Real Estate Law: Understanding Ownership, Contracts, And Disputes

Real estate law is a branch of civil law that governs how people hold, use, and convey interests in real property. Courts apply law on real estate to resolve conflicts involving titles, boundaries, and land use rights. Legal rules guide how people establish rights to property and protect individuals’ interests through formal deeds and contracts. Professionals working in the field ensure transactions comply with statutory requirements. Clear guidelines maintain fairness and stability for anyone who holds or transfers land.

The purpose of real estate law is to safeguard secure property transactions while protecting each party’s rights to property. Statutory rules reduce fraud risk by requiring accurate documentation and public recording of deeds. Clear procedures make property acquisition transparent and reliable for individuals and businesses. Well-structured rules resolve disputes over ownership or encumbrances without unnecessary conflict. Courts interpret the rules to balance private ownership interests with the community’s need for orderly development and fair taxation.

Real estate laws are crucial to the legal system because they uphold confidence in property ownership and encourage market stability. Reliable enforcement of rights to property allows economic growth through safe investments and secure financing. Judges use statutory rules to settle conflicts over boundaries, defects, or usage limitations. Well-defined principles create predictable outcomes in transactions, strengthening public trust. Legal clarity keeps communities stable and helps governments manage zoning, taxation, and infrastructure in line with public interests.

Real estate laws classify property into real property and personal property based on mobility and attachment to land. Real property includes land, structures, and fixtures that stay permanently connected, while movable items remain personal property. Different estates, such as fee simple, life estates, and easements, define specific levels of control or usage. The numerus clausus doctrine limits legal recognition to clearly defined property rights. The system ensures owners, buyers, and courts share a consistent understanding of legal interests.

Table of Contents

- What Is Real Estate Law?

- What Is The Purpose Of Real Estate Law?

- How Does Real Estate Law Support The Legal And Economic System?

- What Kinds Of Ownership Structures Are Recognized In Real Estate Law?

- What Legal Processes Govern The Sale And Purchase Of Real Estate?

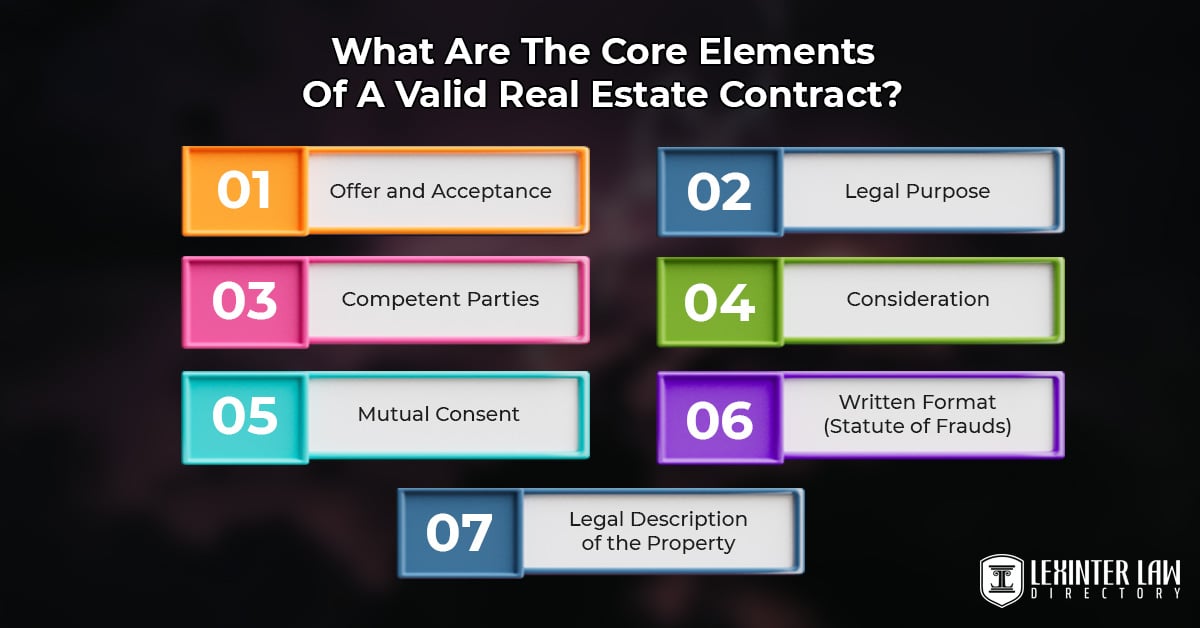

- What Are The Core Elements Of A Valid Real Estate Contract?

- How Does Real Estate Law Regulate Sales Agreements And Closing Terms?

- How Does Real Estate Law Protect Against Fraudulent Transactions?

- How Does Real Estate Law Address Zoning And Land Use Regulations?

- What Are The Legal Requirements For Registering Property Titles?

What Is Real Estate Law?

Real estate law is a regulatory framework governing land and permanent structures involving ownership transfer, development, leasing, and permitted usage. All land or building transactions must follow legal standards establishing a valid title, clear boundaries, and lawful occupancy for all parties. Contractual documentation, zoning rules, financing rules, environmental protections, tax duties, and dispute resolution procedures protect market participants. Real estate law ensures transparency, encourages secure investment, supports community development, and restricts unlawful encroachments on privately or publicly owned properties.

Real estate law defines buyer and seller rights during property negotiation, contract formation, closing, and post-closing phases for every valid transaction. Real estate law, which governs legal rights involving land use, property development, and ownership, secures valid interests through clear regulations. Accurate deed drafting, proper title recording, lien checks, and disclosure requirements strengthen legal certainty for owners and buyers. Landlord‑tenant obligations, foreclosure remedies, easement use, and zoning restrictions remain integral elements of real estate law enforcement.

What Is The Purpose Of Real Estate Law?

The purpose of real estate law is to protect ownership interests by providing clear title rules and secure transaction frameworks that benefit all parties involved. Market participants rely on statutes preventing fraudulent claims, hidden liens, or boundary disputes. Buyers and sellers experience confidence when legal standards support fair dealings. Community development thrives when property rights receive protection through consistently enforced real estate law requirements, balancing private and public interests.

Real estate law aims to balance private ownership with broader community needs through zoning restrictions and environmental safeguards. Each transaction reflects legal obligations, ensuring fair practices among buyers, sellers, landlords, and tenants. Real estate law requires mandatory disclosures, accurate deeds, and lawful recordation. Market stability emerges when stakeholders trust regulations that prevent deceptive actions that jeopardize investments or neighborhood welfare through unclear ownership claims.

Real estate law works by defining land use rights, obligations, and remedies for owners, tenants, or developers operating in regulated environments. Courts and agencies interpret legal disputes when parties contest boundaries, title validity, or easement access. Title searches identify hidden issues, while public records maintain ownership transparency. Legal frameworks support smooth conveyancing, secure mortgages, and fair lease terms, strengthening community confidence in property markets everywhere.

How Does Real Estate Law Support The Legal And Economic System?

Real estate law supports the legal and economic system by creating secure frameworks for property transactions and ownership verification. Buyers, sellers, and lenders trust clear titles and predictable dispute resolution when disagreements appear. Transparent rules help maintain fair competition and prevent fraudulent claims undermining confidence. Stable property dealings stimulate investments and development. Legal certainty generated by real estate law strengthens the wider economy and community growth.

The importance of property law for the legal system rests in its protection of property rights through structured rules and enforcement options. Courts resolve boundary conflicts, trespass claims, or contract breaches by applying clear standards. Zoning ordinances and land-use restrictions derive legitimacy from property law principles. Public agencies rely on consistent application to manage urban planning. Property rights encourage responsible ownership, balancing individual freedoms with community needs. Real estate law defines clear frameworks governing transactions involving land, buildings, and permanent improvements within every community. Registries maintain accurate records so ownership stays transparent for all parties. The field represents a type of law relied upon by lenders, investors, and courts to protect interests. Title searches, insurance, and compliance with local codes build confidence. Strong property dealings attract investment and support economic growth through consistent legal stability.

How Is Property Ownership Established Under Real Estate Law?

Property ownership is established under real estate law through valid deed execution, proper delivery, and recording in public registries, which provide constructive notice.

Clear ownership begins with valid deed execution and appropriate delivery. Title registration in public records confirms ownership. Title searches reveal potential encumbrances like liens or easements before ownership finalization. Title insurance adds protection. Courts resolve disputes when conflicting claims threaten ownership. Real estate law guarantees ownership clarity through validated conveyancing procedures.

Legal title grants owners rights through deed transfer, registry recording, or statutory systems such as the Torrens title under real estate law. Deed transfers occur via warranty, quitclaim, or grant deeds, depending on jurisdictional requirements. Public registries, governed by real estate law, create constructive notice for future buyers. Adverse possession establishes ownership after continuous possession meeting the statutory criteria. All conveyancing and registration processes align with established real estate law frameworks, ensuring secure property ownership.

What Are The Legal Rights And Responsibilities Of Property Owners?

The six legal rights and responsibilities of property owners are listed below.

- Right to Possess and Exclude: Property owners protect land boundaries through real estate law, keeping trespassers away from private areas without consent. Real estate law supports owners demanding the removal of unlawful occupants through court action if necessary. Owners respect local easements that grant utility companies or emergency responders access rights without harming full possession privileges.

- Duty to Keep Property Safe: Real estate law expects property owners to maintain safe structures for tenants, guests, or lawful visitors at all times. Regular inspections help prevent dangerous conditions leading to injuries. Property owners fix hazards quickly and follow building codes. Courts hold careless owners responsible for harm caused by ignored maintenance obligations or unsafe conditions.

- Right to Develop and Use Land: Property owners enjoy the freedom to develop land following real estate law, zoning rules, and environmental standards. Agricultural, residential, or commercial activities reflect local ordinances that balance private use with community welfare. Neighbors benefit when owners comply with restrictions preventing harmful nuisances. Proper land use supports property value, neighborhood safety, and legal harmony.

- Obligation to Pay Taxes and Fees: Property owners pay property taxes required by real estate law, supporting roads, schools, and municipal services. Unpaid taxes trigger liens, leading to forced sales through local tax authorities. Responsible owners check assessments for accuracy and file appeals if errors appear. Real estate law ensures public services operate effectively through fair contributions from every property.

- Right to Transfer Ownership: Real estate law allows property owners to sell, lease, or pass real estate interests to family or third parties. Clear titles attract buyers while defective titles cause disputes or delays. Owners record deeds publicly to show valid ownership chains. Transparency builds market confidence, encouraging fair deals. Accurate records ensure trust during negotiations and closing.

- Responsibility to Clear Title Problems: Property owners investigate liens, boundary disputes, or claims to guarantee a marketable title, as required by real estate law. Title insurance helps detect hidden problems threatening ownership. Resolving conflicts avoids court battles later. Owners file quiet title actions when competing interests appear. Resolving problems ensures smooth refinancing, sale, or inheritance without costly delays.

What Kinds Of Ownership Structures Are Recognized In Real Estate Law?

The six kinds of ownership structures recognized in real estate law are listed below.

- Sole Ownership: Single‑party ownership in real estate law grants full control over property use, transfer, and financing decisions. Ownership held entirely by one individual eliminates co-owner conflicts and simplifies management processes. Estate transfer requires a valid will or an intestacy process. Sole ownership remains susceptible to personal liability and necessitates careful estate planning to avoid probate complications.

- Joint Tenancy: An equal interest ownership structure within real estate law grants the right of survivorship among owners upon a co-owner’s death. Four unities—time, title, interest, and possession—must exist under real estate law for validity. Survivorship bypasses probate, transferring the deceased owner’s interest directly to surviving owners. All co-owners share control equally and must consent to property decisions or encumbrances.

- Tenancy in Common: Fractional interest ownership under real estate law allows co-owners to hold unequal shares and transfer their interest independently. Each co-owner sells their share without impacting the interests of the other. No survivorship exists within tenancy in common under real estate law, so the deceased owner’s share passes through their estate. Arrangement suits investment partnerships.

- Tenancy by the Entirety: Spousal ownership recognized in real estate law enables married couples to own undivided property interests with survivorship benefits. Real estate law prohibits creditors of one spouse from attaching property individually. Conveyances require spouses’ signatures. The death of a spouse automatically vests full title in the surviving spouse. Divorce converts tenancy by the entirety into tenancy in common.

- Community Property: Spousal ownership recognized in certain jurisdictions under real estate law treats property acquired during marriage as jointly owned equally. Equal rights apply in nine US community property states. Transfers at death require probate unless the spouse retains a survivorship interest under real estate law. Community property adds complexity in cases of separate premarital or inherited property classification.

- Life Estate and Remainder Interests: A life estate arrangement in real estate law grants one party property rights during lifetime, while the remainder interest vests in another. A life tenant enjoys possession, use, and income rights under real estate law but is not permitted to transfer full ownership. The fee simple title automatically vests in the remainder person when the life tenant dies. Structure aids estate and tax planning.

Real estate law handles shared and joint ownership through four main forms: joint tenancy, tenancy in common, tenancy by the entirety, and community property. Joint tenancy requires four unities—time, title, interest, and possession—to ensure equal shares and survivorship rights. Tenancy in common permits unequal interests and independent transfers but lacks survivorship. Tenancy by the entirety protects married couples with survivorship and stronger creditor protection. Community property states split marital assets equally, giving real estate law unique estate and tax implications.

Real estate law imposes shared responsibilities for mortgage payments, taxes, and repairs among co-owners, creating potential liability. Partition actions divide or sell property when co-owners disagree on management or exit strategies. Creditors claim ownership shares differently under joint tenancy and tenancy in common, affecting risk levels. Joint tenancy and tenancy by the entirety avoid probate, streamlining inheritance. Tenancy in common allows bequests through a will. Real estate law urges written co-ownership agreements to prevent future legal conflicts.

How Does Real Estate Law Define Real Property Versus Personal Property?

Real estate law defines real property versus personal property by recognizing the difference between immovable interests and movable assets under ownership rights. Real property includes land plus anything permanently attached, such as buildings, fixtures, improvements, or easements that remain connected to the land. Real estate law applies the MARIA test to decide if personal items transform into fixtures. Courts consider attachment, intent, and adaptation factors when determining whether built-in improvements legally belong with the land during a valid ownership transfer.

Real estate law treats personal property as movable or intangible things that are not fixed permanently to land, including antiques, furniture, vehicles, patents, or bank accounts. Personal property generally transfers through informal means like bills of sale or simple delivery rather than formal deeds required for real property. Tax rules differ because real property incurs annual property taxes, while personal property has separate tax obligations. Real estate law ensures correct classification to protect rights and support effective estate planning strategies.

What Legal Processes Govern The Sale And Purchase Of Real Estate?

Real estate law governs the sale and purchase of real estate through a series of defined legal steps, protecting all parties involved. Buyers submit a written offer, with earnest money, which sellers accept, reject, or counter. Real estate law requires a binding purchase and sale agreement that includes essential terms like price, conditions, and deadlines. Buyers perform due diligence by conducting inspections, securing financing, and verifying a clear title. Escrow or a conveyancer safely holds funds until every legal requirement is met.

Real estate law ensures that all contingencies, such as financing, inspection, or appraisal, are either satisfied or waived before the closing stage begins. Closing legally finalizes the transaction through the signing of the deed, mortgage papers, and settlement documents while transferring funds. Title insurance is issued to protect against future defects, and the deed is publicly recorded to establish clear ownership. Real estate law mandates recording to secure the buyer’s priority rights and ensures sellers receive proceeds as buyers take legal possession.

How Are Deeds, Titles, And Transfer Instruments Regulated In Real Estate Law?

Real estate law regulates deeds, titles, and transfer instruments by imposing clear legal formalities to ensure valid property ownership. Deeds must be written, signed by the grantor, include a precise legal description, and be properly delivered. Real estate law requires notarization and public recording to establish constructive notice and priority of claims. Different types of deeds, like general warranty or quitclaim, offer various levels of title protection. Recording statutes protect buyers by securing ownership rights against future disputes.

Real estate law treats titles as the legal concept representing the “bundle of rights” transferred by properly executed deeds. Recording deeds and other transfer instruments secures legal title and protects the new owner from competing claims. Transfer instruments, including mortgages, easements, and liens, must comply with statutory requirements for form, execution, and delivery. Torrens systems in some jurisdictions allow the title to vest through registration alone. Real estate law ensures that ownership transfers remain transparent, enforceable, and legally protected in every transaction.

Real estate law protects buyers and lenders by requiring title searches and title insurance before closing transactions involving deeds or liens. Title insurance provides coverage for defects not listed in the public record, offering an added layer of security. Mortgage lenders demand recorded security instruments to protect their interests if a borrower defaults. Courts rely on the public registry to resolve disputes and determine the priority of claims. Real estate law relies on strict recording and formalities so the property market remains orderly, predictable, and legally sound for all stakeholders involved.

What Legal Safeguards Ensure Clear Title In A Real Estate Deal?

The legal safeguards that ensure clear title in a real estate deal are listed below.

- Title Search Process: The thorough title searches under real estate law identify any recorded liens, easements, judgments, or ownership claims before closing. Title searchers examine public records to trace the chain of ownership, uncover defects such as outstanding mortgages or tax liens, and ensure sellers legitimately possess transferable property interests. The process prevents transferring an unclear title to buyers.

- Title Insurance Protection: Lender’s and owner’s title insurance under real estate law safeguards against defects or unknown claims revealed post‑closing. Policies indemnify the lender or owner by covering legal expenses or financial loss stemming from hidden encumbrances, forged deeds, or undisclosed heirs. Title insurance promotes trust in property markets by reducing the risk of future title-related litigation.

- Quiet Title Actions: Quiet title actions under real estate law are court proceedings resolving title disputes or boundary conflicts for disputed properties. Courts adjudicate rightful ownership by dismissing other claimants, clearing title defects like adverse possession claims, missing heirs, or forged transfers. Quiet title lawsuits convert clouded titles into marketable titles ready for a secure future sale or financing.

- Bankruptcy and Judgment Searches: Bankruptcy and judgment searches required by real estate law help identify pending bankruptcies or court judgments affecting sellers or previous owners. The searches safeguard buyers by uncovering potential creditors’ claims that lien or void the transferred title. Title professionals routinely incorporate such searches into title examination to ensure no encumbrances remain.

- Deed Verification and Notarization: Deed verification and notarization under real estate law confirm authenticity, correct execution, and legal compliance of deed instruments. Notaries certify signers’ identities and proper witnessing, reducing the risk of fraudulent deed filings or impersonation. Validated deeds create evidentiary weight, preventing title pirates from submitting forged documents to cloud ownership interests.

- Document Monitoring and Recording Alerts: Automated monitoring and recording alerts under real estate law notify property owners when filings affecting title are recorded with public authorities. The services detect unauthorized transfers or fraudulent recordings early, allowing prompt legal action. Alert systems protect against increasing title fraud threats like forged deeds or impersonation, ensuring real-time oversight of title integrity.

What Are The Core Elements Of A Valid Real Estate Contract?

The seven core elements of a valid real estate contract are listed below.

- Offer and Acceptance: Offer and acceptance serve as a core element in forming a valid real estate contract. The seller states clear terms covering price, condition, and closing schedule. The buyer accepts the terms exactly as presented, without revisions or counter-conditions. The mutual agreement reflects a shared understanding of the contract’s content. The alignment of expectations and the absence of ambiguity establish a legitimate and enforceable relationship between the parties involved. Real estate law enforces the agreements by recognizing mutual assent as a requirement for contract validity.

- Legal Purpose: Legal purpose stands as a core element required in every valid real estate contract. The transaction must support lawful objectives, such as property sales, leases, or transfers, within the bounds of legal regulations. Agreements centered on illegal activities—fraud, zoning violations, or misrepresented ownership—fail to meet the condition. Legal integrity of the contract ensures compliance with public policy and property law standards, enabling courts to recognize and uphold the agreement. Real estate law rejects contracts based on unlawful or deceptive practices.

- Competent Parties: Competent parties form a core element essential to the validity of a real estate contract. Each signer must be of legal age and mentally capable at the time of agreement. Individuals influenced by coercion, intoxication, or cognitive impairments lack the capacity to contract. Business entities must appoint authorized agents to sign on their behalf. The presence of qualified, capable parties protects against invalid or disputed obligations arising from unauthorized consent. Real estate law supports the principle by requiring legal capacity for contractual enforcement.

- Consideration: Consideration is recognized as a core element that gives a real estate contract legal weight. A transfer of value occurs between the buyer and seller, commonly in the form of money, services, or enforceable promises. The contract does not hold legal effect in the absence of the mutual exchange. The parties must receive something of worth, creating an incentive and obligation to fulfill their respective roles under the contract terms. Real estate law defines consideration as a binding component that distinguishes enforceable agreements from informal arrangements.

- Mutual Consent: Mutual consent functions as a core element that confirms agreement in a valid real estate contract. Each party must agree voluntarily and fully to the same terms. Deception, force, or confusion undermines the element and voids enforceability. Clear acknowledgment of the contract’s meaning, conditions, and responsibilities ensures the sides enter with full understanding. Shared intent solidifies the contract’s legitimacy and eliminates hidden disagreements. Real estate law depends on mutual consent to confirm that all parties willingly accept contractual duties.

- Written Format (Statute of Frauds): A written format remains a core element necessary for validating real estate contracts. Verbal commitments do not meet the legal threshold set by the Statute of Frauds. The contract must include names, property identification, price, and signatures in writing. The documentation offers a concrete reference and legal proof of the agreement. Courts rely on the written format to resolve disputes and verify the obligations agreed upon. Real estate law upholds written documentation as a mandatory condition for enforceability in property transactions.

- Legal Description of the Property: A legal property description acts as a core element that defines the contract’s subject matter. Vague or incomplete references introduce uncertainty and potential conflict. Specificity through parcel numbers, boundary maps, or official survey language clarifies exactly what land changes hands. Precise descriptions remove doubt and ensure that each parties understand the physical scope of the transaction. Proper identification safeguards the transfer and its legal validity. Real estate law requires clear and accurate property descriptions to support valid conveyance and title transfer.

How Does Real Estate Law Regulate Sales Agreements And Closing Terms?

Real estate law regulates sales agreements and closing terms by establishing precise rules that ensure clarity, enforceability, and lawful transfer of property interests. Sales agreements require essential components such as the legal names of the buyer and seller, a complete property description, the purchase price, and valid signatures from all parties. The elements confirm the mutual understanding of the contract. The presence of defined contingencies, including financing and inspection clauses, allows lawful exit paths during the transaction. Disclosure requirements mandate that sellers reveal material defects and title issues, thereby preventing fraud and ensuring informed consent. State and federal laws enforce the disclosures to protect the buyer’s interest.

Closing terms are governed by strict legal standards that outline the process for finalizing property transfers. The contract must indicate a specific closing date, which serves as the point for completing the transaction and transferring possession. Allocation of closing costs between the parties relies on contract language or local legal norms. Real estate law enforces clear identification of responsible parties for taxes, title services, and documentation fees. Federally backed mortgage transactions require adherence to the Real Estate Settlement Procedures Act, which mandates transparent cost disclosures and prohibits unlawful referral fees.

Completion of the transaction demands the delivery and execution of legally required documents such as the deed, mortgage, promissory note, and affidavits. Proper recording of the documents in public land records confirms legal ownership and protects against future disputes. Attorneys, title companies, and escrow agents ensure legal compliance in real estate law and monitor the exchange of funds and documentation, securing the validity of the entire process.

How Are Title And Ownership Disputes Resolved In Real Estate Law?

Title and ownership disputes in real estate law are resolved through the application of formal legal procedures, civil law remedies, dispute resolution mechanisms, and record correction methods, ensuring the lawful transfer of property rights during property acquisition. A title search initiates the process by revealing any existing defects, such as liens, forged documents, boundary errors, or conflicting ownership claims. Errors discovered through the examination demand resolution before the transfer proceeds. Payment of outstanding liens, correction of public records, and clarification of historical conveyance documents restore accuracy in ownership documentation.

Title insurance protects the buyer by offering financial coverage against covered defects and by supporting legal action when disputes arise. The legal tool acts as a safeguard in complex property acquisition cases involving unknown heirs, fraudulent signatures, or undisclosed easements. Real estate law recognizes title insurance as a critical mechanism for ensuring secure ownership and preventing future litigation. Mediation serves as an informal resolution method where disputing parties negotiate terms under the guidance of a neutral facilitator. The process addresses boundary disagreements, easement conflicts, and adverse possession claims without litigation.

A quiet title action becomes necessary when conflicting claims prevent clear ownership. The legal action allows a court to examine the historical record and issue a judgment that eliminates uncertainties. Court intervention under civil law validates legitimate ownership and removes competing interests, producing a clear title suitable for lawful transfer. Litigation follows as a structured legal remedy in situations where informal methods fail to resolve title and ownership disputes. Courts examine deeds, affidavits, surveys, and historical title records to determine rightful ownership, applying principles derived from real estate law to reach a legally binding resolution.

Real estate attorneys and title professionals manage the processes by conducting thorough investigations, filing legal remedies, and coordinating with public offices. The oversight ensures integrity in property acquisition and secures a clean title for lawful ownership. Real estate law governs the procedures to maintain the integrity and enforceability of property transfers.

How Does The Law Protect Against Breach Of Real Estate Contracts?

The law protects against breach of real estate contracts by establishing a legal structure that enforces obligations, determines liability, and provides remedies for non-performance. A breach occurs when a party fails to meet the terms of a legally binding agreement without justification. Real estate law addresses the breach by assessing the existence of a valid contract, identifying the specific failure, linking the failure to the resulting harm, and verifying measurable losses. The legal distinction between minor and material breaches guides the nature of the remedy.

Real estate law provides monetary damages as a primary form of compensation. Courts evaluate actual financial harm, including direct and foreseeable losses, to place the injured party in the position they held before the breach. Specific performance serves as an equitable remedy unique to real estate law due to the singular value of land. The remedy directs the breaching party to complete the contract, allowing the injured party to obtain the exact property identified in the agreement. Rescission dissolves the contract and returns each party to their original positions. Restitution under real estate law allows recovery of deposits, fees, or other exchanged value. An injunction restricts further harmful actions related to the breach. Liquidated damages provisions, when reasonable and not punitive, ensure enforceable financial outcomes based on prior agreement. Real estate law imposes a duty to mitigate damages. The duty requires the non-breaching party to take reasonable steps to reduce loss. Recovery of attorney’s fees and legal costs applies where permitted by statute or contract, reinforcing the protective function of the law.

How Does Real Estate Law Protect Against Fraudulent Transactions?

Real estate law protects against fraudulent transactions by enforcing verification procedures, legal remedies, and financial safeguards that uphold the integrity of property transfers. Fraud in real estate involves forged deeds, identity theft, and false representations of ownership. Title searches uncover hidden issues such as falsified documents, undisclosed liens, or impersonation attempts. Title insurance offers protection by covering financial loss caused by certain title defects and providing legal support when fraud affects the transaction.

Real estate law requires identity verification through notarized documentation and official recording systems. Notaries confirm the identity of parties executing deeds, preventing impersonation and forged signatures. County recording offices review documentation for irregularities before accepting ownership transfers into the public record. Registry monitoring services notify registered owners about suspicious filings, helping prevent unauthorized transfers.

Courts apply civil remedies when fraud occurs in a transaction. Rescission cancels the fraudulent contract and restores parties to their original positions. Quiet title actions clear disputed claims and confirm rightful ownership. Reformation corrects errors in documentation caused by deception. Courts impose penalties or damages against individuals who benefit from fraudulent conduct. Real estate law uses the remedies to deter misconduct and resolve disputes with legal authority. Technological tools enhance fraud prevention through digital authentication and automated monitoring. Electronic systems detect irregular activity and help confirm ownership data in real time. Real estate professionals, title companies, and attorneys play a critical role by verifying records, confirming identity, and securing documentation. The legal framework in real estate law protects against fraud through structured oversight and active enforcement.

What Is Adverse Possession And How Is It Treated In Real Estate Law?

Adverse possession is a legal doctrine that allows an individual to gain legal ownership of land by occupying it without the permission of the rightful owner, and it is treated as a form of property acquisition within real estate law when specific legal requirements are satisfied. The requirements include actual, hostile, open, notorious, exclusive, and continuous use of the property over a statutory period, which ranges between five and thirty years, depending on the jurisdiction. The doctrine supports the productive use of neglected or abandoned land and removes uncertainty in property boundaries or titles. Courts require factual evidence showing that the possessor treated the land as an owner does, such as maintaining, fencing, or building on it.

Adverse possession is treated in estate law through judicial processes like quiet title actions, where a court determines whether the possession meets legal standards. Jurisdictions apply objective or subjective tests to evaluate hostility and demand payment of property taxes or show a good faith belief in ownership. Several legal systems, especially systems with registered land, introduce safeguards like the Land Registration Act 2002, which mandates owner notifications and allows objections before transferring title. Real estate law recognizes adverse possession as a means to settle long-standing disputes and prevent land from remaining unused. Courts assess the claim with scrutiny, ensuring that all statutory elements are clearly met. Real estate law maintains clarity and efficiency in land ownership through adverse possession, upholding the integrity of title records by resolving gaps in land use or possession.

How Does Real Estate Law Address Zoning And Land Use Regulations?

Real estate law addresses zoning and land use regulations by establishing legal boundaries for how property is developed, used, and maintained within a jurisdiction. Zoning ordinances divide land into zones such as residential, commercial, industrial, and agricultural, each with specific regulations governing structure types, height limits, lot size, density, and usage. The laws originate from municipal planning authorities and are enforced through local building departments and planning commissions. Zoning ensures that incompatible land uses remain separated, preserving community character and supporting organized development.

Real estate law incorporates variance procedures, allowing exceptions to zoning rules under strict legal conditions. Applicants must demonstrate a legitimate hardship or public benefit to receive a variance, and the decision process involves public hearings and review boards. Nonconforming uses, which existed before zoning laws changed, receive special consideration under real estate law to determine whether they remain valid or require adjustment.

Real estate transactions involve comprehensive zoning due diligence to confirm the lawful use of the property. Legal professionals assess local zoning codes, examine land use maps, and consult with planning departments to verify compliance. Disputes related to zoning violations or denied permits enter judicial review, where courts apply real estate law to interpret ordinance language and resolve conflicts. Real estate law aligns land use with public interests such as safety, environmental protection, infrastructure planning, and aesthetics. The law maintains orderly growth, balances individual rights with community needs, and upholds long-term urban and rural land use goals by structuring development through enforceable codes and legal oversight.

What Is The Role Of Planning And Development Law In Real Estate?

The role of planning and development law in real estate is to establish the legal and regulatory framework that governs how land is organized, used, and transformed within a defined jurisdiction. The body of law directs the orderly development of property by setting clear standards for zoning, land use, infrastructure obligations, and environmental impact. Planning and development law ensures that new construction and land alterations align with long-term urban or rural strategies. Public authorities guide growth patterns, protect natural resources, and shape the built environment in ways that reflect community needs through the framework. Planning and development law functions as a critical mechanism within real estate law by enforcing compliance with zoning classifications, building codes, and subdivision regulations. The branch of law controls density, height, lot coverage, and permissible land uses to prevent disorderly or conflicting development.

Planning and development law demands that developers obtain permits, complete impact assessments, and engage with public planning bodies before altering land. Real estate law applies the principles to enforce legality in every stage of the development process, from initial application to final occupancy. Planning and development law plays a central role in mediating between private land use goals and public planning objectives. The branch of law enables municipalities to impose design standards, require infrastructure contributions, and manage growth boundaries. Real estate law depends on the controls to resolve disputes, validate entitlements, and structure land use agreements. The coordinated legal framework ensures that property development proceeds in a manner that promotes efficiency, equity, and sustainability across real estate markets.

How Are Environmental Regulations Incorporated Into Real Estate Law?

The five-way environmental regulations incorporated into real estate law are listed below.

- Environmental Impact Assessments in Property Development: Environmental regulations enter real estate law through mandatory environmental impact assessments (EIAs). The assessments evaluate how proposed developments affect air, water, soil, and ecosystems. Real estate projects involving large-scale construction or land alteration require detailed environmental studies before receiving approval. Regulatory bodies examine the reports to determine whether a project aligns with environmental preservation goals and legal standards, ensuring that harmful effects receive proper mitigation or redesign.

- Land Use Restrictions and Protected Zones: Real estate law integrates environmental protection by imposing land use restrictions in ecologically sensitive areas. Wetlands, floodplains, wildlife habitats, and coastal zones carry development limitations to prevent degradation. Local zoning ordinances reflect the rules by categorizing land with environmental constraints as non-buildable or conditionally usable. The measures ensure that environmental values remain preserved while maintaining legal clarity for property transactions and future planning.

- Contaminated Property and Brownfield Regulations: Real estate law addresses environmental hazards by regulating the transfer and development of properties contaminated with hazardous substances, known as brownfields. Legal provisions require property owners and developers to conduct site assessments and implement cleanup measures under environmental agency supervision. Liability for pollution, hazardous waste, or industrial residue gets assigned through statutes like CERCLA. The rules protect buyers and nearby communities while promoting safe reuse of previously neglected sites.

- Water and Air Quality Compliance in Construction: Construction activities must comply with environmental standards related to water runoff, dust, and emissions. Real estate law incorporates the requirements through building permits and operational licenses. Developers install drainage systems, erosion controls, and air filtration methods to meet mandated limits. Regulatory agencies inspect sites to verify adherence and impose penalties for violations. The rules minimize health risks and environmental damage linked to real estate development and environmental law.

- Green Building Codes and Sustainability Mandates: Sustainability enters real estate law through green building codes that promote energy efficiency, renewable materials, and reduced carbon footprints. Jurisdictions enforce standards like LEED certification, requiring buildings to meet benchmarks in design, materials, and performance. Real estate developers incorporate solar panels, insulation systems, and low-impact materials to comply with regulations. The codes advance environmental objectives while shaping responsible development practices across residential, commercial, and industrial properties.

What Are The Legal Requirements For Registering Property Titles?

The five legal requirements for registering property titles are listed below.

- Execution and Notarization of Title Deeds: Legal registration begins with the execution of a valid deed, such as a sale, gift, or transfer deed. The document must meet statutory formatting requirements and be notarized to confirm the identity and intent of the involved parties. Real estate law treats notarization as essential for validating ownership transfers and preventing fraud.

- Accurate Legal Description of Property: Title deeds must contain a complete and precise legal description of the property, including boundaries, location, plot number, and survey data. Government registration offices depend on the information to match the property with the cadastral records correctly. Real estate law enforces the requirement to reduce disputes and establish a clear property identity.

- Payment of Stamp Duty and Fees: Applicable stamp duty and registration fees must be paid before submitting a deed for recording. The charges vary by jurisdiction and are usually based on the market or assessed value of the property. Real estate law mandates the payment as a prerequisite for formal recognition of ownership.

- Submission of Statutory Supporting Documents: Legal registration requires the submission of supporting documents such as the original deed, tax clearance certificate, encumbrance certificate, and previous ownership records. The documents verify the seller’s title and ensure compliance. Real estate law requires documentation to establish transparency and protect future transactions.

- Public Recording and Title Issuance: The final step in registration involves recording the deed in public land records. Recording establishes legal ownership and provides notice to third parties, securing the buyer’s claim. Real estate law uses the public record to formalize ownership and resolve priority between competing interests.

How Are Mortgages And Liens Managed Under Real Estate Law?

Mortgages and liens are managed under real estate law by creating a legal framework that secures financial interests and regulates priority among creditors. A mortgage operates as a voluntary lien, placing property as collateral for a loan. The lien grants the lender a legal claim on the property, permitting foreclosure in cases of borrower default. Real estate law mandates that such mortgages be properly recorded to establish priority over subsequent claims. The date of recording determines the legal strength of the mortgage relative to other liens.

Involuntary liens such as tax liens, mechanics’ liens, judgment liens, and homeowner association liens arise through legal actions or statutory provisions without the owner’s consent. The liens attach to the property rather than the individual, affecting title and marketability. Real estate law enforces a hierarchy where tax liens take precedence, followed by recorded mortgages, then other claims based on recording order. Lienholders require full payment or resolution documented through a lien release before selling or refinancing occurs.

A lien release functions as a formal acknowledgment that the debt has been satisfied. Real estate transactions depend on the document to clear encumbrances from public records. Title companies obtain payoff letters and ensure that releases get recorded properly to avoid ownership disputes. Foreclosure proceedings serve as the legal remedy for enforcing unpaid liens. Real estate law governs the actions by defining procedural rules, timelines, and rights of redemption. Public recording of all liens ensures transparency and supports secure, traceable property ownership.

How Does Real Estate Law Apply To Commercial Versus Residential Properties?

Real estate law applies to commercial versus residential properties by using separate legal standards. Commercial law emphasizes business use, complex leases, and income-based financing. Residential law focuses on tenant protection, habitability, and personal ownership rights.

Real estate law applies differently to commercial and residential properties by addressing their unique purposes, transaction structures, and regulatory frameworks. Commercial properties involve business activities such as offices, retail centers, warehouses, or industrial facilities. Residential properties serve as dwellings and include single-family homes, apartments, and condominiums. The functional distinctions lead to significant legal variations in contracts, zoning, tenant rights, and financing procedures.

Commercial real estate law emphasizes complex leasing agreements, which include customized clauses for build-outs, maintenance responsibilities, and lease durations. The leases generally favor landlords and place more negotiation responsibilities on tenants. Residential leases follow consumer protection guidelines, enforcing habitability standards, notice periods, rent control in some jurisdictions, and fair housing requirements. Tenants in residential settings receive statutory protections that limit eviction and require safe living conditions.

Financing in commercial property involves business credit evaluations, larger loan structures, and underwriting based on income potential from leases or operations. Residential real estate law centers financing around personal credit, income verification, and government-backed loan programs. Zoning laws treat commercial and residential properties differently, with stricter usage classifications and parking, signage, or noise restrictions for commercial spaces. Dispute resolution follows different channels based on property type. Commercial real estate disputes proceed through arbitration or contract litigation, whereas residential issues involve housing courts or tenant protection agencies. Real estate law maintains distinct legal pathways for commercial and residential properties, ensuring that each sector operates within a regulatory system tailored to its risks, responsibilities, and social functions.

What Is The Difference Between Real Estate Law And Property Law?

The difference between real estate law and property law is rooted in their scope and application. Real estate law focuses specifically on immovable property such as land and structures attached to it. The branch of law governs transactions involving land sales, leasing, mortgages, zoning, land use regulation, title registration, and development agreements. Real estate law deals with issues that arise from the ownership, use, and transfer of physical property in the residential and commercial contexts. Property law encompasses a broader legal category that includes real and personal property. Real property refers to land and anything permanently attached to it, which aligns with the focus of real estate law. Personal property covers movable assets like vehicles, furniture, intellectual property, and intangible rights. Property law defines rights, interests, and claims over tangible and intangible items, including ownership, possession, and use.

Real estate law operates as a specialized field within the larger framework of property law. Real estate law applies legal standards that address real estate markets, land development, and construction. Property law sets the foundational principles of ownership, transfer, succession, and possession that apply to all types of property, whether fixed or movable. Real estate law interprets the principles in the specific context of land-related matters. Real estate law encompasses practical legal procedures, including contract drafting, disclosure obligations, inspections, and regulatory compliance. Property law addresses theoretical aspects such as types of estates, easements, and legal rights attached to property. The distinctions make property law more comprehensive while real estate law remains more focused and practice-oriented.