11 Best Law Schools For Banking Law

The best banking law schools offer specialized programs that equip students with the knowledge and skills required to excel in the financial sector. Institutions like Harvard Law School, Columbia Law School, and New York University School of Law are consistently ranked among the top choices for students interested in banking law due to their comprehensive curricula and renowned faculty. The schools emphasize financial regulations, corporate finance, and securities law, allowing students to gain a deep understanding of the complexities of banking law. Specialized banking law programs focus on the critical areas of financial regulation and compliance, which are essential for careers in banking law. Law schools such as Boston University School of Law and Georgetown University Law Center provide tailored LLM programs specifically designed for banking and financial law. The programs include practical experiences like internships, enabling students to apply their legal training to real-world financial scenarios. Graduates from the top banking law schools find strong job prospects in law firms, banks, and regulatory agencies. The schools prepare students for roles as legal advisors, compliance officers, and corporate counsels within the financial sector, making them highly competitive in a complex and evolving job market.

The top 3 law schools for banking law are listed below.

- Columbia Law School: Columbia Law School was established in 1858 and stands as one of the most prestigious law schools in the United States. Columbia Law offers a robust program in banking law through its Corporate and Finance Law Institute. The program includes courses in financial regulation, securities law, and corporate finance, providing a comprehensive understanding of banking and finance law. Columbia Law’s proximity to New York’s financial hub further enhances its appeal for individuals interested in banking law.

- Harvard Law School: The world-renowned Harvard Law School, founded in 1817, has a strong reputation, especially for students interested in banking law. The law school, located in Cambridge, offers a specialized focus on banking law through various courses. The acceptance rate at HLS Law is around 9.6%, making it one of the most selective law schools in the country. Graduates of the program are well-prepared for roles in top law firms, banks, and government agencies.

- University of Chicago Law School: Chicago Law School was established in 1902 and has developed a strong reputation for its rigorous academic environment and interdisciplinary approach. The law school, located in Chicago, Illinois, offers specialized training in banking law, with courses focusing on financial regulation, corporate finance, and legal issues in the financial sector. The school’s strategic location in Chicago enhances its appeal for students interested in banking law, offering proximity to a major financial center and numerous networking opportunities.

Table of Contents

- 1. Harvard Law School

- 2. Columbia Law School

- 3. New York University School Of Law (NYU)

- 4. Georgetown University Law Center

- 5. University Of Pennsylvania Carey Law School

- 6. University Of Chicago Law School

- 7. Fordham University School Of Law

- 8. Yale Law School

- 9. Boston University School Of Law

- 10. University Of Michigan Law School

- 11. Emory University School Of Law

- How To Choose The Best Law School For Banking law?

- What Is The Best Degree For Banking Law?

- How To Become An Banking Lawyer?

- How Long Would It Take To Study Banking Law?

- What Is The Average LSAT For Banking Law?

- What Can You Expect From A Career As A Banking Lawyer?

- What Is The Difference Between An Banking Lawyer And A Corporate Lawyer?

- How Do Banking Lawyers Earn?

- Where Do Most Banking Lawyers Work?

- How Can I Find Good Banking Lawyers Near Me With Lexinter?

1. Harvard Law School

Harvard Law School is one of the most prestigious law schools in the world, known for its rigorous academic programs and influential alumni. Harvard Law, established in 1817 and located in Cambridge, Massachusetts, is the oldest law school in the United States. The Juris Doctor (JD) program at Harvard is designed to provide a deep understanding of law, preparing students for various careers in legal practice, academia, government, and business. Harvard Law, moreover, offers specialized programs, including the Master of Laws (LL.M.) and Doctor of Juridical Science (S.J.D.), which focus on advanced legal study and research. Harvard Law School has an acceptance rate of approximately 9.6%, making it one of the most selective law schools. The school received around 8,334 applications and admitted 798 students for the academic year of 2023-24. Applicants generally have high LSAT scores and GPAs, with the median LSAT score being 174 and the median GPA of 3.93. Tuition at Harvard Law School is significant, reflecting the institution’s stature and resources. Tuition and fees amount to $78,692 for the academic year of 2023-24. The total cost of attendance reaches approximately $111,798 annually, including room, board, and personal expenses. Financial aid is available, with 42.55% of students receiving grants or scholarships.

Harvard Law School is ranked 4th by U.S. News and World Report 2024, tied with Duke Law and Virginia Law. The law school, in addition, is ranked 1st according to Q.S. Ranking with an overall score of 99.7. Harvard Law, one of Massachusetts best law schools, offers specialized programs in banking law through various advanced legal courses. The school provides a strong focus on financial law, including courses in banking regulation, securities law, and corporate finance. Students, in addition, pursue the Master of Laws (LL.M.) program, which allows deeper specialization in banking and financial law. The program prepares graduates for leadership roles in financial services, law firms, and regulatory agencies. Harvard Law’s faculty includes experts in banking law and related fields. Professor Hal S. Scott, a prominent scholar in financial regulation, has been instrumental in shaping U.S. and global financial policies. Professor Howell E. Jackson focuses on regulatory law and financial oversight, contributing to banking law through teaching and research. The faculty members provide invaluable expertise, helping students gain in-depth knowledge of regulatory frameworks and financial systems.

Clinical opportunities at Harvard Law School offer hands-on experience in banking law. One notable example is the independent clinical placement with the Federal Reserve Bank of Boston, where students work on fintech-related initiatives and legal issues surrounding payment systems and central bank digital currencies. Another opportunity is the Transactional Law Clinics, which gives students the chance to work on real-world financial transactions and regulatory compliance cases. Harvard Law School provides exceptional networking opportunities for students interested in banking law. The extensive Harvard Law alumni network includes over 40,000 professionals, many of whom occupy influential positions in finance and banking law. Students benefit from platforms like Amicus, where they connect with alumni for mentoring, career guidance, and professional development. Harvard offers various courses tailored to banking law, including banking regulation, securities law, and corporate finance. The courses provide students with a comprehensive understanding of the legal and regulatory aspects of financial institutions and markets. Students further specialize by taking advanced courses such as financial institutions law or participating in independent research projects. Banking law graduates from Harvard Law School frequently secure top-tier positions in law firms, financial institutions, and regulatory agencies. Several alumni have become legal advisors at the Federal Reserve or partners at major law firms specializing in banking law. The law school boasts an employment rate of 95.3% within 10 months of graduation.

2. Columbia Law School

Columbia Law School is a prestigious Ivy League institution located in New York City, renowned for its rigorous academic programs and global influence. The school offers several law programs, including the Juris Doctor (JD), Master of Laws (LL.M.), Executive LL.M., and Doctor of the Science of Law (J.S.D.). The JD program offers a rich, progressive curriculum focusing on the complex legal challenges of modern times. The LLM program allows for further specialization in different legal fields. Columbia Law offers several ten dual-degree programs and one joint degree program with Princeton University. Columbia Law School has an acceptance rate of 12.2%, making it one of the most selective law schools in the United States. 7,754 applications were received for the 2023 entering class, and 948 students were accepted, with a final enrollment of 415. The tuition for Columbia Law School is among the highest in the nation. The law school’s tuition fee is $81,888 for the academic year of 2024-25. The total cost of attendance, including living expenses, books, and personal costs, is $119,997 annually.

Columbia Law School holds a strong reputation as one of the top law schools globally. The school is ranked 8th among the best law schools according to U.S. News and World Report 2024 and QS University ranking. The law school’s notable rankings include No. 1 in contracts law, No. 2 in business law, and No. 4 in international law. Columbia Law offers specialized programs in banking and finance law, with courses covering areas such as financial regulation, securities law, and corporate governance. Students tailor their education by selecting electives in banking law and engaging with real-world issues through joint-degree programs like the JD/MBA. Columbia Law’s faculty includes experts in financial and banking law. Professor Kathryn Judge, an expert in financial regulation, focuses on the structure and functioning of financial markets. Professor Eric Talley specializes in corporate law and securities regulation, contributing to the school’s deep expertise in banking law.

Columbia’s clinical programs offer students hands-on experience in financial law. The Entrepreneurship and Community Development Clinic allows students to work on real-life transactional matters, while the Mediation Clinic provides training in conflict resolution within corporate settings. Students engage in externships at financial regulatory agencies or with leading law firms, gaining invaluable practical experience to supplement their classroom learning. Columbia Law School offers robust networking opportunities for students specializing in banking law. The Columbia Business and Law Association (CBLA) frequently hosts events featuring banking and finance law professionals, providing students with valuable insights and connections. Alumni in the banking law sector hold prestigious positions, such as partners at top law firms like Davis Polk & Wardwell LLP and Milbank LLP.

Columbia Law’s course offerings in banking law include advanced seminars such as International Banking and Finance: The Challenges and The Law of Monetary and Financial Institutions. The courses cover the foundations of financial regulation, central banking, insurance law, and the evolving legal frameworks for cryptocurrencies and financial technologies. The curriculum integrates practical and theoretical knowledge, preparing students for careers in financial regulation and policy-making. Graduates of Columbia Law School specializing in banking law frequently secure top positions in law firms, financial institutions, and regulatory bodies. 98.3% of graduates, including banking law graduates, pursue careers with government agencies like the Federal Reserve, focusing on financial regulation and risk management.

3. New York University School Of Law (NYU)

New York University School of Law (NYU Law) is a prestigious law school located in New York City, known for its rigorous academic programs and vibrant campus. NYU Law, part of New York University, was founded in 1835 by Benjamin Franklin Butler. The school offers multiple programs, allowing students to specialize in various areas of law. The JD program is the flagship program, focusing on international, comparative, and foreign law. The law school offers eight specialized LLM degrees, including an LLM in corporation law, an LLM in international taxation, and an LLM in legal theory. NYU Law’s acceptance rate is approximately 16.76%, reflecting its highly competitive admissions process. The median LSAT score for admitted students was 172, with a median undergraduate GPA of 3.90 for the 2023 cycle. The school received over 8,000 applications, ultimately admitting around 400 students into its JD program.

New York University School of Law holds a stellar reputation as one of the top law schools globally. NYU Law consistently ranks within the top 10 U.S. law schools, largely due to its outstanding faculty, academic rigor, and its location in New York City. The law school is particularly renowned for its strength in corporate, international, and financial law, making it a popular choice for students interested in banking law. NYU Law offers specialized programs for banking law, which cover areas such as financial regulation, corporate finance, and international banking law. The school allows students to pursue an LL.M. in Banking Law, which equips them with a comprehensive understanding of regulatory frameworks, financial instruments, and the legal issues surrounding global finance. Faculty at NYU Law are recognized experts in banking and financial law. Professor Richard Pildes, a constitutional and regulatory law scholar, has worked extensively on financial oversight and corporate governance. Professor Jennifer Arlen, a leader in corporate crime and financial regulation, provides invaluable insights into legal strategies used in corporate settings.

Clinical opportunities at NYU Law provide practical experience in financial regulation. The Business Law Transactions Clinic allows students to work on real financial deals, including corporate governance and financial restructuring. Externships with organizations like the Securities and Exchange Commission (SEC) give students exposure to regulatory frameworks, making them highly competitive in banking law. NYU Law School provides excellent networking opportunities for students interested in banking law. The alumni network is extensive, connecting graduates with professionals in top law firms, regulatory agencies, and financial institutions. Notable alumni include Martin Lipton, co-founder of Wachtell, Lipton, Rosen & Katz, who is known for creating the “poison pill” defense in corporate finance, and Evan Chesler, chairman of Cravath, Swaine & Moore. NYU Law offers specialized courses in banking law, such as Corporate Finance and Banking Law and Regulation. The courses provide a comprehensive understanding of the legal frameworks governing financial institutions. The course offerings ensure that students receive theoretical and practical training in financial law. Graduates from NYU Law specializing in banking law secure prestigious positions in law firms and regulatory bodies. Several alumni work at institutions like the Federal Reserve or in corporate legal departments handling regulatory compliance and financial restructuring.

4. Georgetown University Law Center

Georgetown University Law Center, founded in 1870, is a prestigious institution located in Washington, D.C. The law school, with almost 2000 students, is the largest law school in the US in terms of student enrollment. Georgetown Law, with its proximity to the nation’s center, provides students with unique opportunities for internships, externships, and networking in government and legal sectors. The law school offers a JD program spanning over three years. The law school, in addition, offers several LLM degrees in taxation, national security law, and international business law. The dual-degree programs include LLM /MBA from HEC, LLM in public health, and LLM/ Master’s in management. The acceptance rate for Georgetown Law is 19.57%, reflecting its competitive nature. Georgetown received over 10,000 applications in recent admissions cycles, accepting just over 2,100 students. The median LSAT score for accepted applicants is 171, and the median undergraduate GPA is 3.91. The tuition for Georgetown Law for the 2023-2024 academic year is approximately $79,672. The total cost of attendance, including living expenses, books, and various fees, is estimated at $115,812 annually. Georgetown offers financial aid, and about 64% of students receive scholarships or grants, with an average award covering around 43% of tuition costs.

Georgetown Law offers specialized programs in banking and finance law, including courses like banking law and financial institutions and securities regulation. The programs equip students with in-depth knowledge of regulatory frameworks governing financial institutions. The LL.M. in Securities and Financial Regulation further enhances expertise, preparing graduates for high-level positions in financial services law, regulatory bodies, and corporate legal departments. Georgetown Law’s faculty includes renowned experts in banking law, such as Professor Emma Coleman Jordan, a specialist in financial services regulation, and Professor Anna Gelpern, an authority on sovereign debt and financial regulation. The research and teaching of the faculties provide students with cutting-edge insights into banking law and financial policy. Georgetown Law offers several clinical opportunities in financial law. The Social Enterprise and Nonprofit Law Clinic allows students to work on legal matters involving financial structures for businesses. The Federal Legislation Clinic provides hands-on experience in regulatory advocacy and legislative processes related to financial regulation.

Georgetown Law Center offers robust networking opportunities in banking law through its extensive alumni network. Georgetown Law alumni include prominent figures like Jerome Powell, Chair of the Federal Reserve, and Robert Lighthizer, former U.S. Trade Representative. Networking events and the Hoya Lawya Gateway platform help students connect with alumni for mentorship and career opportunities, particularly in the banking and financial sectors. The law center offers various courses in banking law, including banking and financial institutions law, securities regulation, and financial services and the law. The courses provide students with comprehensive training in regulatory frameworks, financial institutions, and corporate governance. Georgetown Law boasts an employment rate of 96.1% within ten months of graduation. The school’s banking outcome is impressive, with several graduates working in the Federal Reserve and top law firms.

5. University Of Pennsylvania Carey Law School

The University of Pennsylvania Carey Law School is one of the leading law schools in the U.S., located in Philadelphia. Pennsylvania Carey Law offers various programs, including the Juris Doctor (JD), Master of Laws (LL.M.), and joint degrees such as JD/MBA, making it an ideal institution for students interested in interdisciplinary legal education. The JD program is the flagship program that emphasizes cross-disciplinary training, with partnerships across various university departments. The LLM program is customizable from two concentrations: Intellectual property law and Human security law. The Doctor of Juridical Science Program (SJD) is the most advanced program offered by Penn Carey Law. UPenn Law has a highly competitive acceptance rate of 9.88%. The median LSAT score for admitted students is 172, with a median GPA of 3.92, reflecting the high academic caliber of its student body. The admissions process is selective, focusing on students with strong academic backgrounds, leadership potential, and demonstrated commitment to the legal profession. Tuition for the 2024-2025 academic year at UPenn Law is $76,934, while the total cost of attendance is $101,722. The University of Pennsylvania Carey Law School holds a prestigious reputation as one of Pennsylvania best law schools. The school’s ranking is 4th among 196 law schools, according to U.S. News and World Report 2024. Penn Carey Law’s notable rankings include 4th in business law, 5th in contracts law, and 11th in constitutional law.

UPenn Law offers specialized programs in banking and financial law, with courses such as Financial Regulation and Corporate Finance Law. Students, moreover, participate in joint degree programs like the JD/MBA, which provides a robust understanding of legal and business principles. The programs are designed to prepare students for careers in corporate law, banking regulation, and financial services. The faculty at Penn Carey Law includes leading experts in financial and banking law. Professor David Skeel specializes in corporate law, bankruptcy, and financial regulation, offering deep insights into legal frameworks governing financial institutions. Professor Jill Fisch, known for her work in securities regulation and corporate governance, plays a key role in guiding students through complex regulatory landscapes. Clinical opportunities at Penn Carey Law provide hands-on experience in banking law. The Detkin Intellectual Property and Technology Legal Clinic allows students to engage in real-world financial transactions and regulatory compliance cases. The Entrepreneurship Legal Clinic offers another avenue for students to work on financial and regulatory matters for startups and businesses.

The University of Pennsylvania Carey Law School provides strong networking opportunities for students interested in banking law. The extensive alumni network includes influential professionals in the financial and legal sectors. Notable alumni include Osagie Imasogie, a senior figure in biotech and corporate law, and Francis J. Carey, a major benefactor of the law school. The connections provide students with valuable insights and career opportunities in banking law. Penn Carey Law offers specialized courses for banking law, including financial regulation and corporate finance. Students, moreover, benefit from cross-disciplinary programs with Wharton, such as the JD/MBA or Wharton’s certificate programs. The courses prepare students for the complex regulatory landscape of banking and finance, providing theoretical and practical legal knowledge. Graduates specializing in banking law find success in prestigious law firms, regulatory bodies, and corporate legal departments. Severe pursue roles in top financial institutions, handling regulatory compliance and financial litigation.

6. University Of Chicago Law School

The University of Chicago Law School is a prestigious private law school established in 1902 located in Chicago, Illinois. The school offers Juris Doctor (JD), Master of Laws (LL.M.), Doctor of Jurisprudence (JSD), and various law programs. The JD program is highly regarded for its rigorous academic curriculum and its focus on developing critical thinking and problem-solving skills. The law school, moreover, offers an MLS (Master of Legal Studies) spanning over one year. The MLS degree is an advanced one, especially for PhD students. The acceptance rate at the University of Chicago Law School is 12.78%, reflecting its highly competitive admissions process. The law school’s LSAT score of enrolled students was between 169 and 175, and the average undergraduate GPA was 3.94. The tuition at the University of Chicago Law School is $77,877 for the academic year of 2024-25. The total cost of attendance, including living expenses, room and board, and personal expenses, reaches approximately $106,225 per year. 83% of students, however, receive grants or scholarships, with the average award amounting to $15,000. Chicago Law School is known for its rigorous academic standards and strong emphasis on legal theory. Chicago Law ranks 3rd among the best law schools according to U.S. News and World Report. The law school’s notable rankings include 2nd in constitutional law, 4th in business law, and 9th in international law.

Chicago Law School offers specialized programs in banking law through various courses and research centers, such as the Center on Law and Finance. The center explores the interplay between law and financial systems, offering opportunities for students to engage in research and attend events focusing on financial regulation and corporate governance. Faculty at the University of Chicago Law School include renowned experts in banking and financial law. Professor Anthony Casey, director of the Center on Law and Finance, specializes in corporate reorganization and financial distress. Professor M. Todd Henderson focuses on securities regulation and the economic analysis of law, contributing significantly to the law school’s expertise in financial legal matters. Clinical opportunities at the University of Chicago Law School provide hands-on experience in banking and financial law. The Institute for Justice Clinic on Entrepreneurship helps students support small businesses with financial and legal guidance, offering practical experience in regulatory compliance. The Corporate Lab, in addition, gives students the chance to work with real-world corporate clients, focusing on financial transactions and governance issues.

Chicago Law School offers valuable networking opportunities for students interested in banking law, supported by a robust alumni network. Notable alumni in the financial sector include Ben Hoffart, a Vice President and Associate General Counsel at Goldman Sachs, and Ricardo Ugarte, Managing Partner at Winston & Strawn’s Geneva office. The connections allow students to access mentorship and career guidance in top law firms and financial institutions. The law school provides a variety of specialized course offerings for students pursuing banking law. Key courses include banking law, corporate finance, and financial regulation, offering comprehensive insights into legal issues within the financial sector. The JD/MBA joint-degree program, in collaboration with the Booth School of Business, further allows students to gain expertise in law and business, preparing them for leadership roles in finance. Graduates from the University of Chicago Law School specializing in banking law achieve excellent career outcomes. Several secure roles at top financial institutions like Goldman Sachs and leading law firms, focusing on regulatory compliance and financial litigation.

7. Fordham University School Of Law

Fordham University School of Law, established in 1905, is a well-regarded law school located in New York City. The law school, located in Manhattan, upholds its guiding principle, “in the service of others.” The law school features an extensive library, offering 676 study spaces and a vast collection of 436,000 volumes, supporting the academic needs of its students. Fordham University offers a comprehensive JD program incorporating several highly-ranked clinics and externships. The law school offers flexibility and allows students to join part-time or evening JD programs. Fordham Law offers LLM in various specializations, including an LLM in banking, corporate, and finance law. The M.S.L degree is primarily for students from non-lawyer backgrounds. The S.J.D. program is an advanced research program that requires students to commit to full-time work. The acceptance rate at Fordham Law School is 21.13%, reflecting a competitive admissions process. The school received 6,346 applications and admitted 1,341 students in the most recent admission cycle. The law school’s selectivity attracts top-tier students interested in diverse legal careers. Tuition at Fordham Law School is $72,282 for the academic year of 2024-25, a significant investment in legal education.

Fordham Law is highly regarded, ranked 33th in best law schools and 2nd in part-time law. The law school’s ranking by specialty area includes 4th in trial advocacy, 8th in intellectual property law, and 13th in dispute resolution. National Law Journal ranks Fordham Law by 15th in “Go-to Law School.” The law school, in addition, ranks 1st for the evening JD program in New York City and 3rd nationally. Fordham Law offers specialized programs in banking, corporate, and finance law, providing an in-depth understanding of financial regulation, capital markets, and corporate governance. The LL.M. in Banking, Corporate, and Finance Law includes courses such as banking regulation and enforcement and international banking law. Students gain practical knowledge applicable to U.S. and international financial systems, preparing them for careers in law firms, regulatory bodies, and corporate legal departments. The faculty at Fordham Law includes experts in banking law, offering students valuable insights into complex financial issues. Professor Richard Squire, specializing in corporate law and financial regulation, focuses on restructuring and insolvency. Professor Sean Griffith, another key faculty member, is known for his work in corporate governance and securities regulation.

Fordham Law provides several clinical opportunities for hands-on experience in financial and banking law. The Securities Litigation and Arbitration Clinic allows students to represent investors in disputes, gaining practical experience in securities law. The Community Economic Development Clinic offers insights into financial transactions and regulatory compliance, supporting small businesses and nonprofits. Fordham Law School offers extensive networking opportunities in banking law through its robust alumni network and strategic location in New York City. Notable alumni include Ramona Ortega, founder of My Money My Future, and Nick Gonzalez, an associate at Vinson & Elkins. The alumni actively engage with current students, providing mentorship and career guidance, particularly in finance and banking law.

Fordham University School of Law provides specialized courses for students interested in banking law, including banking regulation and enforcement, international banking law, and securities regulation. The courses offer a comprehensive overview of the regulatory frameworks and transactional aspects of the banking sector. Graduates of Fordham Law specializing in banking law achieve strong career outcomes, securing roles in prestigious law firms, regulatory bodies, and corporate legal departments. Several alumni work with the Securities and Exchange Commission (SEC) and top financial institutions, handling complex regulatory compliance issues.

8. Yale Law School

Yale Law School, established in 1824, is one of the most prestigious law schools in the United States. The law school, located in New Haven, Connecticut, is known for its scholarly orientation and small class sizes, fostering close faculty-student relationships.

The Juris Doctor (JD) program at Yale Law School provides a comprehensive education in law, emphasizing critical thinking and a deep understanding of legal principles. The JD program includes a unique grading system, focusing on Honors, Pass, and Low Pass, which encourages academic exploration without traditional class rankings. Yale Law, in addition, offers various advanced degrees, including the Master of Laws (LLM), Doctor of the Science of Laws (JSD), and Master of Studies in Law (MSL). The programs allow students to specialize in particular fields, contributing to a broad legal education. Yale Law School is known for its highly competitive admissions process, with an acceptance rate of about 5.6%. The selectivity ensures that the institution attracts students with exceptional academic records, with a median LSAT score of 175 and a median GPA of 3.96. Yale Law School’s tuition is $76,369, with estimated living expenses bringing the total cost of attendance to around $100,469 annually.

Yale Law ranks 1st among the top law schools in the United States, maintaining its position as a leader in legal education. The law school’s notable rankings include 2nd in international law, 3rd in constitutional law, and 5th in clinical training. Yale’s QS University ranking is 4th, with an overall score of 94.3. Yale Law School offers specialized programs in banking and finance law, providing students with a comprehensive understanding of financial regulations and corporate governance. The JD curriculum includes courses in corporate finance, securities regulation, and banking law, preparing students for roles in corporate legal practice. Yale Law’s program integrates theoretical knowledge with practical applications, allowing students to engage deeply with topics like financial markets and regulatory compliance.

Yale Law School boasts distinguished faculty members with expertise in banking and finance law. Jonathan R. Macey, the Sam Harris Professor of Corporate Law, Corporate Finance, and Securities Law, is known for his scholarship on corporate governance and financial regulation. Jonathan’s extensive work provides students with a critical understanding of the legal frameworks that shape financial markets. Another key faculty member, Yair Listokin, the Shibley Family Fund Professor of Law, specializes in the intersection of economic policy and banking law, focusing on topics such as monetary policy and financial systems. Yale Law School offers several clinical opportunities for students interested in banking and finance law. The Entrepreneurship & Innovation Clinic, directed by Sven Riethmueller, provides students with hands-on experience in business law, including advising startups and navigating regulatory challenges. Another notable opportunity is the Corporate Law Center, where students explore advanced topics in corporate law and financial transactions through research projects and workshops.

Yale Law School offers robust networking opportunities for students interested in banking law, leveraging its extensive alumni network. Alumni such as Gene Ludwig, founder of Promontory Financial Group, provide valuable insights into financial regulations and compliance. Another notable alumnus, Michael S. Chae, CFO at Blackstone, exemplifies the influence of Yale graduates in the finance sector. Yale Law School offers specialized courses in banking and finance law that provide students with theoretical and practical insights. Key courses include corporate finance, financial institutions regulation, and advanced issues in capital markets. Interdisciplinary options through the Yale School of Management allow students to explore complex financial systems in-depth. Graduates of Yale Law School pursuing careers in banking law enjoy strong employment outcomes. Several secure positions at top law firms specializing in financial regulations, mergers and acquisitions, and corporate finance.

9. Boston University School Of Law

Boston University School of Law (BU Law), founded in 1872, stands as a highly respected institution in legal education. Boston University, located in Boston, Massachusetts, has developed a reputation for its commitment to academic excellence, offering various courses and experiential learning opportunities. The JD program at BU Law provides a rigorous curriculum, covering foundational courses in the first year, followed by specialized electives and clinics in subsequent years. Students choose from numerous clinics, such as the Entrepreneurship and Intellectual Property Clinic, which offers real-world legal practice. The school, in addition, offers dual-degree programs, including JD/MBA and JD/LLM, which allow students to gain expertise in law and business or tax law. The acceptance rate at BU Law is 17.82%, reflecting its competitive nature. The median LSAT score for admitted students is 170, while the median undergraduate GPA stands at 3.86. The tuition for the 2024 academic year at BU Law is $65,020, with estimated living costs bringing the total cost of attendance to around $86,344.

Boston University School of Law (BU Law) holds a strong reputation as a top-tier law school. The law school ranks 24th among the law schools according to U.S. News and World Report 2024. The school’s notable rankings include 3rd in health care law, 8th in intellectual property law, and 20th in business law. BU Law offers a specialized program in banking and financial law through its LLM in Banking & Financial Law, which is the first of its kind in the country. The program focuses on regulatory frameworks, financial services law, and transactions, providing students with a deep understanding of the industry. The program’s emphasis on theoretical and practical learning ensures that graduates are well-equipped for careers in banking and finance. Faculty expertise in banking law at BU Law includes experienced professionals with backgrounds in regulation, finance, and corporate law. Faculty members have served in key roles at the Securities and Exchange Commission and the Federal Reserve, bringing valuable real-world insights to the classroom. Professors such as David Webber and Cornelius Hurley are known for their work in financial regulation and banking law, contributing significantly to the academic depth of BU Law’s offerings.

BU Law provides hands-on learning opportunities through its clinical programs focused on financial law. The Entrepreneurship and Innovation Clinic allows students to advise startups and navigate complex regulatory challenges. The Financial Law Internship Program offers students practical experience with firms and financial institutions. The clinics and internships enable students to apply their knowledge to real-world legal issues. BU Law offers strong networking opportunities for students pursuing banking law. The school’s extensive alumni network, with over 25,000 graduates, provides connections in various financial sectors, including law firms and regulatory agencies. Notable alumni like Eugene Ludwig, a former Comptroller of the Currency and founder of Promontory Financial Group, contribute to a supportive network that aids students entering the banking law field. BU Law collaborates with the Boston Bar Association, hosting events and panels where students engage with industry professionals and potential employers.

BU Law’s banking law program includes specialized courses that provide in-depth knowledge of financial regulations and transactions. Core courses such as “US Banking Structure and Regulation” and “Financial Services Transactions” cover the legal frameworks governing banks and financial institutions. The program, in addition, offers courses in derivatives, cybersecurity, and corporate finance, equipping students with skills to navigate complex banking law scenarios. Graduates of BU Law pursuing banking law find promising career outcomes in various sectors. Several secure positions in prestigious law firms, financial institutions, and government agencies, including roles at the Federal Reserve Bank of Boston and major banks like Natixis Advisors. The Financial Services Law Internship program provides practical experience, preparing students for positions in compliance, regulatory affairs, and financial transactions.

10. University Of Michigan Law School

The University of Michigan Law School, established in 1859, ranks among the top law schools in the United States. The school’s location in Ann Arbor provides access to a vibrant academic community and a strong network of legal professionals, contributing to its national reputation for excellence. Michigan Law offers a comprehensive Juris Doctor (JD) program, emphasizing foundational courses in the first year, followed by advanced electives and clinics. The school, in addition, provides specialized degree options, such as the Master of Laws (LLM) and the Doctor of Juridical Science (SJD). The acceptance rate for the University of Michigan Law School is highly competitive, standing at approximately 12.6%. Applicants generally present strong academic credentials, with an LSAT score between 165 and 172 (25th – 75th percentile) and a median undergraduate GPA of 3.85.

Michigan Law ranks 9th among best law schools according to U.S. News and World Report 2024. The school’s notable rankings include 5th in criminal law, 5th in clinical training, and 6th in international law. The Princeton Review ranks the school 3rd for best career prospects and 9th for best classroom experience. Michigan Law offers specialized programs in banking law through its comprehensive curriculum and interdisciplinary opportunities. Students pursue an LLM in Corporate and Finance Law, providing in-depth training in banking and financial services regulation. The programs ensure a well-rounded education, preparing students for roles in complex financial sectors. Faculty expertise in banking law at Michigan Law includes accomplished scholars and practitioners. Professor Reuven S. Avi-Yonah, an expert in international tax law, offers insights into the intersection of taxation and global finance. Another prominent faculty member, Professor Daniel Crane, focuses on antitrust law and its impact on financial markets, providing students with a nuanced understanding of regulatory frameworks.

Michigan Law provides hands-on clinical opportunities for students interested in banking law. The International Transactions Clinic allows students to work on cross-border financial transactions, offering practical experience in global finance. The Entrepreneurship Clinic, in addition, supports startups with legal advice, including navigating financial regulations and compliance. The University of Michigan Law School offers robust networking opportunities for students pursuing careers in banking law. The alumni network includes over 22,000 members worldwide, providing valuable connections across various sectors, including finance and banking. Alumni like Richard L. Trumka Jr., a former NLRB member, and various notable figures in regulatory bodies offer insights and mentoring through Michigan Law Connect, an online networking platform designed for alumni and students.

Michigan Law provides comprehensive course offerings in banking law, preparing students for the complexities of financial regulations. Courses include “banking law,” which focuses on regulatory systems for banks, and “corporate finance,” addressing the legal aspects of financial management. The curriculum, in addition, features specialized seminars on topics such as mergers, acquisitions, and international financial transactions. Michigan Law School boasts an employment rate of 96.9% within ten months of graduation. The banking outcome of Michigan Law is impressive, with several securing positions at top law firms, investment banks, and regulatory agencies like the Federal Reserve and the SEC.

11. Emory University School Of Law

Emory University School of Law, founded in 1916, is a prominent private law school located in Atlanta, Georgia. Emory Law is well-regarded for its emphasis on combining rigorous academic study with practical legal training. The school’s affiliation with Emory University, a leading research institution, enriches its academic resources and provides a supportive environment for legal education. The Juris Doctor (JD) program at Emory Law offers a comprehensive curriculum featuring foundational courses in the first year and a range of electives in subsequent years. The program encourages experiential learning through clinics, externships, and simulation courses. The LLM program is tailored to fit the student’s needs, spanning over nine months (full-time) to four years (part-time). The law school offers several joint degree programs, including JD/ MBA, JD/MA, JD/ MDiv, and JD/MPH. Emory University School of Law has an acceptance rate of approximately 40.87%, reflecting its moderately competitive nature. Admitted students generally have a median LSAT score of 166 and a median GPA of 3.82. The school enrolls about 282 new students each year, creating a balanced environment supporting individualized learning and collaboration.

Emory Law’s tuition is $65,510, with total estimated living expenses bringing the cost of attendance to around $89,466 per year. The tuition is considerable; however, 96% of students receive financial aid, with an average grant of $37,000. Emory Law is known for its strong reputation, and it is ranked 42nd among the best law schools. The law school’s specialty rankings include 21st in healthcare law, 21st in commercial law, 25th in constitutional law, and 33rd in international law. Emory Law offers specialized programs for students interested in banking law, focusing on corporate and financial regulations. The Center for Transactional Law and Practice plays a pivotal role in the area, offering courses such as Securities Regulation and Corporate Finance. The courses provide a deep understanding of the complexities of financial markets and the regulatory environment. Emory Law’s faculty includes experts with significant experience in banking and corporate law. Professor George S. Georgiev, for example, is known for his work on corporate governance and financial regulation. Another distinguished faculty member, Professor Thomas Arthur, has made contributions in the areas of antitrust and market regulation, offering valuable insights into the financial sector.

Emory Law provides various clinical opportunities for students interested in banking and financial law. The Transactional Law and Practice Center allows students to work on real-world legal issues, such as drafting financial agreements and advising startups. Externships in Atlanta’s financial institutions offer hands-on experience, providing insights into compliance and regulatory matters. Georgia best law schools, including Emory University Law, offer strong networking opportunities and an active alumni network, which is valuable for students pursuing careers in banking law. Notable alumni, such as Luis A. Aguilar, a former commissioner at the U.S. Securities and Exchange Commission, provide valuable mentorship and industry insights to students.

Emory Law offers various courses tailored to banking and financial law. Core offerings include “banking law,” which covers the regulatory frameworks of financial institutions, and “securities regulation,” focusing on market compliance and investor protection. Courses like “corporate finance” and “mergers and acquisitions” allow students to deepen their understanding of financial transactions and corporate governance. The Center for Transactional Law and Practice supports the curriculum, emphasizing practical skills essential for the banking sector. Emory Law graduates specializing in banking law have strong employment outcomes. Several secure roles at top law firms, financial regulatory bodies, and major corporations, including placements at institutions like Wells Fargo and the Federal Reserve Bank of Atlanta. The school’s proximity to Atlanta’s financial district provides additional job opportunities in corporate finance and compliance roles.

How To Choose The Best Law School For Banking law?

To choose the best law school for banking law, follow the six steps listed below.

- Research Program Specialization and Curriculum. Select a law school offering a comprehensive curriculum in banking, corporate, and finance law. Programs must cover areas like securities regulation, financial institutions, and corporate finance. A robust curriculum helps build expertise in industry-specific legal frameworks. Specialization ensures that graduates possess the expertise needed to excel in competitive roles within law firms, banks, and regulatory bodies.

- Evaluate Faculty Expertise. The expertise and experience of faculty are crucial for high-quality instruction in banking law. Law schools like Fordham Law and Boston University employ professors with significant industry experience in financial law. Faculty with connections to financial institutions, regulatory bodies, and law firms enrich the learning experience through practical insights and professional advice. A strong faculty network translates into better mentoring opportunities, which is critical for understanding complex regulatory challenges.

- Assess Location and Networking Opportunities. Choosing a law school in financial hubs such as New York or Boston provides valuable networking opportunities. Schools like New York University and Fordham Law have strategic locations that allow students to connect with leading financial institutions. Proximity to major financial centers facilitates internships, externships, and potential job placements in banking and financial firms. Networking with professionals in the industry helps in securing employment and gaining practical exposure.

- Explore Experiential Learning Opportunities. Look for schools offering practical experiences, including internships, clinics, and moot courts related to financial law. Boston University, for example, has a Financial Services Internship program that allows students to work in real-world settings. Experiential learning enables students to apply theoretical knowledge to practical scenarios, such as regulatory compliance, mergers and acquisitions, and financial litigation, making them more marketable to employers.

- Investigate Dual Degree Programs. A dual degree program like a JD/MBA is advantageous for individuals interested in banking law. Combining legal and business education provides a comprehensive understanding of financial regulations and business management practices. Schools offering such programs help bridge the gap between legal theory and financial operations, making graduates versatile in handling complex financial transactions.

- Consider Alumni Network and Employment Outcomes. Evaluate the alumni network and job placement rates in the banking and finance law sector. Law schools with a strong record of placing graduates in financial services firms, banks, and regulatory agencies significantly enhance career prospects. A supportive alumni community provides mentorship and opens doors to prestigious job opportunities.

What Is Banking law?

Banking law is the body of regulations that govern financial institutions, including banks, credit unions, and various entities involved in financial services. The laws ensure that banks operate fairly and transparently while protecting the financial system and consumers. Banking law, moreover, deals with various types of financial transactions, including loans, mortgages, mergers, and acquisitions, along with areas such as anti-money laundering (AML) and compliance. Lawyers specializing in banking law help banks adhere to the laws, as well as represent clients in legal disputes related to banking activities.

Banking law covers several key areas, such as regulatory law, transactional law, and compliance. Regulatory law focuses on the laws governing financial institutions, ensuring they meet legal standards. Transactional law covers financial agreements, including loans, credit transactions, and mergers. Compliance law ensures that banks follow local, state, and federal regulations. The complexity of banking law requires a deep understanding of how various financial services interact with legal requirements. A banking law degree, such as a Master of Laws (LLM) in Banking and Financial Law, equips students with specialized knowledge in the areas. Banking law programs generally include coursework in regulatory frameworks, financial transactions, and compliance management, making graduates experts in domestic and international banking law.

What Is The Primary Goal Of Banking Law?

The primary goal of banking law is to maintain stability within the financial system by regulating banks’ activities and ensuring they operate safely and soundly. The goal of the law is to promote market discipline by holding banks accountable, encouraging them to maintain sound practices, and safeguarding depositors’ interests. The purpose of banking regulations is to reduce systemic risks, protect consumers, and ensure that financial institutions adhere to ethical and legal standards. Banking law seeks to prevent bank failures, which have severe repercussions on the economy, such as loss of public confidence and economic downturns.

Banking law operates through a framework of regulatory measures enforced by national and international authorities. The Federal Reserve and different regulatory bodies in the United States set standards that banks must meet, such as capital requirements, liquidity ratios, and compliance with anti-money laundering rules. The regulations limit the risks that banks take and ensure they hold sufficient capital to cover potential losses. Regulatory enforcement is a critical aspect of banking law, ensuring compliance through penalties, sanctions, and oversight. Regulators impose fines, revoke banking licenses, or enforce corrective measures when institutions fail to meet legal standards. The oversight helps mitigate risks like excessive lending and fraudulent activities, contributing to a healthier financial system.

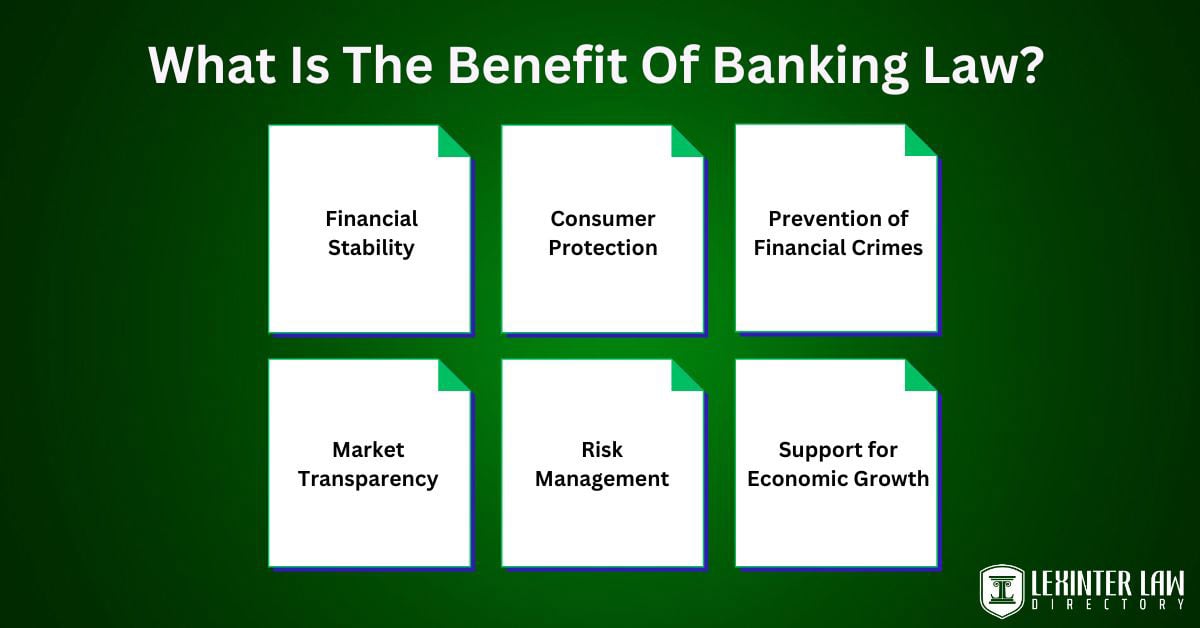

What Is The Benefit Of Banking Law?

The six benefits of banking law are listed below.

- Financial Stability: Banking law aims to maintain stability in the financial sector by enforcing regulations that ensure banks are well-capitalized and manage risks effectively. Regulatory frameworks, such as capital adequacy standards under Basel III, require banks to hold enough capital to absorb potential losses, thereby reducing the risk of failures that lead to economic downturns. The stability encourages a safer environment for depositors and investors, promoting confidence in the financial system.

- Consumer Protection: Banking laws include measures to safeguard consumer interests by regulating how banks offer loans, disclose terms, and manage customer information. The regulations ensure transparency in lending practices, preventing predatory lending and unfair practices. The focus on consumer protection creates a fairer marketplace where customers trust their financial institutions, fostering a healthier relationship between banks and their clients.

- Prevention of Financial Crimes: Banking law plays a crucial role in preventing money laundering, fraud, and financing of illegal activities. Laws such as the Bank Secrecy Act (BSA) require banks to monitor and report suspicious transactions, aiding in the detection of illegal financial activities. The framework helps maintain the integrity of the financial system and supports law enforcement efforts to combat financial crimes.

- Market Transparency: Banking laws enhance market transparency by requiring banks to disclose financial information to regulators, stakeholders, and the public. Transparency ensures that investors and customers make informed decisions regarding their financial activities. The openness helps maintain trust in the banking system, contributing to a more stable and efficient market environment.

- Risk Management: Regulatory measures within banking law help banks manage risks effectively by imposing standards for lending practices, liquidity, and investment strategies. The regulations prevent excessive risk-taking, which leads to financial crises or bank insolvencies. Risk management frameworks allow banks to better handle economic shocks, ensuring their long-term viability and the safety of the broader financial sector.

- Support for Economic Growth: Banking law supports economic growth by enabling banks to lend safely and effectively to businesses and individuals. The access to credit drives investment and consumer spending, key components of economic development. Banking regulations, thus, help ensure that financial institutions fulfill their role in supporting economic activities while maintaining safety and soundness.

What Is The Best Degree For Banking Law?

The best degree for banking law is a Master of Laws (LL.M.) in banking and financial law. The advanced degree provides specialized training in the legal frameworks governing financial institutions, capital markets, and regulatory compliance. An LL.M. in the field is highly regarded because it offers focused knowledge on complex subjects like banking regulations, securities law, and financial transactions. The degree makes it ideal for legal professionals aiming to specialize in financial services law.

The LL.M. in banking and financial law is particularly beneficial for lawyers who already possess a Juris Doctor (JD) or an equivalent first degree in law. The degree provides an in-depth understanding of regulatory issues, compliance requirements, and the legal aspects of global finance. Programs like degrees offered at Boston University, Columbia University, and New York University are known for their rigorous curriculum, combining theoretical courses with practical experiences such as externships and seminars on financial law. The LLM degree is highly effective because it focuses on practical application, allowing graduates to engage directly with real-world issues in banking law.

How To Become An Banking Lawyer?

To become a banking lawyer, follow the six steps listed below.

- Earn a Bachelor’s Degree. A Bachelor’s degree is the foundational requirement for pursuing a career in law. Any major is acceptable; however, degrees in finance, economics, or business provide a solid background in financial concepts. The subjects enhance understanding of the banking sector, which is beneficial when studying banking law. Students must focus on maintaining a high GPA, as competitive law school admissions require strong academic records.

- Take the LSAT. The Law School Admission Test (LSAT) is required for admission to most law schools. The standardized test assesses reading comprehension, logical reasoning, and analytical skills, which are crucial for law studies. A high LSAT score significantly enhances chances of getting into top law schools, particularly schools known for strong programs in banking and financial law. Preparation through practice tests and study courses is essential for achieving a competitive score.

- Earn a Juris Doctor (JD) Degree. Earning a JD degree from an accredited law school is crucial for aspiring banking lawyers. Law schools offer a curriculum that includes foundational subjects like contracts, property law, and torts. Students specialize in banking law degree through elective courses in areas such as financial regulation, securities law, and corporate finance. The specialization prepares students to navigate the complexities of the financial and legal landscape.

- Gain Practical Experience. Analyzing the steps of how to become a banking lawyer includes gaining practical experience. Internships and clerkships at law firms, financial institutions, or regulatory bodies provide valuable practical experience in banking law. The opportunities allow aspiring lawyers to apply classroom knowledge to real-world scenarios, such as drafting contracts or analyzing regulatory compliance issues. Gaining practical experience is crucial for building a network of industry contacts and understanding the specific legal needs of banks and various financial entities.

- Pass the Bar Exam. Passing the Bar exam is necessary for practicing law within a specific jurisdiction. The rigorous test evaluates knowledge of general legal principles, including subjects like contracts and property law. Candidates must prepare thoroughly, using Bar review courses and study groups. Successfully passing the Bar enables a lawyer to become licensed and represent clients, including banks and various financial institutions.

- Pursue an LLM in Banking Law. An LL.M. in Banking and Financial Law provides advanced training in regulatory compliance, securities law, and financial transactions. The degree is particularly valuable for individuals aiming to specialize deeply in banking law. An LLM offers a comprehensive understanding of U.S. and international banking regulations, preparing lawyers for roles in global financial services. Graduates of LL.M. programs secure positions in top law firms, banks, and regulatory agencies.

How Long Would It Take To Study Banking Law?

It would take approximately seven to eight years to study banking law. The process starts with earning a Bachelor’s degree, which takes about four years. A degree in subjects like economics, finance, or business is particularly beneficial as it provides foundational knowledge relevant to banking law. The next step involves taking the LSAT and applying to law school after obtaining a Bachelor’s degree. The Juris Doctor (JD) degree, the core requirement for becoming a lawyer, generally takes three years to complete when studied full-time. Law schools offer courses in various legal fields, and students interested in banking law must focus on electives like financial regulation, securities law, and corporate finance. Several law students, in addition, pursue internships or clerkships during the summers, gaining practical experience with law firms or financial institutions. The combination of coursework and hands-on training prepares students for a career in banking law.

Several aspiring banking lawyers choose to pursue an LL.M. in banking and financial law after the J.D. degree. An LLM generally requires an additional year of full-time study. The advanced degree allows lawyers to specialize further, offering in-depth training in financial regulations, international banking, and compliance. The LL.M. enhances career prospects, making graduates more competitive for roles in law firms, regulatory agencies, and corporate legal departments.

What Is The Average LSAT For Banking Law?

The average LSAT for banking law is generally around 160 to 165 for entry into mid-tier law schools, with top programs requiring higher scores, around 170 or more. Several applicants targeting specialization in banking law aim for admission to prestigious law schools, where competitive LSAT scores significantly increase their chances. Law schools like New York University, Columbia, and the University of Chicago Law, known for their strong banking and finance programs, have median LSAT scores ranging from 172 to 175, making a high LSAT score crucial for admission to the programs.

The LSAT, or Law School Admission Test, serves as a standardized measure of skills crucial for success in law school. The test evaluates reading comprehension, logical reasoning, and analytical thinking through multiple-choice questions and a writing sample. The LSAT score ranges from 120 to 180, with a higher score indicating a stronger aptitude for legal studies. Law schools heavily weigh LSAT scores in the admissions process because the test is designed to predict first-year law school performance and overall readiness for legal education.

Is Banking Law Difficult?

Yes, banking law is difficult due to its complex and constantly evolving nature. The field requires a deep understanding of intricate regulatory frameworks that govern the banking and financial sectors. The complexities arise from dealing with numerous regulations at national and international levels, such as anti-money laundering laws, capital requirements, and compliance with central bank directives. Banking lawyers must stay updated on changes in financial regulations and their practical implications, making the field challenging for individuals who wish to specialize in it.

The purpose of banking law involves regulating financial institutions to ensure stability and compliance within the sector. The goal requires a detailed understanding of risk management, financial instruments, and legal standards for transactions. Banking lawyers must interpret and apply the regulations while considering the interests of clients, whether they are banks, corporations, or individual consumers. The legal frameworks around banking evolve in response to financial crises and technological developments, requiring lawyers to adapt their knowledge continually.

What Can You Expect From A Career As A Banking Lawyer?

You can expect a challenging but rewarding path from a career as a banking lawyer. Banking lawyers must navigate intricate legal frameworks, ensuring that financial institutions comply with local and international regulations. The role demands a deep understanding of finance, economics, and regulatory policies to effectively advise clients on complex financial transactions. The nature of the work requires staying updated on changes in regulations and adapting to evolving legal requirements in the financial sector. The dynamic requirements make the career demanding but offer a stimulating intellectual challenge.

A banking lawyer’s work involves advising clients on financial transactions, regulatory compliance, and risk management strategies. Lawyers in the field work with banks, investment firms, or corporate clients, providing guidance on issues like mergers, acquisitions, and securities regulation. The work includes drafting and reviewing contracts, negotiating deals, and ensuring legal safeguards in financial agreements. Aspiring banking lawyers must expect to engage in complex problem-solving and build expertise in areas like anti-money laundering, financial regulations, and corporate finance. The career offers significant opportunities for specialization, allowing lawyers to focus on niche areas like securities law or cross-border transactions. The demanding nature of the field is balanced by the opportunity to work in a global environment, with many banking lawyers handling transactions that involve multiple jurisdictions.

What Is The Difference Between An Banking Lawyer And A Corporate Lawyer?

The difference between a banking lawyer and a corporate lawyer is that a banking lawyer focuses on laws governing financial institutions, and a corporate lawyer concentrates on the laws surrounding the formation, operation, and governance of corporations. Banking lawyers focus on laws governing financial institutions, including regulations related to lending, capital requirements, and compliance with federal and international banking standards. The lawyers advise clients on issues like mergers of banks, anti-money laundering (AML) compliance, and loan agreements. A corporate lawyer, in contrast, works within the framework of corporate law, focusing on issues like mergers and acquisitions, company formation, and corporate financing. Corporate lawyers concentrate on the internal operations of companies, such as drafting corporate bylaws, managing mergers, and advising on corporate governance.

Banking law and corporate law differ primarily in their focus and the specific legal frameworks they address. Banking law centers on the regulatory and compliance aspects of financial institutions, focusing on the relationship between lenders and borrowers. The law includes managing regulatory requirements, addressing compliance with laws like the Dodd-Frank Act, and overseeing transactions like loans, mortgages, and deposits. Corporate law, however, deals with the broader legal aspects of businesses, including company formation, governance, mergers and acquisitions, and shareholder rights. The similarities between banking law and corporate include their critical role in the financial and business sectors. Working in the two fields of law requires strong negotiation skills, analytical thinking, and the ability to navigate complex regulatory environments.

How Do Banking Lawyers Earn?

Banking lawyers earn by providing specialized legal services related to financial transactions, regulatory compliance, and corporate finance. The lawyers advise banks, investment firms, and corporations on navigating complex financial regulations and drafting contracts for loans, mergers, and acquisitions. The expertise of lawyers in regulatory frameworks and financial law makes them crucial for ensuring compliance with state and federal laws, especially for institutions facing audits or involved in high-stakes transactions. Compensation includes base salaries, bonuses, and additional benefits, reflecting the importance of their role within the financial industry.

The average salary of a banking lawyer in the United States is approximately $122,292 annually. Entry-level banking lawyers generally earn around $96,000 per year, with lawyers in major cities like New York and San Francisco earning significantly more due to the higher demand for financial services in the markets. Senior banking lawyers, particularly with over five years of experience, earn between $130,000 and $214,000 annually. Top earners working at large law firms or as in-house counsel for major banks see their salaries exceed $300,000 per year. Bonuses and various forms of compensation significantly enhance banking lawyers’ earnings. The professionals frequently receive performance-based bonuses, which range from 10% to 50% of their annual salaries, depending on their firm’s profitability and individual contributions.

Where Do Most Banking Lawyers Work?

Most banking lawyers work in environments such as large law firms, in-house legal departments within banks, and regulatory agencies. Law firms, especially lawyers specializing in financial and corporate law, provide opportunities for banking lawyers to handle complex transactions like mergers, acquisitions, and lending agreements. The lawyers focus on drafting contracts, ensuring regulatory compliance, and representing clients in negotiations. In-house roles at financial institutions represent another common workplace for banking lawyers. Banking lawyers in such roles focus on internal matters, helping banks adapt to changes in regulations and manage legal risks. The environment offers a stable work environment compared to a banking law firm. Regulatory agencies represent another key employment area for banking lawyers, where they oversee and enforce the legal framework governing financial institutions. Banking lawyers work with organizations like the Federal Reserve or the Securities and Exchange Commission (SEC), ensuring banks adhere to legal standards.

The work environment for banking lawyers is dynamic and high-pressure, especially in large law firms and during significant transactions. Banking lawyers must keep up with evolving financial regulations and manage client expectations in a demanding field. The work frequently involves collaboration with various legal professionals, financial analysts, and compliance officers to ensure legal and regulatory adherence in complex financial operations. The working hours are long; however, the roles offer opportunities for professional growth and the chance to work on high-profile financial cases.

Are Banking Lawyers Highly Paid?

Yes, banking lawyers are highly paid due to their specialized skills in handling complex financial transactions and regulatory compliance. The lawyers work with large financial institutions, investment firms, and corporations, navigating intricate banking regulations and providing legal counsel for major financial deals. The specialization requires a deep understanding of financial laws, making their expertise particularly valuable to clients. The lawyers’ ability to manage high-stakes transactions and ensure regulatory compliance drives the demand for their services, contributing to their higher compensation.

The salary for banking lawyers varies based on experience, location, and type of employer but generally remains high. Starting salaries for banking lawyers range from $145,000 to $215,000 per year in large firms, especially in major legal markets like New York and San Francisco. Mid-career professionals with several years of experience earn between $200,000 and $300,000 annually. Senior banking lawyers, particularly lawyers at top firms or in specialized in-house roles, earn even more, with various compensation packages, including significant bonuses tied to performance.

How Can I Find Good Banking Lawyers Near Me With Lexinter?

You can find good banking lawyers near me with Lexinter by leveraging the platform’s advanced search features and extensive legal listings. Lexinter’s search function enables users to filter results by specialization and location, making it ideal for individuals seeking banking lawyers nearby. Users must enter their city or region and select “Banking Law” as the practice area to generate a list of qualified attorneys. The platform, in addition, includes a “find a lawyer near me” feature, allowing users to narrow down their search to lawyers operating within a specific radius. The tool helps users avoid the general confusion of online searches and directly access experienced banking lawyers.

Lexinter, moreover, allows users to view detailed information on each professional, such as their education, office hours, and availability. Profiles generally include contact details, enabling users to schedule appointments directly through the platform. The streamlined process eliminates the need for time-consuming phone calls and consultations. Lexinter, therefore, makes it easier for clients to connect with the right legal expert for their banking-related needs. Lexinter’s emphasis on up-to-date information ensures users find a suitable lawyer without delays or outdated listings.