Tax Law: Understanding Regulations And Taxation Principles

Tax law is an important part of the legislative system. Tax law establishes a framework that outlines the rules and regulations for imposing taxes by the government. It has a crucial role in guaranteeing the correct collection and management of revenue necessary for funding public services and infrastructure, among other various government functions.

One question asked online is “What are taxes?” and the answer is that they are financial obligations that are imposed on individuals, corporations, or properties in order to provide support for government spending. Another question is “What are taxes used for?” and its purpose is to fund various government-provided benefits ranging from public goods and services and defense to public safety and public infrastructure. Every citizen, company, and piece of property pays taxes, making them a crucial component of economic structures.

There are different types of taxes, such as sales taxes and corporate taxes. Other types include property taxes and income taxes. Compliance with distinct sets of rules and principles outlined in the tax law is necessary for each type. Income taxes relate to the taxation of earned income for individuals or businesses.

Sales taxes pertain to charges imposed on the sale of goods and services. Corporate taxes pertain to the taxation of profits obtained by business entities. Property taxes focus on the assessment and taxation of owned properties. Income taxes are levied on the taxable revenue of citizens and businesses.

The structure and dynamics of tax law embody a comprehensive approach. Taxing authorities impose taxes according to established laws, and the entities subject to such taxes must adhere to rules, from the specified regulations to filing requirements and payment deadlines, answering the question “How do taxes work?” Failure to comply with regulations or not paying taxes altogether results in legal consequences, highlighting the significance of comprehending and following tax laws. Having a thorough understanding of taxation principles helps navigate tax obligations effectively, ensuring accurate and timely submissions.

Tax law encompasses various aspects, from determining taxable entities and identifying taxable events or items to calculating tax liabilities. It clarifies the responsibilities of entities subject to taxation and the rights and responsibilities of tax authorities. It establishes the boundaries of lawful taxation and outlines the procedures for resolving disputes between taxpayers and tax collectors.

It is crucial to understand that tax law reflects a nation’s economic policy and socio-political philosophies. Tax law incorporates economic theories and social justice principles, among other factors related to economic growth and equality. Comprehending tax law requires a diligent examination of legislative texts and judicial decisions that shape the taxation framework.

Tax law upholds order and fairness in the collection and use of taxes. It helps achieve societal needs and governmental objectives through the lawful and fair collection of revenue. Tax law affects many sectors, so it’s important to have a deep understanding of its principles and applications for effective compliance and navigation.

Table of Contents

- What Is The History Of Tax Law?

- What Is The Importance Of Tax Law?

- What Are Different Types Of Tax Law?

- How Does A Tax Law Work?

- What Are The Best Ways To Legally Reduce Your Taxable Income?

- How Is Tax Law Different From Other Types Of Law?

- What Is The Source Of Tax Law?

- What Happens When Tax Law Is Violated?

- How Can You Avoid Making Tax Mistakes That Can Lead To An Audit?

- What Are The Different Tax Law Terms To Know?

- 1. Taxpayer

- 2. Marginal Tax Rate

- 3. Audit

- 4. Depreciation

- 5. Capital Gains

- 6. Standard Deduction

- 7. Itemized Deductions

- 8. Tax Evasion

- 9. Tax Withholding

- 10. Taxable Income

- 11. Regressive Tax

- 12. Progressive Tax

- 13. Tax Liability

- 14. Exemptions

- 15. Deductions

- 16. Credits

- 17. Filing Status

- 18. Tax Avoidance

- 19. Tax Treaty

- 20. Tax Return

- What Are The Benefits Of Tax Law?

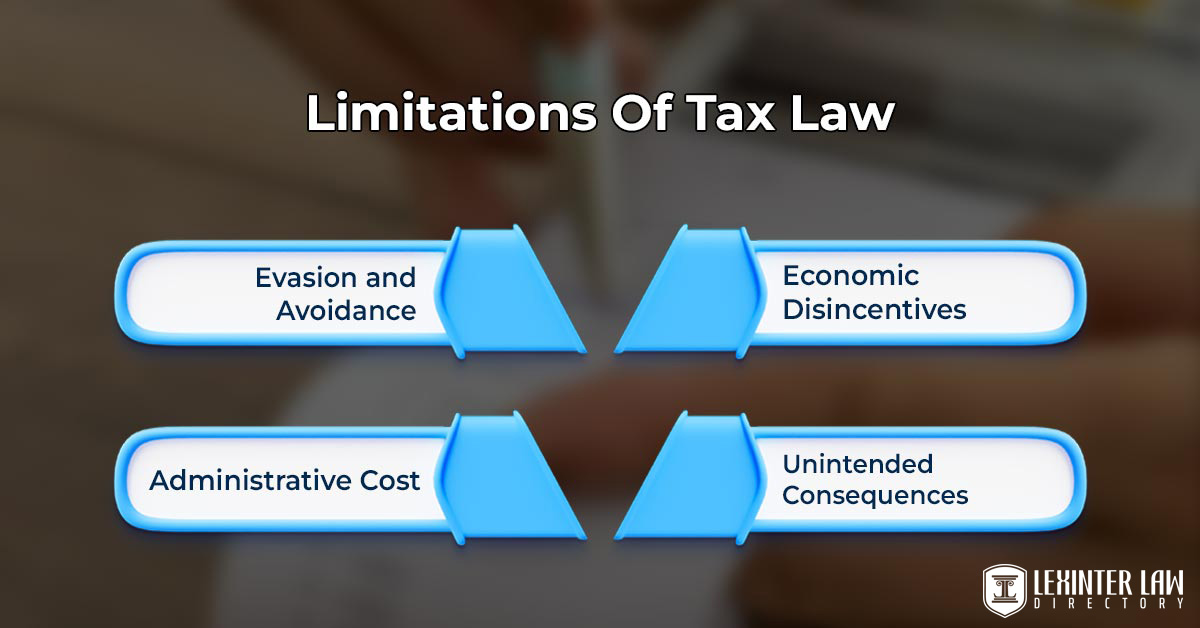

- What Are The Limitations Of Tax Law?

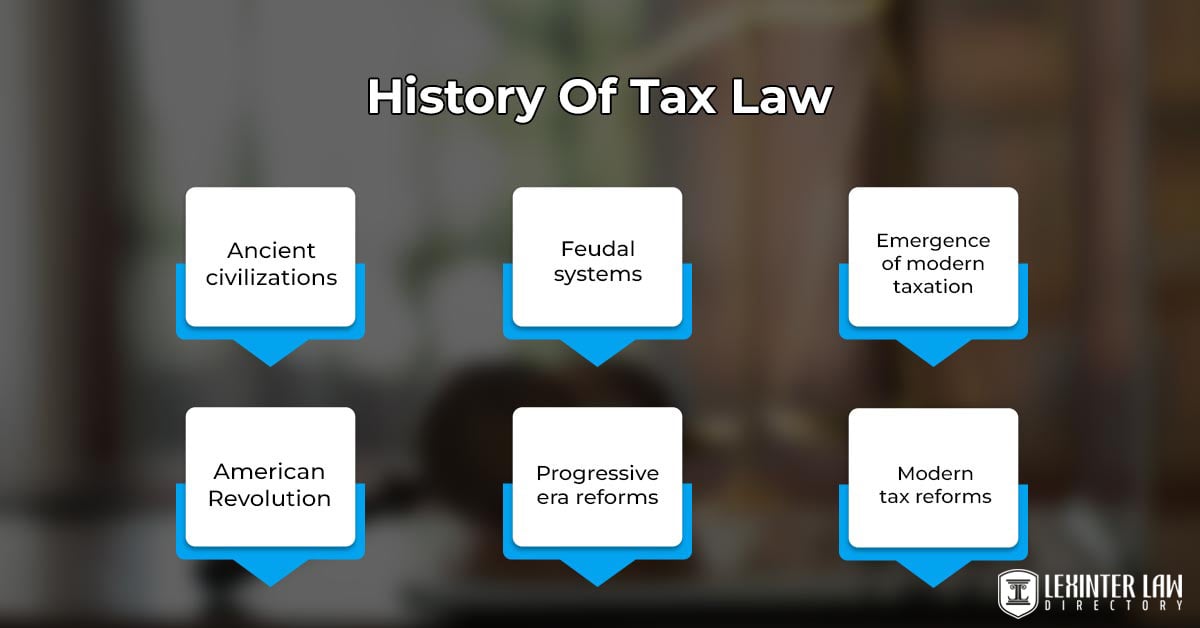

What Is The History Of Tax Law?

The history of tax law is a reflection of several elements, from social and economic to political, indicating significant changes in civilizations and governance structures. The history of tax law must be examined to understand the establishment and evolution of tax legislation in the United States. The origin of US taxes traces back to the early days of the country, connected with foundational principles and revolutionary ideals.

The tax law was introduced in the United States within the constitutional framework, as the Constitution granted Congress the power to impose taxes. The Constitution became a cornerstone, establishing the legal foundation for tax imposition and guiding future tax legislation. Federal income tax legislation was first introduced during the Civil War era with the Revenue Act of 1861.

The government enacted the law to generate revenue to fund war expenses. The 16th Amendment in 1913 represented a crucial moment in US tax law history after undergoing amendments and repeals. It laid the foundation for the federal government to levy income taxes on individuals without proportionate distribution among the states.

Congress and later administrations were crucial in creating and implementing various tax laws in line with the socio-economic needs and fiscal policies of their respective times. The tax law underwent various reforms and modifications, reflecting the changing needs and economic conditions of the country. A transformation took place with the Tax Reform Act of 1986, which sought to simplify the income tax code, leading to the lowering of tax rates and the removal of tax shelters.

The tax law in the US has evolved through a dynamic interaction between legal frameworks and economic policies. Every amendment and every enactment reflects a reaction to current economic conditions and societal needs. Tax law continues to refine legal provisions to align with constitutional principles and adapt to a growing nation’s challenges.

A study of tax law throughout history reveals the inherent connection between taxation and the progress of society. The adaptation and modification of tax law demonstrate an ongoing effort to achieve fairness and equality in collecting and distributing revenue. It mirrors the nation’s progression through several stages, from economic cycles and wars to reforms and advancements, showcasing the durability and flexibility of the legislative system in meeting the varied and changing needs of society.

The history of tax law in the United States is a diverse and intricate subject that weaves together several aspects, from legal to economic and social. Tax law exemplifies the nation’s continuous effort to attain fiscal fairness and economic steadiness, starting from constitutional provisions to various legislative acts and reforms. Understanding the historical context and evolutionary journey of tax law is important in navigating the complexities of contemporary taxation systems, as it highlights the interplay between legal frameworks and economic imperatives.

What Is The Purpose Of Tax Law?

The purpose of tax law is to create a complete structure for imposing and collecting taxes. Tax law acts as the legal foundation to guarantee the fair and consistent acquisition of revenue for the government. Tax law establishes the responsibilities and processes related to taxation, enabling the government to gather funds necessary for supporting and improving society and infrastructure.

Tax law is an essential part of governance and civic responsibility, as it establishes the guidelines for taxation and facilitates the distribution of resources to different sectors. It defines the responsibilities of individuals and entities in contributing to the financial reservoir that funds public services and national defense, among other governmental functions. Paying taxes is a civic duty that allows the government to function and provide essential services to the public.

Taxes support education systems, enabling the development of knowledge and the nurturing of future generations. They provide essential support to the healthcare system, aiding public health initiatives and healthcare services that are crucial for maintaining societal health and well-being. Taxes offer financial assistance to law enforcement agencies, guaranteeing safety and order in communities. They facilitate connectivity and mobility by driving infrastructural development, enabling the construction and maintenance of roads and public transport systems.

The reasoning for paying taxes aligns with the goals of societal progress and communal well-being. The fair sharing of financial resources through taxation is a joint effort to maintain and improve the quality of life, guaranteeing the presence and reach of public goods and services. Tax law embodies the principles of mutual contribution and shared responsibility, which promote a favorable and advancing living environment.

Tax law serves as a regulatory mechanism, defining the legal boundaries within which individuals and corporations fulfill their obligation to contribute to the national treasury. It offers clarity and structure, enabling taxpayers to navigate their obligations and aiding the government in implementing and enforcing tax policies. The regulatory components of tax law help uphold fiscal discipline and integrity and promote compliance, maximizing revenue collection and allocation.

Tax law plays a crucial role in shaping a nation’s fiscal dynamics. It connects individual and corporate contributions to achieving societal goals and communal advancements. Tax law and paying taxes are essential for creating a strong and forward-thinking society. They help the country work together and contribute to its growth and development.

What Is The Importance Of Tax Law?

The importance of tax law is highlighted in its guarantee of sufficient funding for government bodies and public services. It serves as the essential foundation for a nation’s operations, establishing the structure for the collection of taxes from individuals and corporations. A fair and well-understood tax law is essential for the efficient functioning of any government and the society it serves.

Tax law establishes a well-organized framework that facilitates the legal and systematic gathering of taxes, guaranteeing that all parties are aware of their obligations and adhere to them. It is the foundation for upholding social order and fostering civic responsibility. Clear tax obligations prevent disputes and facilitate the smooth operation of the tax collection process, preventing revenue leakage and maintaining transparency in governmental financial dealings.

Tax law facilitates the establishment of different tax brackets, exemptions, and deductions, ensuring fairness and equity in the taxation process. It guarantees that taxation does not become a burdensome process for the poorer sections of society and encourages progressive taxation, where the affluent sections of society contribute more to government revenue. Equity in tax law is essential for maintaining social harmony and promoting a collective sense of responsibility and shared commitment to societal well-being.

Governments face difficulties in collecting the necessary revenue to support essential services and infrastructure without a firmly established tax law, resulting in a decline in citizens’ quality of life and well-being. Effective tax laws guarantee a consistent supply of funds for essential public services, ranging from healthcare and education to security, which are vital for a nation’s progress and advancement. The efficiency and effectiveness of tax laws impact the sustenance and enhancement of public amenities and services.

Taxation legal frameworks contribute to stabilizing the economy by adjusting tax rates and offerings, which guide economic behavior and investment patterns. Governments use tax rates and incentives to shape economic activities, which have an impact on several factors, from investment to consumption and savings. The aforementioned factors influence economic growth and development.

Tax law shapes societal structures and government operations. It has a profound effect on all aspects of life, connecting the people to the government in a social agreement to contribute to the common good. Tax laws’ support of a number of factors, from the fostering of societal advancement and guarantee of the public’s access to necessary services and amenities to the maintenance and improvement of the standard of living and societal fabric, highlights their significance.

How Does Tax Law Affect A Country’s Legal Framework?

Tax law affects a country’s legal framework by molding the economic structure and shaping the behavior of individuals and corporations. Tax law is a significant part of a government’s toolkit to steer the economic choices of businesses and individuals using incentives and disincentives. Understanding tax law is important as it’s the source of a country’s revenue necessary for government operations and public services.

Tax law fuels the engine of government, enabling the nation’s effective and efficient execution of its functions. Insufficient tax revenue compromises the provision of public goods and services, ranging from education and healthcare to infrastructure, making it difficult for the country to fulfill its obligations to its citizens. Tax law contributes to the revenue stream of a government and the enforcement of economic equity and justice.

Tax law facilitates the redistribution of wealth through the implementation of higher tax rates for the affluent and lower rates for individuals with lower incomes. Progressive tax systems seek to decrease income and wealth disparities among the population, promoting a fair and balanced economic structure. Enforcing tax laws guarantees that individuals and businesses contribute their fair share to the state’s coffers, promoting economic fairness and social justice.

The tax law has a significant influence on corporate and individual behavior, encouraging economic activities that align with the government’s policy objectives. It influences economic outcomes through the provision of incentives for specific actions, from investing in specific sectors and promoting research and development to supporting charitable contributions and environment-friendly practices. The tax code includes provisions that aim to encourage or discourage certain activities, guiding the allocation of economic resources in line with policy objectives.

For example, tax credits or deductions are provided for investments in renewable energy sources or research and development. They serve as motivators for businesses to allocate resources toward such areas. The government utilizes tax laws to encourage innovation and enhance societal well-being.

The complexity and provisions of the tax code have a significant impact on the legal framework. The tax system is complex and requires comprehensive laws and regulations to handle the various issues that come up with several types of taxation. It requires strict adherence and affects corporate structures and individual decisions.

Tax laws have significant implications for international relations and trade. It impacts trade competitiveness and has consequences for cross-border transactions and international businesses. Nations engage in negotiations for tax treaties to address concerns regarding double taxation and promote a favorable atmosphere for global trade and investment.

Each change in the tax law has a ripple effect on the legal and economic system of a country, requiring adjustments and recalibrations in corporate strategies and governmental policies. Tax law plays a crucial role that goes beyond the simple collection of revenue. It is instrumental in shaping economic structures and attaining policy objectives. It guides and influences the legal framework of a country, which in turn determines the economic trajectory and societal structure.

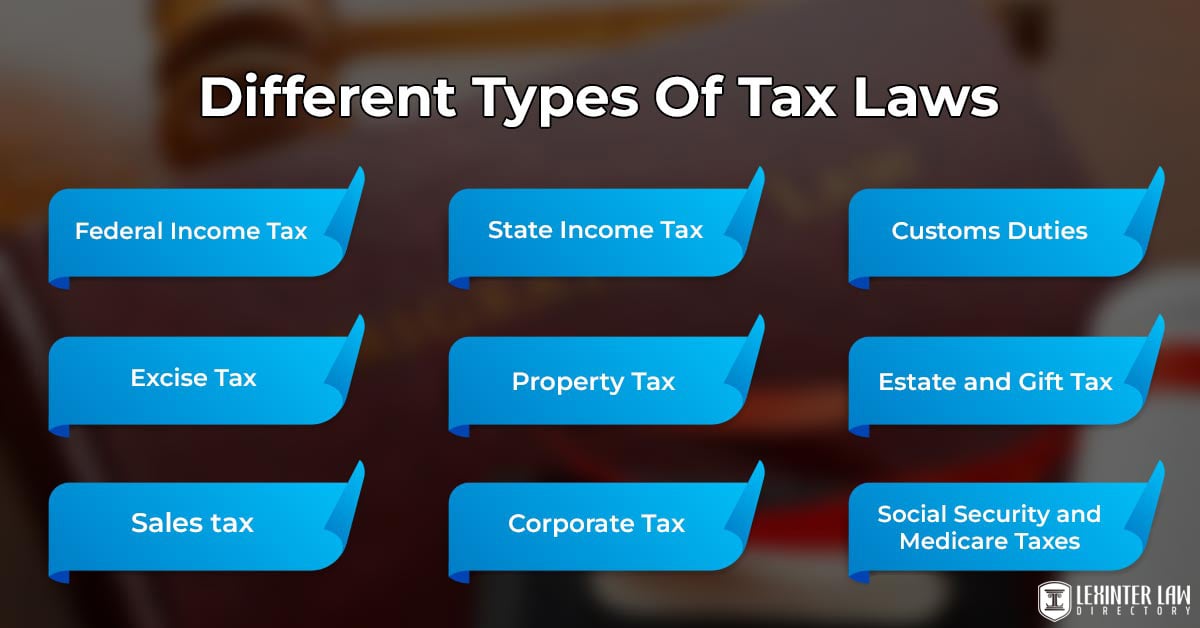

What Are Different Types Of Tax Law?

The different types of tax laws are listed below.

- Federal Income Tax: The government enforces federal income tax on the taxable income of several entities, from individuals and trusts to estates and corporations. It is the revenue-generation machinery of the federal government and funds public services and government operations. Federal income tax is progressive, with rates that differ based on income levels, resulting in higher tax rates for higher income brackets. The Internal Revenue Service (IRS) is responsible for enforcing federal income tax laws and regulations.

- Excise Tax: An excise tax is an indirect tax imposed on the sale or production of certain goods and services. The government enforces it to discourage the consumption of certain products considered harmful or to generate revenue designated for certain expenses. Excise taxes are imposed on products ranging from alcohol and tobacco to gasoline. Revenue generated from excise taxes supports various governmental initiatives, from public health programs to highway maintenance.

- Sales tax: A sales tax is a fee that the government levies on the purchase of goods and services. Businesses collect a pass-through tax at the point of sale and then pay it to the government. Sales tax rates differ across jurisdictions and are calculated as a percentage of the purchase price. Sales tax revenue plays a major role in funding state and local governments.

- State Income Tax: States levy their own income tax on individuals and entities earning income within the state in addition to federal income tax. States have different rates and structures for their income tax, with some using a progressive system and others using a flat rate. States utilize the revenue generated from state income tax to finance services and operations at the state level. Certain states choose to forgo implementing an income tax and instead depend on alternative sources of revenue.

- Property Tax: Local governments impose property tax based on the assessed value of real property, which includes land and buildings. It acts as a significant revenue source for local governments, supporting vital services from public education and police and fire protection to local infrastructure development. Property owners must pay an annual property tax based on the assessed value of their property. Not paying property taxes results in serious outcomes, such as foreclosure.

- Corporate Tax: A corporate tax is a tax imposed on the profits of corporations and businesses. The company’s profits determine the corporate tax rate, with higher profits resulting in higher rates. Governments utilize corporate tax revenue to finance public services and infrastructure development. Tax authorities are responsible for enforcing and collecting corporate taxes, ensuring businesses adhere to applicable laws and regulations.

- Customs Duties: Governments impose customs duties on imported goods. The duties aim to safeguard domestic industries against foreign competition and generate extra revenue for the government. The customs duties vary based on the imported goods’ type and value. Importers are required to pay the assessed duties prior to the release of goods from customs control.

- Estate and Gift Tax: Estate and gift taxes apply to the transfer of assets, whether through inheritance or gifts. The estate tax is applicable to asset transfers upon death, while the gift tax is applicable to transfers made during one’s lifetime. The purpose of taxes is to hinder the concentration of wealth among a limited group of individuals or families. There are exemptions and deductions that lower the estate and gift tax burden. The rates for such taxes increase as the estates and gifts get larger.

- Social Security and Medicare Taxes: Social Security and Medicare taxes finance the Social Security and Medicare programs. Employers and employees share the duty to pay the total amount of taxes, while self-employed individuals are accountable for the full amount. The taxes offer financial assistance to retirees and the disabled, along with their dependents, guaranteeing healthcare access for the elderly. Collecting and enforcing such taxes is vital for the long-term viability of a country’s social security and healthcare systems.

1. Federal Income Tax

Federal income tax is a government-imposed charge on individuals’ and corporations’ annual income. An example of federal income tax is when an individual earning a large annual salary enters a high-income tax bracket and must pay a substantial portion of their income to the government. Another example is small businesses being required to pay taxes on their net income after deducting allowable expenses, which affects their profitability. Understanding is crucial for ensuring compliance and effective financial planning, helping entities and individuals fulfill their legal obligations, and preventing penalties.

The federal income tax law is complex, encompassing different rates and stipulations relevant to different types of income. A thorough comprehension of federal income tax law allows entities and individuals to utilize available credits and deductions. A thorough understanding is instrumental for making well-informed legal investment and financial decisions and for exploring legal ways to reduce tax responsibilities.

Adhering to the federal income tax law is vital, requiring precise calculation and reporting of tax obligations. Filing tax returns in a prompt and accurate manner is essential to avoid legal consequences and ensure compliance with the law and effective financial planning. Understanding federal income tax is essential for accurate application and adherence to such laws.

The federal income tax law is complex and requires deep understanding and precise handling. Understanding the intricacies of the subject helps organizations and individuals handle their tax situations and promote strong financial plans while influencing the country’s economic health.

2. Excise Tax

Excise tax is an indirect form of taxation imposed on specific goods and services. For example, the excise tax is the added charge on the sale of gasoline or the taxes imposed on alcohol and tobacco products, influencing the final consumer prices and aiming to modify consumer behavior related to these goods. Grasping the concept and application of excise tax is crucial as it alters consumer behavior and the prices of goods and services, illustrating the economic ramifications of producing and consuming such taxable items.

Excise tax serves to fulfill various objectives, including revenue generation for the government and behavior modification concerning harmful or luxurious goods. A thorough understanding of excise tax principles is imperative for businesses to maintain compliance, correct computation, and appropriate remittance of the tax to the government, ensuring transparency and adherence to legal obligations.

Excise tax requires businesses to have a thorough understanding of the products and services that are subject to such taxation. Knowledge of the subject is important for businesses to apply the correct tax amount and remit it. It ensures they meet the government’s requirements and avoid any legal and financial repercussions related to non-compliance or incorrect application.

Acquiring proficiency in excise tax laws helps with strategic planning and informed decision-making for businesses. It allows them to assess the impacts of such taxes on pricing strategies, consumer preferences, and market dynamics, leading to better-informed business strategies and operations in the competitive market landscape.

3. Sales Tax

Sales tax is a consumption tax imposed on the sale of goods and services, calculated as a percentage of the purchase price. For example, if an individual buys a piece of furniture, the sales tax applies to the purchase price and increases the total amount paid. Another example is the addition of sales tax to the cost of purchasing a vehicle, which affects the consumer’s final payment. Understanding sales tax is important as it affects consumers and retailers by altering the final prices of goods and services, and it represents a significant revenue source for state and local governments.

In-depth knowledge of sales tax law aids businesses in the proper collection, reporting, and remittance of the tax, ensuring compliance with state and local regulations. Understanding the various rates and rules applicable in different jurisdictions helps businesses avoid legal complications and penalties associated with incorrect collection or remittance of sales tax. It is fundamental for retailers to navigate the complexities of sales tax law effectively to maintain transparent and lawful operations.

Maintaining compliance with sales tax laws requires meticulous record-keeping and accurate calculations by businesses. Proper understanding and application of such laws help in the preparation and submission of accurate tax returns and in the correct collection and remittance of taxes, preventing legal disputes and financial discrepancies with tax authorities.

Proficiency in sales tax law enables businesses to incorporate tax considerations into their pricing strategies and operational processes effectively. It helps in making well-informed decisions, understanding the implications of sales tax on transactions, and evaluating the impact on business operations and consumer behavior, leading to more competitive and compliant business practices.

4. State Income Tax

US states impose state income taxes on entities operating within their borders. For example, California imposes such a tax on entities that earn income within the state. Texas is a counter-example as it’s a state without such a tax. Revenue is generated through alternative sources like sales tax.

Entities must possess a thorough comprehension of state income tax in order to understand their tax obligations within their respective states and adhere to different state tax laws. Having a comprehensive understanding of the diverse nature of state income tax laws helps residents and businesses calculate and pay their tax obligations. Having a complete understanding is important for following the various tax rates, exemptions, and deductions in different states, enabling lawful compliance and efficient financial planning.

Filing returns and making payments for state income tax requires careful attention to detail due to its complex provisions. Having a deep understanding of state-specific regulations and requirements is crucial for staying compliant, avoiding penalties, and representing accurate income and deductions. A thorough understanding of the details is essential for individuals and businesses to effectively navigate the intricacies of state income tax law.

A complete comprehension of state income tax law is essential for making informed financial decisions and strategic planning for individuals and businesses. Understanding its details permits the optimization of tax positions. It allows entities and individuals to utilize available provisions and exemptions and handle their financial obligations within their respective states.

5. Property Tax

Local government entities, such as counties or municipalities, levy property tax, which is a levy based on the value of real property. An illustration of property tax is a homeowner paying an annual tax based on the assessed value of their home. Another instance involves a business owner who remits property tax on a commercial building, affecting their operating costs.

A nuanced understanding of property tax is beneficial. The tax affects property owners’ financial obligations and contributes to local government revenue, funding essential services such as education and public safety. Delving deep into property tax laws and regulations aids in the accurate assessment and payment of taxes, ensuring compliance with local ordinances.

A refined understanding of details, from assessments and exemptions to rates and payment options, is important for property owners. It helps them meet their obligations and benefit from any available reliefs or reductions in a lawful manner. Attaining proficiency in property tax law helps property owners and businesses contest assessments and seek adjustments, leading to potential reductions in tax liability.

Insight into the law enables the exploration of lawful avenues for minimizing property tax obligations through accurate assessments and the application of available exemptions and reliefs. Meticulous management and understanding of property tax obligations impact the financial planning of property owners. It enables the development of robust strategies for effective management of property tax liabilities. Understanding helps with considering the tax in investment decisions and budgeting, influencing the economic viability of owning property.

6. Corporate Tax

Corporate tax is a levy imposed on the profits of a corporation. For example, a multinational company operating in the US is subject to corporate tax on its profits, influencing its net earnings and financial standing. A small domestic corporation paying its corporate tax is another example, affecting its profitability and operational strategy. An intricate understanding of corporate tax is vital for corporations to comply with legal obligations and implement effective tax planning strategies to optimize their financial positions.

Corporations need to engage in accurate computation, reporting, and remittance of taxes to maintain compliance with corporate tax laws. A deep understanding of details, from applicable rates and allowances to credits and deductions, is essential for corporations to fulfill their legal obligations. It allows for the leverage of available benefits to minimize their tax liabilities in a lawful manner.

Thorough knowledge of corporate tax law allows corporations to implement strategic tax planning. It assists in making informed financial and operational decisions. It helps in evaluating the tax implications of various business strategies and transactions, contributing to the development of tax-efficient business models and practices.

In-depth insight into corporate tax laws facilitates corporations in managing their global tax positions. It enables them to assess the tax consequences of international operations and transactions. Deep insight allows for optimizing the use of tax credits and incentives and managing risks associated with cross-border activities, impacting their global competitiveness and sustainability.

7. Customs Duties

Customs duties are taxes imposed on goods transported across international borders. An example is an electronics retailer importing smartphones and paying customs duties on such goods, affecting the final retail price. Another example is a manufacturer importing raw materials and paying duties, influencing the cost of production. A profound understanding of customs duties is paramount for importers and exporters to ascertain the cost implications of international trade and to ensure compliance with international trade regulations and agreements.

Businesses engaged in international trade need to acquire extensive knowledge of details, from applicable duty rates and valuation methods to goods classification, to navigate the complexities of customs duties. It is imperative for accurate comprehension of such aspects to calculate and remit the correct amount of customs duties. Accurate understanding helps adhere to legal requirements associated with international trade transactions.

Proficiency in customs duties enables businesses to optimize their international trade strategies. The proficiency allows for the exploration of duty-saving opportunities, leading to cost-effective and compliant international trade operations. Examples of opportunities are preferential trade agreements and duty drawback provisions

In-depth insight into customs duties assists businesses in managing risks and enhancing compliance with their international trade activities. It helps in evaluating and addressing the regulatory and financial implications of importing and exporting goods. Acquiring knowledge on the subject fosters lawful and efficient international trade practices.

8. Estate And Gift Tax

Estate and gift taxes are imposed on the transfer of assets from one individual to another, such as through bequests or gifts. An example showcasing estate tax occurs when an individual inherits a substantial estate and is required to pay a tax based on its value. An example of a gift tax is when an individual receives a sizable gift and is liable for the tax. Understanding estate and gift tax is crucial for entities to plan for efficient asset transfers, allowing them to reduce tax obligations and guarantee the legal transfer of assets.

A meticulous understanding of estate and gift tax law assists with strategic planning for estate and gift transfers. Having deep knowledge allows for the accurate computation of tax liabilities. It allows for the effective use of available tax reliefs, from exemptions to deductions and credits, leading to optimized wealth transfer strategies.

Knowledge of estate and gift tax provisions assists individuals and families in the proper execution of wills, trusts, and gift transfers. It ensures adherence to legal requirements. It aids in the lawful and efficient transition of assets, avoiding disputes and complications during the asset transfer process.

Deep insight into estate and gift tax law facilitates informed decision-making and planning regarding wealth transfer and preservation. It enables individuals and families to explore various options for asset distribution and succession planning. It allows plans to consider the tax implications and leverage lawful avenues to preserve wealth for future generations.

9. Social Security And Medicare Taxes

Social Security and Medicare taxes, or FICA taxes, are payroll taxes that fund the Social Security and Medicare programs. Employers deduct such taxes from employees’ wages, and examples include deductions for Social Security and Medicare from the wages of a retail worker or a software engineer. It is important for employers and employees to understand the taxes, as they are mandatory and contribute to the funding of essential social programs providing benefits to certain groups, from retirees and the disabled to the elderly.

A thorough understanding of Social Security and Medicare taxes is essential for employers to calculate and remit the correct amount of tax. It ensures adherence to legal requirements and accurate reporting. It contributes to the proper functioning of the Social Security and Medicare systems.

Accurate knowledge and management of the FICA taxes are vital for individuals to understand their contributions and entitlements. It enables the accurate assessment of their future benefits and helps with the effective planning of their retirements. It assists with making informed decisions about their participation in such programs.

Insight into the regulations governing Social Security and Medicare taxes is helpful for compliance and planning. It aids in the resolution of disputes related to contributions and benefits. It allows for strategic planning around payroll tax obligations and benefits entitlements, affecting financial well-being and retirement planning.

How Does A Tax Law Work?

A tax law works by establishing the legal framework for tax administration, from levying and collection to management. Tax law outlines the financial responsibilities of entities and individuals to support the government’s functions and services. Different taxes exist within tax law, from income tax and corporate tax to sales tax and property tax, with each one serving a unique purpose and operating under specific rules and regulations.

Tax law enforces financial charges imposed by the government on taxable entities, specifying the details, from the scope and rate to the method of tax collection. It controls how governments collect money for public services and infrastructure, from roads and schools to healthcare. Tax laws are created and implemented to collect taxes in a fair and systematic manner, helping the government and society function.

The tax law provides entities with clear guidelines for their taxable obligations and rights, ensuring adherence to established legal norms. Adhering to tax law is instrumental for societal balance, ensuring government resources for public projects. The regulation of income taxation applies to all entities. It outlines the necessary details, from rates to deductions and credits, for the accurate determination of tax liability.

Different taxes operate in various ways. For example, sales tax law governs the taxation of goods and services, collecting revenue at the point of sale. Corporate tax law governs the taxation of business and corporate income, setting rules and rates for various types of business income. Tax laws have various purposes, from redistributing wealth and influencing economic activities to funding public services.

Understanding tax law is essential to grasping its economic and social implications. Tax laws change to reflect economic changes and government priorities. They control the flow of money between the government and its citizens, influencing society’s structure and progress.

Tax law is important for the government and society. It combines different tax types with their own rules, supporting government functions and societal welfare. Tax law is complex and diverse, necessitating understanding and adherence to support the country’s progress and development.

What Are The Best Ways To Legally Reduce Your Taxable Income?

The best ways to legally reduce your taxable income are listed below.

- Contributions to Retirement Accounts: Depositing funds into retirement accounts, such as a 401(k) or an IRA, serves as a viable method to reduce taxable income. Contributions to such accounts are pre-tax, reducing the amount of income that is subject to taxation. Individuals find it beneficial to maximize contributions to retirement accounts to lower their taxable income and secure their financial future. Awareness and utilization of such options allow for substantial savings on income taxes.

- Investment in a Health Savings Account (HSA) or Flexible Spending Account (FSA): Placing funds into an HSA or FSA aids in reducing taxable income. Contributions made to such accounts are pre-tax, and withdrawals for qualified medical expenses are tax-free. Many find investing in such accounts beneficial due to the dual advantages of lowering taxable income and covering medical expenses. Proper utilization of HSA and FSA accounts provides financial ease in managing health-related expenditures and mitigates the tax burden.

- Engagement in Charitable Donations: Giving to charitable organizations offers a legitimate way to lower taxable income. The amount given as a donation is deductible from the taxable income, providing support for the charitable cause and reducing tax liability. Individuals find it advantageous to contribute huge amounts to charitable organizations, serving humanitarian causes while allowing for effective management of their taxable income. The integration of charitable contributions into financial planning supports philanthropic endeavors and facilitates tax-efficient wealth management.

- Adoption of Energy-Efficient Home Improvements: Investing in energy-efficient improvements for a home is another lawful approach to reducing taxable income. Certain improvements qualify for tax credits, leading to a reduction in the tax liability. Many homeowners are encouraged to explore and integrate such enhancements to contribute to energy conservation and enjoy the benefits of lower taxes. The implementation of energy-efficient measures in residences propels environmental conservation efforts while resulting in financial benefits through tax reductions.

- Claiming Available Tax Credits: Making use of accessible tax credits is another effective strategy to decrease taxable income. Numerous tax credits are available, ranging from ones for education and childcare to ones for low-income earners, and claiming them leads to direct reductions in tax owed. Individuals and families must endeavor to identify and claim applicable tax credits to optimize their tax positions. Comprehensive knowledge and application of relevant tax credits facilitate considerable savings and ensure lawful management of tax liabilities.

Why Is It Important To File Your Federal Income Taxes Every Year?

Filing your taxes every year is important to avoid legal and financial issues. Successful filing of taxes has a positive effect on several aspects, from credit scores and loan eligibility to personal freedom. Federal income encompasses revenue sources, from wages and salaries to bonuses and investment income.

All incomes require annual tax evaluations. Taxpayers must provide accurate income information to the government for taxation. The question, “What is federal tax?” is answered as a mandatory payment to the government on income and profits, or added to the cost of goods and services. Individuals and groups must pay taxes to fund government operations and public services, from healthcare and education to infrastructure.

Compliance with tax laws requires the prompt and accurate filing of federal income taxes. Society must run smoothly for public services and government institutions to function. Filing taxes supports national well-being and progress.

Late or inaccurate filings lead to penalties and legal consequences. Tax authorities penalize late tax payments with fines and interest, which increases the defaulter’s financial burden. Noncompliance leads to stricter actions, such as asset seizures or imprisonment, highlighting the need to adhere to tax regulations.

The annual filing of taxes encourages financial integrity and responsibility. It helps verify income for loans and financial decisions. Lenders assess tax documents to gauge creditworthiness and financial stability. Filing taxes is important for financial reliability and future prospects.

Filing taxes is a legal and civic duty for the nation and its people. Fair resource distribution and collective goal achievement are crucial for the government and society. The annual filing of taxes is crucial to avoid legal problems and build financial credibility. It is vital for a successful and organized society.

How Is Tax Law Different From Other Types Of Law?

Tax law is different from other types of law in its focus, application, and goals. Tax law focuses on taxation rules and regulations for entities and various sources of revenue. Criminal law focuses on actions that are offenses against the state or the public.

Criminal law aims to determine guilt and enforce appropriate punishments. It defines offenses and punishments to maintain order and protect people and property. Contract law governs agreements between parties and enforces promises and provisions within such agreements. It ensures parties uphold contract terms and resolve disputes using contract provisions or remedies.

Family law deals with family relationships, from marriage and divorce to child custody. It resolves family disputes and protects family members, with a special focus on children, by enforcing rights and protections within the family. Constitutional law focuses on interpreting and implementing a country’s constitution. It resolves disputes related to governing principles and norms and establishes laws and government structures.

Administrative law oversees government agencies and their actions, focusing on reviewing government actions and protecting individuals’ rights. Tax law focuses on numerical calculations and financial assessments to regulate financial contributions to the government. It aligns with a country’s economic goals and reflects its policies, adjusting to changing economic landscapes and objectives.

Tax law is the most important, but the other branches of law have a significant influence on a country’s success. Each branch has a crucial role and contributes to society and the government. Different types of law are interconnected, creating a complete legal system that maintains order and safeguards rights and freedoms.

The differences in objectives and applications make tax law unique among legal disciplines. All Types of Law work together to create a balanced legal system, covering different aspects of society and government, from rights to principles. Tax law is unique because it has a close link to economic policies and financial regulations. It reflects a nation’s fiscal needs and economic vision.

What Is The Source Of Tax Law?

The source of tax law is a combination of legal documents, government entities, and regulatory frameworks. One source of tax law is legislative branch-enacted statutory law. Legislatures create tax laws that define tax obligations for people and organizations. The statutes provide important details, from the taxes imposed and their rates to methods of assessment, collection, and enforcement.

Constitutional provisions are an important source of tax law. The provisions establish the legal framework for imposing and collecting taxes and set limitations on such powers. Constitutional provisions guide tax statutes to ensure justice and equality.

Tax authorities’ regulations and rulings are a key source of tax law. Tax authorities enforce tax laws and provide guidance on their application. The documents guide the interpretation and execution of tax laws, addressing any ambiguities and ensuring consistent application of the law.

Judicial decisions shape tax law evolution. Courts interpret tax laws to resolve tax disputes. Courts interpret tax laws, shaping legal principles and precedents in the field. Court rulings in tax cases shape and interpret the law, influencing its application and development.

Tax law comes from several sources, from statutory law and constitutional provisions to administrative regulations and judicial decisions. Each component is important in defining tax laws, ensuring legal tax imposition and collection, and addressing tax complexities and disputes. The sources converge to create a flexible legal framework that meets society and the economy’s changing needs.

What Happens When Tax Law Is Violated?

What happens when a tax law is violated is a process of legal consequences and financial penalties. Tax law violations encompass various offenses, from tax evasion and fraud to failure to file tax returns. Tax authorities investigate to find out what happens when someone breaks the tax law. Authorities employ a thorough process, from reviewing financial records and conducting audits to gathering evidence, to determine violations.

Tax authorities identify violations and take legal action against offenders. Penalties, in addition, are imposed, and the punishment varies based on the violation’s severity and nature, from simple fines and interest on unpaid taxes to imprisonment in severe cases. The penalties deter illegal tax activities and maintain tax system integrity.

A tax lawyer proves beneficial when arrested for a tax law violation. Individuals hire tax law attorneys to protect their rights and guide them through legal proceedings. A skilled tax attorney analyzes the evidence and devises a defense strategy to dispute accusations and minimize consequences.

Using tax law provisions when facing arrest involves exploring defenses and legal remedies. Legal counsel examines the procedural correctness and legality of the evidence obtained. Attorneys defend the accused rights and ensure legal proceedings follow fairness and due process.

Legal representation helps negotiate settlements and resolve disputes with tax authorities. Attorneys achieve favorable outcomes by showing no intent to violate the law or presenting mitigating factors. Legal counsel is crucial in protecting the rights of individuals accused of tax law violations.

Tax law is complex, and its violation processes are intricate. Understanding the interaction of the law’s rules and regulations requires deep expertise in the field. Legal representation supports and guides individuals facing tax law violations, advocating for their rights and interests in legal challenges.

How Can You Avoid Making Tax Mistakes That Can Lead To An Audit?

You can avoid making tax mistakes that can lead to an audit through careful adherence to tax authority guidelines. Keeping accurate records of details, from income and expenses to transactions, helps with the accurate completion of tax returns. Store documents such as receipts and invoices in a secure place. Maintain organized transaction logs for accurate reporting.

Consulting tax professionals or certified public accountants is beneficial. The experts have extensive knowledge and expertise in tax laws and tax code compliance. Expert advice minimizes errors and omissions in tax filings and assures compliance with tax laws.

Accurate and on-time filing of taxes helps avoid audits. Late tax returns result in scrutiny and penalties from tax authorities, along with interest on unpaid taxes. Following tax deadlines and promptly paying taxes helps maintain good standing with tax authorities and reduces audit risk.

Understanding the tax code is beneficial. It involves knowing the tax reliefs, from deductions and credits to income inclusions, that apply to an individual’s situation. Understanding tax implications helps with the advantageous leveraging of tax code provisions. It helps avoid mistakes in reporting income and deductions.

Filing tax returns requires careful attention to detail and accurate reporting of all necessary information. Reviewing tax returns before submission helps identify and correct errors. Reporting complete details, from income and deductions to credits, ensures an accurate tax return, reducing the chance of an audit.

Being honest and transparent with tax authorities is important. Avoiding taxes by hiding income or inflating deductions leads to sanctions, from penalties and interest to legal consequences. Maintaining integrity in tax reporting and payment builds trust with authorities and streamlines the filing process.

Accurate and prompt responses to tax authorities show cooperation and resolve issues. Clear and immediate clarifications regarding tax authorities’ inquiries and providing requested documentation help resolve issues and reduce the likelihood of a full audit. Individuals promote a compliant and transparent approach to handling taxes by adhering to the guidelines, reducing the chance of making mistakes that attract attention and lead to an audit.

Do I Need A Lawyer To Help With Tax Laws?

No, you do not need a lawyer to help with tax laws, but one is beneficial in certain situations. Tax lawyers have deep expertise in tax law, including the complexities of its codes and legislation. They help navigate tax laws by providing clarity and ensuring compliance.

Consulting a tax professional or certified public accountant is enough for simple financial situations. The experts provide ample guidance on tax matters and help with accurate tax return preparation and filing. They ensure tax law compliance and maximize tax savings with deductions and credits.

A tax lawyer’s expertise proves beneficial in complex financial situations, such as legal disputes and intricate tax issues. Tax lawyers’ expertise is required by entities ranging from businesses involved in complex financial transactions and multinational corporations dealing with international tax laws to individuals facing tax-related legal issues. The lawyers advise on structuring transactions for tax efficiency and legal compliance. They represent clients in tax disputes, defending their rights and interests, and negotiating resolutions.

Legal counsel is essential for tax fraud allegations and other serious tax-related legal matters. Tax lawyers defend accused rights and seek effective resolutions. They navigate tax-related legal frameworks, representing and advocating for clients.

People in estate planning or wealth transfer benefit from legal advice on taxes. Tax lawyers advise on minimizing estate and gift taxes. They assist with the efficient transfer of assets within the law. They help clients organize their finances to reach their goals and follow tax laws.

A tax lawyer is not necessary for regular tax needs, but those with complex financial and tax situations benefit from hiring tax lawyers. The lawyers have specialized knowledge and skills in tax law. They provide valuable support in resolving tax-related legal issues and ensuring compliance with the law.

Is The United States Under Tax Law?

Yes, the United States is under tax law. US tax law is extensive and intricate, covering rules and legislation for taxation. The laws come from various sources, from the US Constitution and federal and state statutes to administrative regulations and court decisions.

Congress passed the Internal Revenue Code, which is the main source of federal tax law. It is the main source of federal tax law and covers all types of taxes, from income and estate to gift taxes. The IRS enforces federal tax laws and provides regulations and guidelines for the Internal Revenue Code.

State tax laws vary from state to state, each with its own statutes governing taxation. The laws apply to several state-levied revenues, from state income and sales to properties. States have tax authorities that administer and enforce state tax laws.

State governments enforce local tax laws. The laws pertain to several aspects, from property taxes and business licenses to local fees. Local tax authorities handle local tax assessment and collection based on local laws and rules.

US tax law includes procedures starting from the assessment and collection of taxes to the enforcement of regulations and resolution of tax disputes. Federal and state courts interpret tax laws and resolve disputes between taxpayers and tax authorities. They ensure tax laws align with the Constitution and follow the rule of law.

Tax compliance is required for all entities, such as individuals and businesses, subject to US taxation. Noncompliance results in consequences, from penalties and interest to other sanctions under tax laws. The US tax system helps the country’s growth, from revenue generation and public service provision to achieving policy objectives.

Tax law in the United States is complex. It involves a range of jurisdictions and systems, from federal, state, and local laws to tax authorities and judicial systems. The system reflects the diverse and complex economic and social landscape of the nation. The tax law system balances and ensures fairness in collecting taxes, supporting the country’s growth.

Does Tax Law Vary Between Countries?

Yes, tax law varies between countries, reflecting the economic structures, government philosophies, and public policy objectives of each one. Each country has its own tax laws to govern taxes within its territories. The differences are due to various factors, from legislative processes and legal frameworks to administrative practices.

Countries align tax laws with fiscal policies and economic goals. Certain nations implement progressive tax systems to distribute the tax burden in a fairer manner based on income. Other countries opt for a regressive or proportional tax system to boost investment and economic activity.

Taxation’s legal basis varies between countries. Certain countries include tax authority and taxation principles in their constitutions, necessitating constitutional amendments for significant tax law modifications. Other countries use statutory laws to create and change tax regulations.

Tax treaties and agreements are important for defining relationships between countries’ tax systems. The agreements aim to prevent double taxation and tax evasion. They resolve tax-related disputes between countries. Countries negotiate treaties to protect their interests and maintain the integrity of their tax systems.

Countries prioritize different taxes based on their economies and policies. Countries with abundant natural resources levy higher taxes on the extraction and export of such resources. Developed countries, on the other hand, prioritize taxing corporate profits and international trade.

Tax laws and enforcement methods differ between countries. Some nations have centralized tax authorities that implement tax laws nationwide, while others give tax administration powers to regional or local governments. Tax collection and enforcement affect a country’s tax system’s success.

The varied tax laws in different countries highlight the complexity of international taxation. Countries have different ways of approaching taxation, which is reflected in each country’s legalities, from legal frameworks and tax types to administrative structures and enforcement strategies. Tax laws worldwide show how a country’s history, economy, and politics affect its tax regulations.

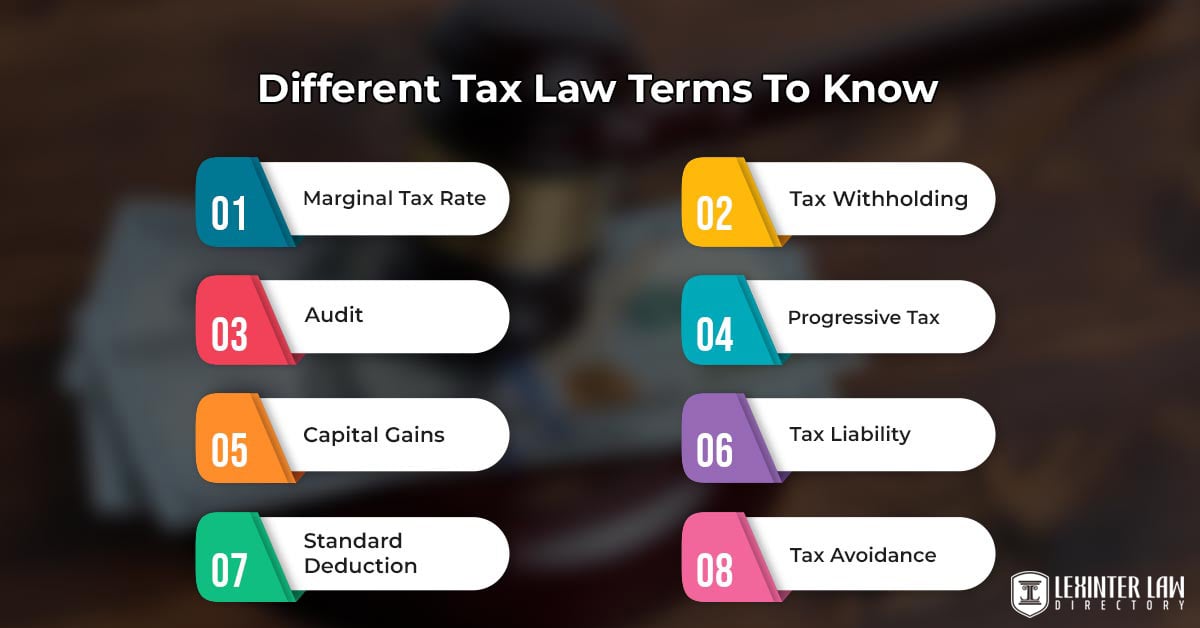

What Are The Different Tax Law Terms To Know?

The different tax law terms to know are listed below.

- Taxpayer: A taxpayer is an individual who must pay taxes and report accurate income to the government. Not following tax obligations leads to legal consequences such as penalties and interest.

- Marginal Tax Rate: The marginal tax rate represents the rate applied to the next dollar of income. It serves as a fundamental concept in financial analysis and economic policy, enabling informed financial decision-making.

- Audit: An audit involves the evaluation and examination of records and activities to confirm the accuracy of financial declarations and adherence to relevant tax laws. Any discrepancies found during an audit lead to adjustments in reported income and tax, entailing additional payments or refunds.

- Depreciation: Depreciation refers to the reduction in the value of assets over time due to several factors, such as wear-and-tear and obsolescence, allowing businesses to distribute an asset’s cost over its useful life.

- Capital Gains: Capital gains result from selling capital assets, such as real estate and stocks, at a profit. Proper calculation and reporting of capital gains are essential for precise tax returns and compliance with tax laws.

- Standard Deduction: The standard deduction is a predefined amount deducted from taxable income, available to taxpayers who do not itemize their deductions. It simplifies the tax filing process and plays a critical role in the tax system, influencing the decision to itemize deductions or opt for the standard deduction.

- Itemized Deductions: Itemized deductions are specific expenses subtracted from taxable income, including medical costs and charitable donations. They provide an alternative to the standard deduction and necessitate detailed record-keeping and documentation to lower taxable income and the resulting tax owed.

- Tax Evasion: Tax evasion is the illicit practice of avoiding taxes by providing fraudulent information about income and deductions, resulting in serious legal repercussions such as fines, penalties, and imprisonment.

- Tax Withholding: Tax withholding pertains to the practice of deducting taxes from employees’ wages before payment, and the employer remits such taxes to the government.

- Taxable Income: Taxable income is the income amount subjected to tax after considering deductions and exemptions, forming the basis for determining tax owed to the government.

- Regressive Tax: A regressive tax imposes a disproportionate burden on lower-income individuals, affecting the income and wealth distribution in society. The fairness and implications of such taxes are subjects of extensive debate concerning economic equality and social justice.

- Progressive Tax: A progressive tax system imposes higher rates on higher income levels, aiming for a more equitable distribution of the tax burden across different income brackets. Progressive tax systems are central in discussions related to economic fairness and income inequality.

- Tax Liability: Tax liability is the total amount of taxes an individual or business owes, derived from various income sources and calculated per the prevailing tax laws and rates.

- Exemptions: Exemptions are amounts subtracted from taxable income for each taxpayer and dependent, reflecting the government’s acknowledgment of financial responsibility for dependents.

- Deductions: Deductions, subtracted from gross income to ascertain taxable income, encompass diverse expenses and are integral to reducing taxable income and subsequent tax liability.

- Credits: Credits are amounts subtracted from the tax owed and are more beneficial than deductions, incentivizing specific behaviors and investments.

- Filing Status: The marital status and make-up of the household determine filing status. It influences the rate at which income is taxed and affects the availability of tax relief, from deductions and credits to exemptions.

- Tax Avoidance: Tax avoidance involves the legal arrangement of financial affairs to minimize tax liability and differs significantly from illegal tax evasion. Employing tax avoidance strategies is essential for proficient tax planning and financial management.

- Tax Treaty: A tax treaty is a bilateral agreement designed to prevent double taxation and tax evasion, providing stability and clarity regarding tax obligations to promote international trade and investment.

- Tax Return: A tax return is a document filed with tax authorities detailing information ranging from income and expenses to other relevant financial information. It serves as a vital communication tool between taxpayers and tax authorities.

1. Taxpayer

A taxpayer represents any individual or entity mandated by law to pay taxes to a federal, state, or local government within the stipulated time. Understanding the term is essential to understanding the intricacies of tax law, as it designates entities that have a legal obligation to contribute a portion of their income or assets. Knowledge of the roles and responsibilities associated with being a taxpayer ensures adherence to the law and fosters a sense of civic duty and accountability.

Recognizing the importance of the taxpayer within tax law is important, as it enables an understanding of the legal implications and stipulations associated with tax obligations. Having insight into the diverse aspects of taxpayer obligations allows for a more informed approach to financial planning and management. It fosters an environment of compliance and responsibility, ensuring the fair contribution of each entity to the communal pot and supporting the provision of public goods and services.

Understanding who constitutes a taxpayer and the ensuing responsibilities impact the perception of and approach to tax law. It aids in deciphering the various tax codes, ensuring that each taxpayer remains well-informed about their legal obligations. Enlightenment about taxpayers and their significance in tax law is fundamental to promoting lawful conduct and financial transparency, leading to a collective responsibility toward the sustenance of societal structures and services.

2. Marginal Tax Rate

The marginal tax rate is the percentage at which the next dollar of taxable income is taxed. Having an in-depth knowledge of the marginal tax rate is pivotal when learning about tax law. The term illuminates the progressive nature of the tax structure for income and is important in financial planning, as entities must be cognizant of what they owe, which varies based on differing income levels. It is instrumental in evaluating investment opportunities and optimizing earnings to gain an effective understanding of the tax system’s intricacies.

Clarity regarding marginal tax rates is imperative, as it aids individuals and entities in their long-term strategy. Entities must factor in the marginal tax rate into their economic judgments to avoid unforeseen fiscal obligations and maximize their income following taxation. A thorough comprehension of the rate, from its implications to its functionality, allows entities to handle their finances better.

Ample knowledge of the marginal tax rate allows for more strategic decisions regarding finances. The knowledge of the rate proves vital in assessing the tax consequences of additional income and in determining the post-tax return on investments, helping in crafting efficient financial strategies.

A deep understanding of the marginal tax rate is indispensable. It provides insights into the varying rates at which different income levels are taxed, allowing for more accurate tax forecasting and planning. It impacts choices related to income generation, expenditure, and investment.

A clear comprehension of the rate’s significance and application is integral to tax law studies. It enables a more nuanced comprehension of the tax structure. It fosters the development of effective strategies for tax liability management and financial well-being.

3. Audit

An audit is a thorough inquiry and study of monetary records or operations to assess conformity and compliance with accounting and tax laws. All entities are subject to audits, necessitating a thorough comprehension of the processes and specifications involved. A deep knowledge of auditing procedures and standards aids in the preparation of precise accounting documents and fosters adherence to tax laws, promoting transparency and financial integrity. Knowledge of audits serves to illuminate areas of non-compliance, reducing legal repercussions and fostering ethical accounting practices.

Audits function as a safeguard against accounting inaccuracies and acts of fraud. They unveil errors, misconduct, and areas for improvement in financial records and tax forms. Knowledge of audits is integral for legal compliance and financial accuracy, acting as an instrumental tool for individuals and organizations to avoid fiscal penalties and maintain a sound financial standing. It is essential in tax law due to its role in ensuring the correctness and validity of the reported financial transactions and tax obligations.

The importance of an audit lies in its ability to substantiate financial claims and enhance credibility with stakeholders, tax authorities, and the public. A sound understanding of audits mitigates the risk of legal complications and enriches the knowledge base of entities, preparing them for effective and lawful financial management. It is an invaluable component of tax law education due to its pivotal role in establishing and maintaining fiscal compliance and transparency.

4. Depreciation

Depreciation is the process through which an asset’s value declines due to regular, daily use. Understanding how depreciation works is beneficial in studying tax law, as it impacts the accounting records and tax obligations of an entity. It is central to tax law and affects how entities determine their taxable earnings and their tax obligations. Grasping its principles enables entities to arrive at well-informed choices and precise calculations regarding asset values and corresponding tax obligations.

The significance of comprehending depreciation in tax law extends to its application in figuring out taxable earnings. It helps with taxable income reduction by dividing up assets’ costs over their lifespans, allowing for effective tax liability management. A profound understanding of its mechanisms is imperative for adequate financial preparation and lawful tax reduction, allowing for the efficient navigation of tax law and optimizing financial performance.

Depreciation is a major factor in the calculation of tax obligations. Knowledge of it aids in the lawful lowering of taxable revenue and compliance with statutes. A foundational understanding of depreciation principles is essential for entities aiming to maintain accurate financial records and adhere to tax obligations while optimizing asset value management.

5. Capital Gains

Capital gains are the proceeds from the sale of assets, such as stocks. It is the increase in value at the time of sale from the asset’s original acquisition cost. Long-term assets, one year or older, incur long-term capital gains and are subject to preferential tax rates, while short-term assets are subject to ordinary rates. Knowing the details and mechanisms is instrumental in making informed investment decisions.

Capital gains are important for entities’ taxable income. Understanding capital gains regulations is necessary for following tax rules and maximizing tax advantages. Jurisdictions have varying tax laws, highlighting the need to study and apply relevant statutes to comply with the law and for effective financial planning. Understanding its implications helps entities navigate tax law better.

Capital gains are crucial for understanding tax laws and have a significant impact on investment outcomes. Understanding capital gains and tax laws helps entities and individuals better maximize financial gains and reduce tax liabilities. Gaining knowledge of its implications helps make better decisions and plans for personal and corporate finances, leading to sustainable financial growth and development.

6. Standard Deduction

A standard deduction is a predetermined amount taken from gross income, decreasing the income subject to tax. The government establishes a predetermined figure, with the figure changing according to the individual’s filing status. It streamlines the tax filing process for individuals wanting to avoid itemizing their deductions, providing a simple method to minimize tax obligations.

Standard deduction has a direct impact on the total tax owed, highlighting the importance of understanding the term. Having knowledge about the regulations and conditions allows taxpayers to make informed decisions about their tax filings, promoting effective financial planning and legal compliance. It is an important part of the tax system, impacting a wide range of taxpayers and offering various advantages.

Standard deductions in tax law have a wide application and have a significant effect on individual financial situations. It offers a practical way for taxpayers to efficiently handle their tax obligations. Having a strong understanding of the term is important for improving personal financial knowledge and responsible money management.

7. Itemized Deductions

Itemized deductions come from specific expenses removed from gross earnings to lower total taxable earnings. There are several qualified expenses, such as dental expenses and philanthropic contributions. Individuals with higher qualified expenses benefit more when taking advantage of such deductions instead of standard ones.

Understanding itemized deductions is important in the study of tax law. Individuals optimize the reduction of gross earnings through the meticulous accounting of specific expenses. Grasping the principles and application is important for accurate and lawful tax filings. It allows for the full utilization of available tax relief and the fulfillment of tax obligations.

Itemized deductions have a direct influence on tax liabilities. Gaining thorough knowledge of such deductions allows for effective navigation of tax law and the strategic application of the deductions, improving the ability to plan and manage finances. Having knowledge about itemized deductions is essential to obtaining ideal tax results and attaining financial wisdom.

8. Tax Evasion

Tax evasion is an illegal act involving the intentional falsification of information to avoid paying taxes. It includes practices ranging from exaggerating deductions to concealing money stored in foreign accounts, resulting in a decrease in government earnings. Tax evasion is a grave transgression carrying serious ramifications, such as imprisonment.

Tax evasion is a focal point in tax law due to its illegal nature and the severe consequences it carries. Knowing which behavior qualifies as tax evasion and the resulting implications is vital for promoting adherence to tax regulations. It provides education on the limits of lawful tax planning and the repercussions associated with engaging in illegal practices.

Tax evasion serves as a deterrent to illicit financial activities. Recognizing the statutory frameworks related to crime supports the cultivation of ethical financial practices and emphasizes the significance of following established tax laws and regulations. The focus on the illegal nature and repercussions of tax evasion highlights the importance of following the law and maintaining integrity in financial dealings.

9. Tax Withholding

Tax withholding is the act of deducting tax from specific income types, such as wages, at the source. For example, employers take away a specific sum from worker’s paychecks to cover their tax obligations by sending it straight to the government. It serves as a method of gathering tax revenue over the course of the year.

Tax withholding is one of the government’s primary methods to gather income tax revenues. It guarantees a consistent income stream for the government and assists individuals in avoiding the weight of substantial tax bills at the end of the year. A clear comprehension of the mechanisms surrounding it ensures adherence to tax obligations and precise financial planning.

Tax withholding holds significant importance in tax law education because of its wide-ranging relevance and influence on personal and business finances. A solid grasp of the term’s principles allows for efficient financial resource management and adherence to tax laws. It promotes fiscal responsibility and awareness among entities.

10. Taxable Income

Taxable income is the segment of gross income subject to tax. It serves as the basis for determining the tax amount owed after deducting all permissible costs and exemptions from the aggregate revenue. Factors, from the kind and level of income to exemptions and deductions, are taken into consideration when determining the taxable income in its entirety.

Taxable income is significant because it is an essential component in the process of determining the amount of income tax that must be paid to the government. A comprehensive understanding of the factors that go into calculating taxable income and how it is determined is necessary for legal compliance with tax duties and for the optimum use of financial planning methods. The notion of taxable income is fundamental to the operation of the entire taxation system and has an impact on a diverse range of financial behaviors and choices.

Taxable income is a key component in determining a person’s tax liability, highlighting its importance. A strong command of its underlying concepts and applications ensures legal compliance and effective management of financial resources. The accurate determination and reporting of taxable income are necessary in order to obtain beneficial financial outcomes and act in a manner that is compliant with monetary laws.

11. Regressive Tax

A regressive tax is one where the tax rate decreases as the amount subject to taxation increases, implying a higher relative burden on lower-income individuals compared to higher-income individuals. Examples include sales taxes and property taxes, where the rate remains constant but the effective burden is higher for those with lower incomes. It contrasts with progressive taxes, which place a higher relative burden on entities with higher incomes.

Understanding regressive taxation is important as it elucidates the implications and impacts of different tax structures on various income groups. Knowledge of how regressive taxes operate and their effects on economic equality is crucial for informed discussions and evaluations of tax policies. It brings up considerations about fairness and equity in tax law, influencing policy deliberations and reforms.

The study of regressive tax law is necessary as it facilitates a comprehensive understanding of its societal and economic implications. Insight into regressive taxation enables informed evaluations of tax systems and fosters discourse on equitable tax reforms. A nuanced understanding of regressive tax structures contributes to the broader conversation on economic justice and policy development.

12. Progressive Tax

A progressive tax imposes a higher tax rate on higher income levels, meaning individuals with higher incomes pay a higher percentage of their income in tax compared to lower-income individuals. Income tax is a prime example, where tax rates escalate with the increase in taxable income. It is a means to redistribute wealth and achieve fiscal equity within society.

The understanding of progressive taxation is integral to tax law as it embodies principles of financial equity and social justice. A comprehension of the structure and implications of progressive taxation is essential for the analysis and development of equitable tax policies. Progressive tax systems play a pivotal role in addressing income disparities and shaping societal norms regarding fiscal responsibility and fairness.

Progressive tax holds immense significance in learning tax law due to its impact on income distribution and social fairness. Knowledge of its principles enriches discussions on fiscal policies and informs debates on wealth redistribution mechanisms. It is central to the exploration of equitable and responsible tax structures, fostering informed discourse on fiscal impartiality and societal welfare.

13. Tax Liability

Tax liability is an entity’s aggregate amount owed to the government. It is calculated by applying appropriate tax rates to the revenue taxable, and it represents a legal obligation to the government. Correct calculation and prompt settlement of tax debts are fundamental to lawful adherence to tax laws.