collude to manipulate pricing rather than allow free market forces to determine them. This practice can take several forms, including setting minimum or fixed prices, agreeing on specific price ranges, or coordinating when and how much to raise prices.

For example, two companies in the same industry may agree not to lower their prices below a certain level, which prevents consumers from benefiting from competitive price reductions. In more complex cases, firms might coordinate on periodic price hikes to ensure that all participants in the collusion maintain higher profit margins without the threat of being undercut by competitors.

Price fixing fundamentally disrupts the competitive process, where businesses are supposed to compete by offering better prices, higher quality, or more innovative products. By eliminating this competition, price fixing leads to artificially inflated prices, causing consumers to pay more than they would in a truly competitive market.

It reduces consumer welfare, as individuals have fewer affordable options and no alternative for more reasonably priced products or services. Moreover, price fixing stifles innovation, as businesses no longer need to improve their products or services to attract customers, knowing that prices are controlled across the board. This lack of competition reduces overall market dynamism and efficiency.

Regulatory authorities, such as competition commissions or antitrust bodies, treat price fixing as a serious violation of competition laws because of its direct and far-reaching negative impact on both consumers and market health. In most jurisdictions, including the United States, the European Union, and many other regions, price fixing is strictly prohibited and carries severe penalties, including hefty fines and imprisonment for company executives involved in such schemes. The prohibition of price fixing aims to preserve market integrity, protect consumer interests, and promote a healthy, competitive economic environment where companies are incentivized to compete fairly and innovate continuously.

Market Allocation

Market allocation is another form of anti-competitive conduct where competitors agree to divide markets among themselves, allowing each to operate in its own designated space without competition from others. This division can occur along geographic lines, product categories, or even customer segments. For instance, two companies might agree that one will only sell its products in the northern region of a country while the other will focus on the southern region. Alternatively, companies could agree to serve distinct customer groups, ensuring that they do not compete for the same clientele.

Market allocation undermines the natural competitive forces that drive innovation, better pricing, and higher-quality services. When companies carve up markets, they effectively create mini-monopolies in their designated areas. Consumers within these territories or segments suffer because they no longer have access to competitive alternatives.

As a result, prices tend to remain high, service quality may decline, and innovation is stifled since companies feel no pressure to improve when their market share is guaranteed. This practice not only limits consumer choice but also significantly hinders overall market efficiency by creating artificial barriers that prevent new entrants or competitors from challenging incumbents in those regions or segments.

Market allocation agreements are illegal under competition laws because they distort the competitive landscape. Authorities, such as the Federal Trade Commission (FTC) in the United States and the European Commission in the EU, actively investigate and prosecute such agreements. Violations often lead to large fines and legal sanctions, as regulators aim to restore competitive market conditions and protect consumers from the detrimental effects of reduced competition. The enforcement of these laws helps ensure that businesses must continuously compete for market share through innovation, better customer service, and competitive pricing.

Abuse Of Dominant Position

Abuse of a dominant position occurs when a company that holds significant market power engages in practices intended to suppress competition or exploit consumers. A dominant firm has the ability to influence market conditions due to its size, market share, or control over essential resources. While holding a dominant position is not illegal in itself, using that position to engage in anti-competitive practices is a violation of competition law.

One common form of abuse is predatory pricing, where a dominant firm intentionally lowers its prices to unsustainably low levels, often below cost, to drive competitors out of the market. Once rivals have been eliminated or significantly weakened, the dominant firm raises prices again, often higher than they were before. Another tactic is the use of exclusive agreements, where the dominant firm requires suppliers or customers to only work with them, effectively blocking competitors from accessing critical inputs or markets. Such exclusivity can prevent smaller firms from competing effectively, reinforcing the dominant firm’s market control.

Firms may also engage in refusals to deal, where they deny competitors access to essential facilities or services needed to operate in the market. For instance, a telecommunications company with control over vital infrastructure might refuse to allow competing firms access to its network, preventing them from providing competing services. These exclusionary practices limit consumer choice and prevent competitors from gaining a foothold in the market, ultimately leading to higher prices, reduced innovation, and less diversity in the marketplace.

Competition laws aim to prevent such abuses by regulating the behavior of dominant firms. Authorities closely monitor these firms and intervene when their conduct is deemed to harm competition or exploit consumers. Penalties for abuse of dominance can include fines, restrictions on business practices, and even the forced breakup of a company in extreme cases. The objective of regulating dominant firms is to ensure that markets remain open and competitive, allowing for the entry of new players and providing consumers with more choices, lower prices, and better services.

Merger Control Regulations

Listed below are the regulations of Merger Control:

- Antitrust Review: Competition authorities conduct a comprehensive analysis of the proposed merger to determine its potential effects on market competition. This review focuses on whether the merger will create or enhance a dominant market position, reduce competition, or harm consumers by leading to higher prices, lower quality, or decreased innovation. Authorities assess factors such as market share, the level of market concentration, and barriers to entry for new competitors. The goal is to ensure that mergers do not harm the competitive landscape of the market.

- Remedies and Conditions: When a merger raises competition concerns but is not harmful enough to be blocked entirely, authorities may approve it with specific conditions or remedies. These remedies often involve structural changes, such as the divestiture of certain business units, assets, or intellectual property to preserve competition in the affected markets. Authorities may also impose behavioral commitments, such as requiring the merged entity to provide fair access to certain services or resources to competitors. These conditions are designed to maintain market balance and prevent anti-competitive outcomes.

- Merger Blocking: When a merger is determined to pose a substantial threat to competition, regulators have the authority to block the transaction. This can happen when the merger would create a near-monopoly, significantly reduce the number of competitors, or give the combined entity too much market power. Blocking a merger is considered a last resort when no feasible remedies or conditions can adequately address the competition concerns. Blocking ensures that consumers and smaller competitors are protected from the negative effects of excessive market concentration.

- International Cooperation: In cases involving mergers with global implications, competition authorities from different countries collaborate to assess the merger’s impact across international markets. This cooperation ensures that mergers that span multiple jurisdictions do not escape scrutiny and that consistent regulatory standards are applied. International coordination is essential for preventing anti-competitive outcomes in global industries, such as technology, pharmaceuticals, and telecommunications, where companies often operate across borders.

- Judicial Review: If a company disagrees with a competition authority’s decision regarding a merger, it can seek judicial review. Courts play a critical role in reviewing the legality and fairness of regulatory decisions, ensuring that they adhere to legal standards and principles. Judicial review offers a mechanism for businesses to challenge decisions that they believe were unjustly made, providing a system of checks and balances in the merger control process. Courts assess whether the competition authorities acted within their legal authority and whether their decisions were based on sufficient evidence and proper procedure.

Purpose Of Merger Control

The different purposes of merger control are listed below.

- Preventing Market Dominance: Ensures that mergers do not create monopolies or dominant firms that could control entire markets, limit competition, and harm the overall market structure.

- Protecting Consumer Welfare: Aims to protect consumers from potential negative impacts of mergers, such as higher prices, lower-quality products, or fewer choices in the marketplace due to reduced competition.

- Promoting Fair Competition: Ensures that businesses of all sizes can compete on a level playing field, preventing larger firms from using mergers to unfairly strengthen their market position and eliminate smaller competitors.

- Fostering Innovation: Maintains healthy competition in the market, which encourages companies to constantly innovate, improve their products, and introduce new services to stay ahead of their competitors.

- Preventing Abuse of Power: Prevents companies from using mergers to gain excessive control and engage in anti-competitive practices, such as predatory pricing or restricting access to key resources, which can harm both competitors and consumers.

Preventing Market Dominance

A key objective of merger control is to prevent the formation of monopolies or dominant firms that could control significant portions of a market. When two large companies merge, their combined market power may enable them to dominate a market, reducing competition. This can lead to fewer businesses being able to compete effectively, as the dominant company gains too much influence. Dominant firms can control pricing, manipulate supply chains, or even dictate the terms under which smaller companies must operate. This imbalance creates a market where innovation slows down, prices rise, and consumer options diminish. By enforcing merger control, competition authorities make sure that no single firm gains too much market power, which keeps the market open and dynamic.

Protecting Consumer Welfare

Another important purpose of merger control is to protect consumers from the negative consequences that can result from reduced competition. When companies merge and limit competition, the end result can be harmful to consumers. This often leads to higher prices, as there is less competitive pressure on companies to keep costs low. In addition, consumers may face fewer choices and lower-quality products, as businesses have less incentive to innovate or improve. Without adequate competition, companies may prioritize profits over delivering value to consumers. By regulating mergers, authorities ensure that consumers continue to benefit from fair pricing, product variety, and improved services, which results in a healthier market for everyone.

Promoting Fair Competition

Merger control is vital for promoting fair competition, especially for smaller businesses that may struggle to compete against large, well-established firms. Without proper regulation, mergers can allow large companies to grow even larger, eliminating smaller competitors in the process. This can lead to a market dominated by a few big players, making it harder for new businesses to enter and compete. Large firms may also use their expanded resources and influence to create unfair barriers to entry, making the market less competitive overall. Merger control ensures that all companies, regardless of size, have the opportunity to succeed based on their merits, such as offering better products or services. This prevents large corporations from using mergers to create unfair advantages and allows smaller businesses to compete fairly.

Fostering Innovation

Innovation is a key driver of economic growth and consumer benefits, and merger control helps ensure that competition continues to fuel innovation. In markets with little competition, companies may feel less pressure to improve their products or develop new technologies. A lack of competition allows dominant firms to maintain the status quo, leading to stagnation in innovation. Merger control keeps markets competitive by preventing companies from using mergers to reduce the number of competitors. This keeps the pressure on businesses to innovate and offer better products, services, and technology to consumers. In a competitive market, companies must stay ahead by constantly improving, which leads to greater advancements that benefit consumers and the economy as a whole.

Preventing Abuse Of Power

Merger control also plays a crucial role in preventing companies from using mergers to consolidate too much power and engage in anti-competitive practices. When a company becomes too large after a merger, it may engage in unfair tactics, such as predatory pricing—where prices are temporarily lowered to drive competitors out of the market. Once competition is eliminated, the company can raise prices again. Another tactic is entering into exclusive agreements with suppliers or distributors, making it difficult for competitors to access essential goods or services. These practices harm both competitors and consumers, as they limit competition and drive up prices. By regulating mergers, authorities ensure that companies cannot use their market power to engage in such harmful practices, maintaining a fair and competitive marketplace for all players.

Notification Thresholds

Notification thresholds are an essential part of merger control regulations. They define when companies involved in a merger must notify competition authorities about their planned transaction. These thresholds help ensure that only mergers with a significant potential impact on market competition are reviewed, while smaller mergers that are unlikely to affect competition can proceed without delay.

The thresholds are generally based on financial criteria such as the annual turnover (revenue) of the companies involved or the value of the merger itself. Each jurisdiction, such as the European Union, the United States, or specific countries, sets its own thresholds to determine when a merger must be reported to competition authorities. For example, in the United States, the Hart-Scott-Rodino (HSR) Act outlines specific financial criteria that, if met, require companies to submit their merger plans for review by the Federal Trade Commission (FTC) or the Department of Justice (DOJ).

The purpose of these notification thresholds is to filter out smaller mergers that are unlikely to harm competition. By focusing on larger mergers, competition authorities can allocate their resources effectively and ensure that transactions with the greatest potential impact on market dynamics are carefully examined. Smaller mergers, which typically have less impact on competition, are not subject to the same level of scrutiny, allowing businesses to move forward more quickly with their plans.

Once a merger meets or exceeds the notification thresholds, the companies involved must file detailed information about the merger with the relevant competition authorities. This includes financial data, market information, and details about how the merger might affect competition. The authorities then review this information to determine whether the merger should proceed as planned, require modifications, or be blocked entirely if it threatens to significantly reduce competition.

In summary, notification thresholds are an important tool in ensuring that competition authorities can focus on mergers with the potential to impact markets. They streamline the review process by requiring only significant mergers to be assessed while allowing smaller, less impactful deals to go through without heavy regulatory involvement.

Key Examples Of Merger Cases

The key examples of significant merger cases are listed below:

- AT&T and Time Warner Merger: This high-profile vertical merger combined one of the largest telecommunications providers with a major media and content producer, raising concerns about the potential for reduced competition in the distribution of media content.

- Bayer and Monsanto Merger: The merger of two global leaders in the pharmaceutical and agricultural sectors sparked fears about reduced competition in critical markets like seeds, pesticides, and crop protection products, leading to the imposition of divestiture conditions.

- Facebook and Instagram Acquisition: Facebook’s acquisition of Instagram raised long-term concerns about the concentration of power in the social media industry, with regulators questioning whether the deal gave Facebook too much control over the social media market.

- Staples and Office Depot Merger: The proposed merger of the two largest office supply retailers in the United States was blocked by regulators due to concerns about reduced competition, higher prices, and fewer options for consumers, particularly in the business-to-business market.

AT&T And Time Warner Merger

The AT&T and Time Warner merger was a significant vertical merger that combined a telecommunications giant with a major media producer. AT&T provides communication services and owns distribution channels, while Time Warner is known for creating popular media content. The merger raised concerns that AT&T could use its control over distribution to favor Time Warner’s content, potentially disadvantaging competitors in the media industry.

Regulators closely examined whether this merger would harm competition by limiting other media companies’ access to AT&T’s platforms or by reducing consumer choice. After a lengthy legal battle, the merger was allowed to proceed, but it highlighted the complexities involved in regulating vertical mergers where companies operate at different levels of the supply chain.

Bayer And Monsanto Merger

The Bayer and Monsanto merger was one of the most closely watched cases in the agricultural and pharmaceutical sectors. Bayer, a global pharmaceutical company, sought to acquire Monsanto, a leading agricultural biotechnology firm known for its seed and pesticide products.

This merger sparked concerns about reduced competition in key agricultural markets, especially for seeds and crop protection products. The European Commission approved the merger, but only after Bayer agreed to divest certain business units to maintain competition in the sector. The case is a prime example of how regulators can impose conditions on mergers to prevent anti-competitive outcomes and ensure that no single company controls too much of the market.

Facebook And Instagram Acquisition

When Facebook acquired Instagram in 2012, it was initially considered a smaller transaction. However, as Instagram grew into a social media powerhouse, this acquisition drew increased scrutiny from regulators. The concern is that Facebook’s control over Instagram, along with its ownership of WhatsApp, gives it an outsized influence over the social media industry, potentially stifling competition.

While the merger was approved at the time, regulators are now reconsidering whether it allowed Facebook to gain too much market dominance, limiting competitors’ ability to grow and reducing options for consumers.

Staples And Office Depot Merger

The Staples and Office Depot merger was a high-profile case where the Federal Trade Commission (FTC) blocked the deal to preserve competition in the office supplies market. Staples and Office Depot were the two largest office supply retailers in the United States, and their merger would have created a near-monopoly, particularly affecting large businesses that purchase supplies in bulk.

The FTC argued that the merger would lead to higher prices and fewer choices for consumers. This case demonstrates how regulators can step in to block mergers that would significantly harm competition and result in negative outcomes for consumers.

What Are The Goals Of State Aid Regulations In The Context Of Competition Law?

The goals of state aid regulations in the context of competition law are to regulate and control the financial assistance that governments provide to particular businesses or industries. The regulations are intended to prevent distortions of competition within the European Union’s internal market that result from government subsidies or preferential treatment.

State aid regulations in the European Union (EU) serve several important goals. They’re focused on preventing distortions in competition within the EU’s single market. The regulations aim to ensure that government subsidies, grants, or financial support don’t create an unfair competitive advantage for specific companies or sectors, thus maintaining a level playing field for all businesses operating in the EU. State aid regulations promote economic efficiency by discouraging wasteful or inefficient state support that artificially bolsters uncompetitive companies or sectors. The regulations encourage innovation and the development of new technologies by fostering competition, as subsidies that discourage competition and innovation are prohibited.

They are designed to protect consumer interests, ensuring that government interventions don’t result in higher prices, reduced product quality, or limited choices for consumers. Preserving the integrity of the single market is another vital goal of state aid regulations. They prevent member states from providing aid that disrupts the free flow of goods, services, and capital across EU borders. The regulations prioritize transparency, requiring governments to provide information about support measures. Transparency allows competitors and the European Commission to scrutinize and assess whether such aid complies with EU rules. State aid regulations play a role in maintaining fiscal discipline among member states. They impose limits on the extent to which governments offer financial assistance to companies, subject to strict criteria and notification procedures, to ensure responsible fiscal management.

Competition law is primarily focused on ensuring competitive markets, preventing anticompetitive behavior, and protecting consumer welfare. State aid regulations do intersect with competition law in some cases (e.g. when state aid distorts competition), but their primary goals and mechanisms differ. State aid regulations are more focused on the direct financial assistance that governments provide, while competition law addresses a wider range of anti-competitive practices and market behaviors.

What Is The Concept Of Essential Facilities In Competition Law Analysis?

The concept of “essential facilities” in competition law analysis refers to a legal doctrine that addresses anti-competitive behavior, particularly in cases involving monopolists with significant market power. The doctrine is primarily concerned with preventing dominant firms from exploiting their control over crucial infrastructure or facilities to stifle competition or deny entry to competitors in a given market. The essential facilities doctrine, a vital component of competition laws, lays out specific criteria that must be met when making a legal claim related to monopolization. The essential elements encompass monopolist control, the inability to duplicate, denial of access, the feasibility of providing access, and the absence of regulatory oversight.

There must be a clear demonstration that the facility in question is under the control of a dominant firm or monopolist possessing substantial market power. It is imperative to establish that potential competitors face practical or reasonable obstacles when attempting to duplicate or reproduce the essential facility, emphasizing the presence of significant barriers to entry. The doctrine necessitates proof that the monopolist has actively denied access to the facility to one or more competitors, thereby curbing their ability to function effectively within the market.

Competition is encouraged, but only if it is demonstrated that opening up the monopolist’s facilities to other businesses doesn’t compromise the monopolist’s ability to continue meeting the needs of its current clientele. The absence of regulatory oversight from an agency vested with the authority to mandate access becomes a crucial element, particularly highlighted in the landmark U.S. Supreme Court case Verizon v. Trinko. The components collectively form the framework of the essential facilities doctrine, a fundamental aspect of competition law aimed at safeguarding fair and open competition in markets characterized by dominant players.

Establishing these elements is challenging for potential plaintiffs, as they must demonstrate that the facility in question is genuinely “essential” for market entry and competition. The facility must be indispensable to the extent that smaller firms find it impossible to compete effectively without access. Plaintiffs must show that granting access to the facility doesn’t disrupt the monopolist’s ability to serve its own customers.

The concept of essential facilities finds its roots in U.S. antitrust law, but it has been adopted, with variations, into the legal systems of other countries, including the United Kingdom, Australia, South Africa, and the European Union. It has been applied in various contexts, including cases involving natural monopolies such as utilities, transportation facilities, and even intellectual property rights such as patents and copyrights, when a firm uses them to limit competition.

The essential facilities doctrine seeks to ensure that dominant firms refrain from abusing their control over critical facilities or infrastructure to impede competition, restrict market entry, and harm consumer welfare. It is an important tool in competition law to maintain fair and open markets.

What Are The Implications Of Collusion Within The Framework Of Competition Law?

Collusion within the framework of competition law has implications, as it constitutes a fundamental violation of antitrust regulations aimed at preserving fair competition. The implications include reduced competition, higher prices, lower product quality, consumer harm, market distortion, and economic inefficiency.

Collusion within the framework of competition law has far-reaching implications. Collusion leads to reduced competition, which frequently occurs in the form of price-fixing agreements or market allocation schemes. The reduction in competition eliminates the rivalry that drives lower prices, better product quality, and innovation, ultimately harming consumers who are left with fewer choices and higher costs for goods and services.

The immediate consequence of collusion is higher prices, as competitors agree to artificially inflate prices, resulting in economic detriment to consumers. Collusion stifles product quality and innovation. There’s less incentive to excel or introduce innovative features when competitors no longer need to compete vigorously to attract customers, potentially leading to lower product quality and slower technological advancements.

Consumer harm extends to both individual consumers and businesses that rely on fair competition. Collusion disrupts the natural functioning of markets by manipulating prices and quality, thereby undermining market efficiency. Companies and individuals involved in collusion face significant legal consequences, with competition authorities actively investigating and prosecuting antitrust violations, potentially resulting in substantial fines and even criminal charges.

Collusion tarnished the reputation of the companies involved, eroding trust and credibility in the business community and among consumers. It introduces economic inefficiency by allocating resources based on agreements rather than market demand, leading to overproduction or underproduction of goods and services and contributing to economic waste. Market manipulation tactics, such as bid rigging or customer allocation, are part of collusion schemes, deceiving buyers and creating artificial market conditions.

Collusion has international repercussions, affecting global trade and competition. Many countries have antitrust laws and international bodies such as the World Trade Organization (WTO) work to promote fair competition in global markets. Collusion disrupts the fundamental principles of fair competition, resulting in numerous adverse consequences for both consumers and the broader economic landscape.

How Do Competition Lawyers Manage Cases Regarding Competition Law?

Competition lawyers manage cases regarding competition law by employing a multifaceted approach. Their responsibilities encompass various facets of competition law cases, including investigations, counsel, merger clearances, and claim defense. Competition lawyers employ a comprehensive approach when managing cases related to competition law. Their role encompasses several key responsibilities. They initiate thorough investigations into their client’s business operations, aiming to uncover any potential violations of antitrust or competition laws. It involves a meticulous examination of business practices, agreements, and conduct to ensure strict compliance with competition regulations.

Competition lawyers provide invaluable advice and counsel to their clients regarding various agreements and arrangements. They meticulously analyze proposed agreements, assessing their potential impact on market competition. Their guidance is instrumental in structuring agreements that align with the principles of competition law, promoting fair and open markets.

Legal professionals navigate the intricate terrain of merger and acquisition clearances. They assist clients in obtaining regulatory approvals for such transactions, particularly focusing on compliance with complex merger control regulations. Their goal is to ensure that mergers and acquisitions don’t result in anticompetitive consequences, and they work diligently to secure approvals from relevant competition authorities.

Competition lawyers play a crucial role in defending their clients against allegations of antitrust or competition law violations. Lawyers fight hard for their client’s interests when they have to deal with these kinds of claims. They represent clients in competition appeal tribunals, drawing upon their expertise to construct compelling defenses. It involves challenging allegations of anticompetitive behavior or practices and ensuring that the client’s rights are safeguarded throughout legal proceedings. The ability of competition lawyers to take a holistic view is crucial for them to successfully navigate the nuances of competition law, safeguard their client’s interests, and uphold the values of free and open competition.

Competition lawyers are instrumental in guiding businesses through the intricate landscape of competition law. Their proactive approach to conducting investigations, providing sound legal counsel, obtaining necessary clearances, and defending against claims ensures that their clients navigate the challenges of competition law while maintaining compliance and competitiveness in the market. Their expertise is essential in safeguarding their clients’ interests and preserving fair competition.

How Do Leniency Programs Encourage Cooperation In Competition Law Investigations?

Leniency programs encourage cooperation in competition law investigations to identify illegal cartels. The programs are aimed at offering incentives for companies or people taking part in anticompetitive behavior, such as hardcore cartels, to come forward voluntarily and disclose their involvement in exchange for reduced penalties or immunity from prosecution.

Leniency programs create a compelling motivation for cartel members to initiate self-reporting. The allure of reduced penalties or the shield of prosecution immunity serves as a potent inducement for companies or individuals to expose their cartel activities to competition authorities.

The initiation of self-reports catalyzes the investigative process and aids in evidence gathering. The proactive disclosure jumpstarts investigations and assists competition authorities in uncovering cartels that have remained concealed. Leniency applicants have the obligation to provide critical evidence, which is critically important for substantiating the existence and impact of the cartel.

The programs feature a graduated penalty framework. The initial participant to come forward enjoys the most substantial leniency, potentially including full immunity from fines. Subsequent applicants benefit from reduced fines or penalties compared to those who don’t cooperate. It creates a competitive race among cartel members to be the first to seek leniency, leading to a breakdown of trust and cooperation within the cartel.

Leniency programs extend their reach internationally. Cases involving international cartels require close coordination between national competition authorities. Leniency applicants in one jurisdiction seek leniency in others, fostering a collaborative network that is able to dismantle international cartels.

The effectiveness of these programs depends on a robust political commitment to combat cartels. Developing countries stand to gain from adopting leniency programs, but the success of such initiatives hinges on a resolute commitment to enforcing competition law and fostering a culture of cooperation among all stakeholders involved.

Leniency programs play a pivotal function in investigations involving competition law by incentivizing cartel participants to come forward, providing essential evidence, and creating a powerful deterrent effect. Their success hinges on the effectiveness of penalty structures, global cooperation, and the dedication of authorities to combat unlawful competition.

How Do Dominant Market Positions Attract Scrutiny Under Competition Law?

Dominant market positions attract scrutiny under competition law because they have the potential to harm competition, consumers, and innovation. The goal of competition authorities is to keep markets competitive for the benefit of all parties by closely monitoring and responding to anti-competitive behavior by dominant firms.

Dominant market positions are subject to rigorous scrutiny under competition law due to their potential to wield significant influence over market dynamics. The positions grant firms substantial market power, allowing them to shape prices and control trade conditions. Competition law regulates business practices to ensure that no one company has an unfair advantage over another. It addresses concerns related to anticompetitive conduct that arise from these positions, including practices such as price-fixing and exclusive dealings, which hinder competition, limit consumer options, and lead to inflated prices.

The dominant group sets up roadblocks to prevent newcomers from entering the market. Controlling essential facilities and using aggressive advertising are just two examples of the many barriers that stifle competition and innovation. Consumers suffer as a result of these kinds of actions because they tend to drive up prices, lower product quality, and limit available options. Technology stagnates because dominant firms are less motivated to innovate without any rivals to keep them on their toes.

Market distortion is another consequence of unchecked dominance, as prices and supply are artificially manipulated. Similar actions to monopolies happen when companies have a big share of the market and use it to hurt competitors and customers. Many jurisdictions have specific legal obligations for dominant firms, such as Article 102 of the Treaty on the Functioning of the European Union, which prevents abuses of dominant positions and mandates compliance.

Competition law considers the broader public interest when scrutinizing dominant market positions. A single dominant firm with unchecked power impacts employment, economic stability, and social welfare. Scrutiny thus aims to balance the interests of all stakeholders while preserving fair and open competition. The scrutiny of dominant market positions is essential to prevent anti-competitive practices and ensure that consumers benefit from a diverse range of choices at competitive prices.

How Do Exemptions Apply To Certain Agreements Under Competition Law?

Exemptions apply to certain agreements under competition law by recognizing that a one-size-fits-all approach is not suitable for all sectors or types of agreements. Exemptions are crafted to accommodate specific industries, agreements, or activities. The exemptions serve various purposes, including the protection of certain rights, the promotion of public interest, and the maintenance of essential services.

Collective bargaining agreements and other types of labor agreements are often exempt from certain requirements under competition law. The justification for the exemption comes from the fact that workers must be allowed to bargain for higher pay, better working conditions, and more perks. Competition law recognizes the importance of allowing labor unions and employers the freedom to negotiate without undue interference by exempting these agreements.

Agriculture has its own unique supply chain dynamics, so it benefits from exemptions or rules that are applicable to that sector. The exemptions are carefully tailored to address specific factors such as the necessity to ensure food security, support farming communities, and promote rural development. That is why they are open to cooperative agreements and other practices that benefit agriculture.

The transportation industry uses industry-specific competition rules for certain subsets of the industry, such as air travel or shipping. The exemptions are grounded in the recognition of the need for regulated safety standards and the smooth operation of transportation services. They strike a delicate balance by allowing competition authorities to promote competition while ensuring the reliability and safety of transportation services.

Exemptions are warranted for industries deemed essential, such as energy, telecommunications, and postal services, due to their vital roles in society. The exceptions were carefully thought out to make sure that everyone gets access to basic services while controlling their behavior, which has the potential to hurt competition. They include steps to stop energy companies from raising prices or to make sure that everyone, even those in remote areas, is able to afford to use telecommunications services.