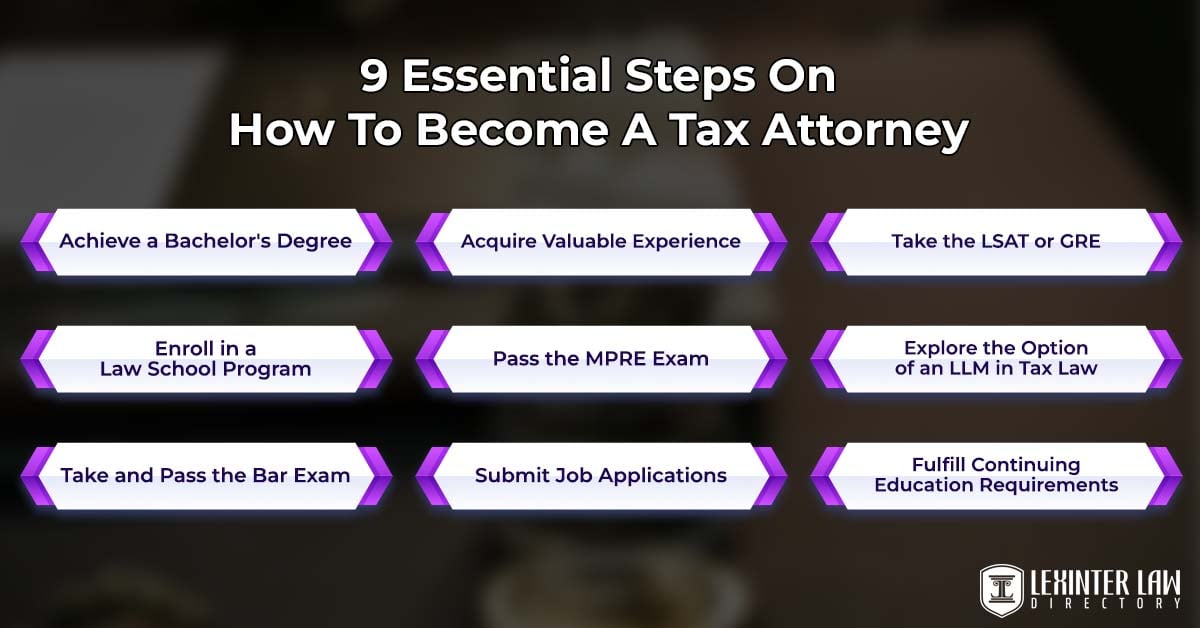

9 Essential Steps On How To Become A Tax Lawyer

There are 9 essential steps to becoming a tax lawyer. Aspiring students begin their journey on the tax lawyer career path by achieving a 4-year Bachelor’s degree in economics, finance, or accounting. Valuable experience through internships or related jobs is crucial for a deeper understanding of the legal and financial sectors. The next steps include taking the LSAT or GRE, as required for law school admission and enrolling in a reputable law school program. Passing the MPRE exam is essential before exploring an LLM in tax law to specialize further. Successfully passing the bar exam is mandatory, followed by submitting job applications. Tax lawyers must fulfill continuing education requirements to stay updated with the evolving tax laws and regulations.

A tax law lawyer specializes in navigating complex tax legislation and regulations. Tax lawyers offer expert advice on tax-related matters to ensure legal compliance. An income tax lawyer deals with personal and business income taxes. Income tax lawyers represent clients in disputes with tax authorities. An income tax lawyer devises strategies to minimize liabilities by analyzing case law and tax statutes.

A tax lawyer aids in structuring financial operations to optimize tax efficiency. The lawyers prepare for potential audits by understanding intricate tax codes. Tax lawyers negotiate with tax agencies to resolve conflicts and secure favorable outcomes. A tax law lawyer ensures assets are transferred with minimal tax implications in estate planning. The lawyers are instrumental during mergers and acquisitions, guiding the tax consequences. The lawyer’s expertise is crucial for businesses seeking to navigate the complexities of corporate tax law.

Here are 9 essential steps on how to become a tax attorney.

- Achieve a Bachelor’s Degree. Earning a Bachelor’s degree is the first crucial step toward becoming a tax lawyer. Prospective law students must focus on finance, accounting, or business to lay a solid foundation for their legal education. The groundwork is essential for understanding complex tax laws and regulations.

- Acquire Valuable Experience. Acquiring valuable experience before law school significantly enhances an individual’s legal career prospects. Internships or jobs in related fields offer practical insights and knowledge. The experiences are invaluable for aspiring tax lawyers, providing a deeper understanding of tax law practices.

- Take the LSAT or GRE (as required). Taking the LSAT or GRE is a mandatory step for law school admission. High exam scores reflect aspiring tax lawyer’s analytical, verbal, and writing skills. LSAT or GRW are crucial indicators of potential success in law school, directly impacting the application’s strength.

- Enroll in a Law School Program. Enrolling in a law school program is a significant commitment to becoming a tax lawyer. Accredited law schools offer the requisite education and training. Law school prepares students thoroughly for legal challenges, with specialized courses in tax law for interested students.

- Pass the MPRE Exam. Passing the MPRE Exam is necessary for legal ethics proficiency. The test assesses the understanding of the professional conduct lawyers must adhere to. MPRE is a prerequisite for bar admission in most jurisdictions, ensuring all tax lawyers meet ethical standards.

- Explore the Option of an LLM in Tax Law. Exploring the option of an LLM in tax law distinguishes aspiring tax lawyers. The advanced degree deepens the tax law expertise, making tax lawyers attractive to employers. The degree is ideal for lawyers seeking specialization in tax-related legal matters.

- Take and Pass the Bar Exam. Taking and passing the Bar exam is indispensable for legal practice. The rigorous assessment tests aspiring tax lawyers’ knowledge of general law and their specialization areas. Passing the bar allows candidates to practice law and represent clients legally in tax matters.

- Submit Job Applications. Submitting job applications is the next step after passing the bar. Aspiring tax lawyers must apply to law firms, government agencies, and corporations. Tailoring the applications to positions that match an individual’s interests and expertise in tax law is crucial.

- Fulfill Continuing Education Requirements. Fulfilling continuing education requirements is essential for maintaining a legal license. Tax laws frequently change, and continuing education helps tax lawyers stay current. Continuing education requirements ensure that tax lawyers remain knowledgeable, providing clients with the best advice and representation.

Table of Contents

- 1. Achieve A Bachelor’s Degree

- 2. Acquire Valuable Experience

- 3. Take The LSAT Or GRE (As Required)

- 4. Enroll In A Law School Program

- 5. Pass The MPRE Exam

- 6. Explore The Option Of An LLM In Tax Law

- 7. Take And Pass The Bar Exam

- 8. Submit Job Applications

- 9. Fulfill Continuing Education Requirements

- What Is A Tax Lawyer?

- What Does A Tax Lawyer Do?

- What Are The Skills Required To Become A Tax Lawyer?

- How Long Does It Take To Become A Tax Lawyer?

- How To Choose A Tax Lawyer?

- How Can Lexinter Help In Choosing The Right Tax Lawyer?

1. Achieve A Bachelor’s Degree

Achieve a Bachelor’s degree as the initial step towards becoming a tax lawyer. The four-year undergraduate degree equips students with comprehensive business, economy, and law knowledge. The degree lays the groundwork for future tax lawyers in critical thinking, analytical skills, and a basic understanding of legal principles.

Pursuing a bachelor’s degree is crucial for aspirants specializing in tax law. The degree fulfills a prerequisite for law school admission and molds the analytical and problem-solving skills essential for tax lawyers. Engaging in business, law, or economics coursework during undergraduate studies equips students with a comprehensive understanding of tax law. A well-rounded education lays a solid foundation for the rigorous analytical thinking required in law school. Combining theoretical knowledge and practical skills is crucial for effectively navigating tax law intricacies.

Selecting a major relevant to tax law is the first step in securing a Bachelor’s degree. Courses in accounting, finance, and economics are beneficial for understanding tax law complexities. Prospective students must choose institutions renowned for their pre-law or business programs. The application process requires showcasing extracurricular achievements, strong recommendation letters, and high LSAT or GRE scores. Excelling in academics is crucial, as law schools weigh undergraduate performance heavily. Participation in internships and law-related extracurricular activities strengthen aspiring tax lawyer’s applications. Building relationships with professors is important for securing future recommendations.

2. Acquire Valuable Experience

Acquire valuable experience through internships, clerkships, and relevant employment to gain practical insights into the tax law field. The experience gained through internships, clerkships, or relevant employment provides practical insight into tax law. The experience enhances aspiring tax lawyer’s understanding of tax regulations, legal research, and client interaction.

Securing practical experience is indispensable for students aiming to excel as tax lawyers. Gaining experience bridges the gap between theoretical and real-world applications of tax law. Internships at law firms or agencies expose aspiring lawyers to tax legislation nuances and procedures. Interns and clerks have the chance to observe or participate in client meetings under supervision. The experience is invaluable in communicating legal advice effectively, understanding client needs, and building trust.

Securing relevant experience requires a proactive approach. Aspiring tax lawyers must seek internships and part-time jobs at law firms specializing in taxation and government agencies. Participating in a tax clinic offers the opportunity to work with real clients under the supervision of experienced tax lawyers. Law schools offer externships and clinical programs, allowing students to earn academic credit while working in the field. Legal seminars and conferences on tax law serve as prime venues for learning about the latest trends, regulations, and case law. The seminars provide a platform for engaging with leading experts and peers, facilitating knowledge exchange and professional connections.

Engaging in online forums dedicated to tax law helps aspiring tax lawyers stay informed about the field. Online forums share insights and connect with professionals who provide career advice or job leads. Involvement in research projects under the guidance of a professor significantly deepens a student’s understanding of tax law. The collaborative work enhances aspiring tax lawyer’s critical thinking and legal analysis skills.

3. Take The LSAT Or GRE (As Required)

Take the LSAT or GRE (as required) to meet law school admission requirements. The LSAT (Law School Admission Test) or GRE (Graduate Record Examinations) represents a pivotal step for aspiring tax lawyers, contingent upon law school requirements. The LSAT assesses critical reading, analytical reasoning, and logical thinking skills, essential for law school success. The GRE measures verbal reasoning, quantitative reasoning, and analytical writing abilities. Law schools evaluate applicant’s potential for legal studies using LSAT or GRE scores, making the test crucial for the application process.

Achieving high LSAT or GRE scores is crucial for aspiring tax lawyers. The LSAT or GRE tests are key to gaining admission into top law schools. Scores act as a critical filter in the competitive admissions process. A good score demonstrates an applicant’s readiness for rigorous academic challenges. High scores distinguish applicants, making them more attractive to elite institutions. Top law schools offer extensive tax law programs, accessible with high scores. The programs lead to internships and jobs in prestigious law firms and agencies. High LSAT or GRE scores lead to significant scholarships, and financial aid reduces the burden of law school costs. Lower debt enables graduates to pursue careers in public service tax law. The tests prepare students for tax law’s demands and make legal education more affordable.

Aspiring tax lawyers must thoroughly prepare before their test date to excel on the LSAT or GRE. The preparation involves familiarizing students with the exam format and question types through official test materials. Creating a study schedule that dedicates ample time to each test section is essential for balanced preparation. Practicing under timed conditions improves time management and reduces candidate’s test anxiety. Seeking feedback from peers or instructors on challenging sections uncovers valuable strategies for improvement. Maintaining a healthy balance between study and well-being through exercise and rest is crucial for aspiring tax lawyers.

4. Enroll In A Law School Program

Enroll in a law school program to pursue the required legal education for a career in tax law. Enrolling in a law school program involves gaining admission to a Juris Doctor (JD) degree program at an accredited institution. The step is essential for aspiring tax lawyers, as law school provides the legal education and training to practice law. Law school programs offer foundational courses in civil procedure, contracts, and property law, along with specialized electives in tax law.

Enrolling in a law school program is a cornerstone for individuals aspiring to become tax lawyers. The law school uniquely positions tax lawyers to explore tax regulations and case law thoroughly. Students have opportunities to delve into income tax, corporate tax, and international tax through electives. Elective courses include estate planning and various critical aspects of the tax code. Law school courses address the application of tax law designed to provoke critical thinking. Law school clinics and internships provide hands-on experience in dealing with tax issues. Tax clinics allow students to work directly with clients under the supervision of experienced tax lawyers, giving them a real-world perspective.

Aspiring tax lawyers must start by pinpointing accredited law schools known for their excellence in tax law. The step involves evaluating the schools’ accreditation, curriculum, faculty expertise, and alumni success within the tax law sector. The criteria are pivotal in ensuring a quality education that aligns with career goals in tax law. Compiling a persuasive application package is essential for candidates. The application includes transcripts, letters of recommendation, a personal statement on tax law, and LSAT scores. The personal statement must highlight the dedication to tax law, supported by recommendations proving academic and professional readiness. Aspiring tax lawyers must plan to meet all application deadlines, ensuring their candidacy is considered without delay.

5. Pass The MPRE Exam

Pass the MPRE exam to meet the professional responsibility requirement for legal practice. The MPRE (Multistate Professional Responsibility Examination) is a two-hour, 60-question, multiple-choice exam. The exam assesses a tax lawyer’s knowledge and understanding of established standards related to a lawyer’s professional conduct. The test is a prerequisite for admission to the bar in most U.S. jurisdictions administered by the NCBE (National Conference of Bar Examiners).

Passing the MPRE is crucial for aspiring tax lawyers, as the exam signifies their comprehension of professional ethics. The exam fulfills a bar admission requirement and instills confidence in clients regarding the lawyer’s ethical standards. A strong ethical foundation is important, as tax law involves complex financial transactions and sensitive information. Ethical lapses within the domain of tax law result in severe legal consequences. The consequences tarnish reputations and sever professional relationships significantly. The MPRE acts as a vital screening tool. The MPRE confirms that entrants into the legal field, particularly tax law, uphold fundamental ethical standards. The prerequisite underscores the legal profession’s commitment to fostering trust and accountability.

Achieving success on the MPRE requires a strategic approach. Aspiring tax lawyers must thoroughly study the ABA Model Rules of Professional Conduct and the ABA Model Code of Judicial Conduct. Candidates must dedicate weeks to study with study guides, practice exams, and review courses for a solid understanding. Regular practice tests help identify weak areas that need more review. Joining study groups provides additional insights and aids in clarifying difficult concepts, ensuring a well-rounded preparation.

6. Explore The Option Of An LLM In Tax Law

Explore the option of an LLM in tax law to deepen tax law expertise and enhance career prospects in the field. An LLM in tax law is a postgraduate degree focusing on the intricate details of tax legislation, policy, and practice. The degree is designed for lawyers who have already completed a law degree and wish to specialize in tax law. The program covers international tax law, corporate tax, and individual tax planning. The degree provides a comprehensive understanding of tax law’s complexities for aspiring tax lawyers.

Pursuing an LLM in tax Law enhances a tax lawyer’s expertise, making them highly sought after by law firms, corporations, and government agencies. The specialization provides lawyers with the expertise to handle complex tax legislation and issues confidently. The lawyer’s dedication is shown in skilled analysis, interpretation, and application of tax laws for strategic legal advice. An LLM in tax law opens lucrative career opportunities. Lawyers with an LLM in tax law are well-positioned to command higher salaries due to their specialized skills and the high demand.

Securing an LLM in tax Law starts with finding accredited law schools with strong programs and faculty. Applicants need a JD or equivalent, a competitive GPA, and relevant legal experience, ideally in tax law. Recommendation letters and a personal statement on tax law interest and career goals are crucial for applications. The documents must clearly express the applicant’s passion for tax law and professional goals. Aspiring tax lawyers must dive into the curriculum and join clinics or internships. The connections provide mentorship guidance and lead to job offers post-graduation. The approach blends academic rigor, practical experience, and networking, laying a foundation for success in tax law.

7. Take And Pass The Bar Exam

Take and pass the Bar exam to fulfill the essential licensing requirement for practicing law in a specific jurisdiction. Passing the Bar Exam is crucial for aspiring tax lawyers. The Bar exam is a rigorous, comprehensive test that assesses a candidate’s understanding of the law and capability to practice it. Administered by each state’s bar association, the Bar examination typically spans two to three days. The Bar exam includes multiple-choice questions, essays, and practical tasks to evaluate legal knowledge and skills.

Passing the Bar exam is pivotal for candidates aiming to become tax lawyers. The Bar Exam provides a license to practice law and showcases extensive legal and tax law principles knowledge. Success in the Bar exam enables tax lawyers to offer expert legal advice and represent clients in tax matters. The credential is crucial for building a reputable practice in tax law, attracting clients, and establishing professional credibility.

Aspiring tax lawyers must approach the Bar exam with a detailed, disciplined strategy. The preparation begins with a comprehensive study plan and an in-depth review of tax law and general legal principles. Tax lawyers gain invaluable insights by utilizing high-quality study materials and participating in Bar prep courses. Candidates must emphasize mastering tax codes, regulations, and case law through methodical study and practice exams. Engaging in study groups focused on tax law provides collaborative learning opportunities and peer support.

8. Submit Job Applications

Submit job applications to seek employment opportunities at law firms, corporations, or government agencies specializing in tax law. The step involves preparing and sending documents that showcase a tax lawyer’s education, skills, and relevant experiences to prospective employers.

The step marks a pivotal transition from academic preparation to professional practice.

The process of submitting job applications is crucial for an aspiring tax lawyer. The step bridges theoretical knowledge from education to the practical application in the real world. The transition into a professional setting is complete with the step. Job applications open the door to interviews, networking opportunities, and the possibility of securing a position to practice tax law. The step lets individuals target organizations matching their career goals and values, setting up a fulfilling career path.

A tax lawyer must start by scouting for firms known for their tax law prowess. Tax lawyers must focus on law firms with strong tax departments or corporations facing intricate tax challenges. Government agencies dealing with tax legislation and enforcement offer promising opportunities. Personalizing one’s resume and cover letter for each job is essential. Experiences outside traditional roles and volunteer work demonstrate practical skills and commitment.

Preparing for tax lawyer interviews is crucial for success in the field. Positions for a tax lawyer require a deep knowledge of tax law and the ability to apply the law in complex situations. Tax lawyers must highlight internships, tax-focused moot courts, and research to show their suitability. Following up after applying is a strategic step that keeps a tax lawyer’s application under consideration. A polite follow-up email or call highlights a tax lawyer’s dedication, swaying the decision in their favor.

9. Fulfill Continuing Education Requirements

Fulfill continuing education requirements to maintain licensure and stay updated on the latest tax law developments. Continuing education requirements for tax lawyers involve structured learning programs. The programs are designed to maintain, improve, and broaden tax lawyer’s knowledge and skills. Tax lawyers must complete credit hours in accredited programs focusing on tax law and ethics. The programs, which are in-person or online, ensure lawyers stay current with legal developments. Documentation of the lawyer’s activities is mandatory, and a portion of the education must cover ethical considerations in tax practice.

Fulfilling continuing education requirements is paramount for tax lawyers. The educational requirements guarantee that practitioners are knowledgeable about the most recent tax code amendments, legal precedents, and effective strategies. The knowledge gained is crucial for providing clients with accurate, strategic advice and upholding the integrity and competency of the legal profession.

Achieving continuing education as a tax lawyer involves several strategic steps. Tax lawyers must determine their state’s continuing legal education (CLE) requirements. Tax lawyers must register for accredited CLE programs that focus on tax law, available through legal associations, law schools, or online platforms. Tax lawyers must prioritize programs addressing recent changes in tax law or the emergence of new areas within tax legislation. Networking with peers in the tax profession yields recommendations for valuable programs. Tax lawyers must keep detailed records of their completed courses to comply with state regulations and aid in renewing their legal licenses. The proactive approach meets legal obligations and improves a tax lawyer’s expertise and professional worth.

What Is A Tax Lawyer?

A tax lawyer is a legal expert who specializes in navigating the complexities of tax law. Tax lawyers possess deep knowledge of the legislation affecting taxation at local, state, and federal levels. Tax lawyers help individuals and businesses manage tax obligations and legally reduce liabilities. The lawyers review financial records, previous tax returns, and documentation related to the client’s income, deductions, and tax history. The review helps identify areas of risk and opportunity for individuals and businesses.

A certified tax lawyer is an attorney who has received special recognition or certification in tax law from a recognized legal institution. The certification requires passing a specialized exam, fulfilling education, and continuing tax law education to maintain status. Certified tax lawyers provide expert tax planning advice, ensuring clients take advantage of all legal avenues. Certified tax lawyers are invaluable during tax disputes, offering representation before tax authorities and in court. The lawyers defend the client’s interests, negotiate settlements, and challenge unjust tax assessments or penalties. Tax lawyers interpret the tax law definition accurately to help clients avoid potential legal pitfalls while optimizing their tax position. The lawyers stay updated on tax law changes, offering advice to reduce risks and seize new tax savings.

What Is The Importance Of A Tax Lawyer?

The importance of a tax lawyer in ensuring legal compliance and financial optimization for individuals and businesses is profound. Tax lawyers possess deep knowledge of tax laws and regulations, which are essential for dealing with complexities. The lawyer’s guidance ensures clients meet legal requirements while optimizing the tax positions. The lawyers advise on the most efficient tax structures and transactions and thoroughly analyze tax implications. Businesses, individuals facing audits, estate planners, entities with international operations, and high-net-worth individuals need tax lawyers for compliance and minimizing taxes.

Individuals with high net worth or complex financial situations need tax lawyers. Tax experts devise strategies to minimize global tax liabilities for assets spread across multiple countries. Tax lawyers offer guidance on structuring international investments to benefit from favorable tax treaties. The lawyers advise on the tax-efficient transfer of wealth, protecting estates from excessive taxation.

Businesses navigating mergers and acquisitions need tax lawyers to guide them. Tax lawyers advise on the tax implications of various business transactions. Tax lawyers handle mergers and acquisitions, assessing potential tax liabilities and finding strategies to minimize them. The lawyer’s involvement ensures that businesses make informed decisions that align with their fiscal strategies and legal obligations.

Individuals facing audits or disputes with tax authorities need tax lawyers as their allies. Tax lawyers represent clients in negotiations with tax agencies, reducing penalties and resolving issues more favorably. The lawyer’s advocacy extends to litigation, where tax lawyers defend a client’s position in court.

Individuals planning their estates need tax lawyers to ensure a smooth asset transfer. Tax lawyers contribute to estate planning. Tax lawyers assist in structuring financials for smooth asset transfers to heirs, minimizing taxes. The process involves intricate legal structures and strategies that a tax lawyer effectively implements. Tax lawyer’s guidance ensures an individual’s legacy is managed as wished, offering peace of mind.

Businesses and individuals with international dealings need tax lawyers to guide global tax laws. Tax lawyers guide businesses and individuals with operations or assets in multiple countries. The lawyers ensure compliance with international tax regulations and treaties. Tax lawyers navigate tax jurisdictions to prevent clients from facing double taxation on the same income. Tax lawyers enable clients to benefit from tax treaties, offering tax obligations or exemption reductions.

What Does A Tax Lawyer Do?

A tax lawyer guides clients through tax filings, analyzes transactions for compliance, represents in tax disputes, strategizes estate planning, and designs tax-efficient business structures.

Tax lawyers guide clients through tax filings to avoid penalties and audits.

Tax lawyers analyze transactions and operations to ensure meticulous compliance with tax codes. The lawyers handle income tax filings and delve into payroll, excise taxes, and industry-specific regimes. Tax lawyers secure research and development credits with Transfer Pricing rules for tech startups. Transfer pricing rules guide inter-company transaction pricing across countries, ensuring tax compliance and fairness.

Tax lawyers represent clients in disputes with the IRS or state tax agencies. The lawyers contest the IRS’s interpretation, advocating for a beneficial tax provision application. Disputing income characterization alters tax rates, shifting from ordinary income to capital gains. Lawyers negotiate settlements or litigate in favorable courts without prepaying disputed taxes.

Tax lawyers ensure estates are structured to pass on wealth efficiently, minimizing estate taxes. The lawyers suggest a grantor-retained annuity trust (GRAT) with little gift tax to pass on asset growth. Another strategy includes using life insurance within irrevocable trusts to cover estate taxes without enlarging the taxable estate. The approaches benefit high-net-worth individuals aiming to protect wealth for heirs and navigate estate and gift tax laws.

Tax lawyers design business deals to minimize tax exposure through strategic corporate structuring. Tax lawyers carefully consider entity selection, weighing S corporation versus C corporation tax implications. An S corporation allows income to be passed on to shareholders, avoiding double taxation. A C corporation, on the other hand, faces corporate tax, and then shareholders are taxed on dividends. The lawyer’s expertise proves essential in mergers and acquisitions, where correct structuring offers significant tax savings.

The role tax lawyers play on clients extends beyond simple tax preparation. Tax lawyers are pivotal in devising strategies that align with current tax laws to optimize clients’ financial outcomes. Tax lawyers stay updated on changes in tax legislation, offering timely, beneficial advice. The lawyers focus on achieving favorable tax outcomes in structuring business deals.

Tax lawyers guide clients on estate planning to reduce future tax burdens. Tax lawyers prevent potential legal issues related to tax laws through their expertise. The services are essential for individuals and businesses navigating complex tax regulations.

What Cases Do Tax Lawyers Handle?

Tax lawyers handle cases that include disputes with tax authorities, corporate tax matters, estate and gift tax planning, IRS audits and appeals, charges of tax fraud and evasion, and bankruptcy tax issues.

Tax lawyers handle tax disputes and litigation, representing clients against tax authorities. Tax lawyers intervene when clients contest tax assessments or disagree with tax authorities. A deep knowledge of tax law aids in defending client’s interests in tax courts or via administrative appeals. The efforts are crucial for achieving favorable resolutions and safeguarding the client’s financial interests.

Corporate tax matters fall within the expertise of tax lawyers. The lawyer’s guidance on structuring business operations includes navigating mergers, acquisitions, and divestitures. Tax lawyers help companies improve their financial strategies and health by leveraging tax credits, deductions, and exemptions.

A tax lawyer’s role includes handling estate and gift tax planning cases. The lawyers strategize asset transfers to minimize taxes, utilizing trusts, gifts, and other mechanisms. The strategic planning ensures wealth preservation for future generations and optimizes asset transfers with minimal tax burden.

Tax lawyers are crucial in defending taxpayer’s rights regarding IRS audits and appeals. Tax lawyers ensure fair treatment during audits and challenge IRS decisions if necessary. The lawyer’s skillful negotiation and litigation lead to reduced liabilities or favorable settlements, protecting clients against undue financial strain.

Tax lawyers defend individuals and businesses accused of tax fraud or evasion. The defense includes criminal charges, with lawyers navigating complex legal strategies. The lawyer’s expertise protects clients’ rights, aiming for favorable outcomes in court.

Tax lawyers provide essential guidance regarding bankruptcy tax issues. The lawyers explain the tax implications of bankruptcy and debt restructuring to clients. Tax lawyers assist in making informed financial decisions by analyzing potential tax liabilities. The lawyer’s strategic advice helps minimize tax consequences during financial recovery. The guidance proves invaluable for businesses and individuals facing financial challenges.

Do Tax Lawyers Attend Court Sessions?

Yes, tax lawyers attend court sessions. One fundamental reason tax lawyers attend court sessions is to represent clients in disputes with tax authorities. Tax disputes stem from disagreements over tax assessments, penalties, or the interpretation of tax laws. Tax lawyers bring a wealth of knowledge about tax legislation and precedent cases to argue for their clients.

Tax lawyers play a crucial role in litigation involving tax refunds and credits. Clients seeking to recover overpaid taxes or disputing the denial of tax credits require legal representation in court. Tax lawyers argue the cases by presenting detailed analyses and interpretations of tax laws. The lawyers ensure the clients receive what is rightfully theirs.

Tax lawyers handle cases related to tax fraud and evasion. Serious allegations require a nuanced understanding of both tax legislation and criminal law. Tax lawyers work to defend their clients by challenging the evidence presented by the prosecution and arguing for the interpretation of tax laws in favor of their clients. The dual expertise in tax and criminal law underscores the necessity of their role in court proceedings.

Keeping up with ever-changing tax laws and regulations is inherently stressful for tax attorneys. The requirement demands ongoing education and adaptation. The Internal Revenue Code is a complex document, and legislators frequently amend it. Tax lawyers must understand state and local tax laws, which vary widely and change regularly. The pressure to stay informed and ensure client compliance contributes significantly to stress. Errors lead to legal consequences for clients, damaging an attorney’s reputation and career.

Is Being A Tax Attorney Stressful?

Yes, being a tax attorney is stressful. Keeping up with ever-changing tax laws and regulations is inherently stressful for tax attorneys. The requirement demands ongoing education and adaptation. The Internal Revenue Code is a complex document, and legislators frequently amend it. Tax lawyers must understand state and local tax laws, which vary widely and change regularly. The pressure to stay informed and ensure client compliance contributes significantly to stress. Errors lead to legal consequences for clients, damaging an attorney’s reputation and career.

Tax attorneys experience stress from representing clients in high-stakes matters. Tax lawyers handle audits, disputes, and compliance issues with consequences that drastically affect a client’s finances. The burden of preventing financial damage or severe penalties for clients leads to long hours and pervasive pressure to secure favorable results.

Tax law practice’s detailed and time-consuming nature is a primary source of stress. Tax lawyers must review complex documents to identify potential issues or advantages. The process is both time-consuming and critical. Working under the constant pressure of tight deadlines imposed by tax authorities while striving for precision results in extended work periods. The demand for thoroughness within constrained timelines challenges work-life balance and significantly elevates stress.

Managing client expectations against the backdrop of complex tax law adds another layer of stress on tax lawyers. Clients seek quick fixes or minimal tax liabilities, expectations that do not always align with legal or practical realities. The stress of communicating effectively with clients while adhering to legal and ethical standards presents a significant challenge. Fulfilling client expectations while staying true to the legal process is a delicate balancing act. The act significantly increases the stress levels of tax attorneys.

Do Tax Lawyers Get Involved In Cases Related To Employment Law?

Yes, tax lawyers get involved in cases related to employment law. Tax lawyers become involved in employment law cases due to the complex tax implications of employment settlements. Employment disputes, wrongful termination, or discrimination claims result in settlements or awards to the employee. The financial compensations have specific tax treatments. Tax lawyers provide crucial guidance on structuring settlements in a tax-efficient manner. Tax lawyers ensure compliance with tax laws and minimize the employer and employee tax burden.

Tax lawyers get involved in employment law cases to address employee benefits and compensation issues. Employee benefits, including health insurance, retirement plans, and stock options, are subject to complex tax rules and regulations. Tax lawyers advise on the tax implications of various compensation structures and ensure companies offer competitive benefits to attract and retain talent.

Tax lawyers get involved in employment law cases that have cross-border elements due to the complexity of international tax laws. The legal scenarios introduce complicated tax issues related to residency, income sourcing, and tax treaty benefits. Tax lawyers provide expertise in applying international tax laws and ensure compliance with tax regulations.

The lawyer’s expertise is vital for structuring expatriate contracts and navigating double taxation agreements.

What Are The Skills Required To Become A Tax Lawyer?

The 7 skills required to become a tax lawyer are listed below.

- Strong Analytical Skills: Tax lawyers must dissect and understand complex legal documents and tax codes, making strong analytical skills indispensable. Tax lawyers analyze laws and regulations to advise clients accurately when dealing with intricate financial data. The skill helps lawyers identify legal issues, apply tax laws correctly, and minimize tax liabilities effectively.

- Attention to Detail: Tax lawyers must scrutinize documents and filings meticulously, ensuring accuracy and compliance with all laws and regulations. The precision prevents costly errors and legal issues, making attention to detail a critical skill for success in the law profession.

- Problem-Solving Abilities: Challenges and disputes are common in tax law, necessitating strong problem-solving abilities. Tax lawyers must creatively approach complex cases, devising strategic solutions to resolve conflicts between clients and tax authorities.

- Excellent Communication Skills: Effective communication is crucial for tax lawyers to simplify complex concepts for clients, colleagues, and courts. The skill extends beyond verbal and written communication, encompassing negotiation and advocacy abilities. Tax lawyers, known as tax advocates, negotiate with tax authorities and advocate in legal proceedings. Persuasive communication greatly influences the outcome for tax lawyers and clients.

- Strong Research Skills: Tax laws constantly evolve, making up-to-date knowledge crucial for tax lawyers. Tax lawyers rely on strong research skills to stay informed about the latest tax codes, regulations, and case law. The lawyers do extensive legal research and analysis to ensure the advice and strategies are based on current legal standards.

- Ethical Judgment and Integrity: Ethical judgment and integrity stand at the core of a tax lawyer’s profession. Tax lawyers handle sensitive information and significant financial implications, where ethical dilemmas are common. A strong moral compass and unwavering commitment to legal and ethical standards are essential. Tax lawyers must conduct work with honesty and integrity. The commitment builds trust with clients, colleagues, and the judicial system, fostering a reputation of reliability and professionalism.

- Negotiation Skills: Negotiation skills are pivotal for tax lawyers when bargaining with tax authorities or opposing parties. The ability to negotiate effectively leads to favorable outcomes, reduced tax liabilities, and the ability to resolve disputes without litigation. Negotiation abilities enable tax lawyers to reach agreements beneficial to all parties involved.

How Long Does It Take To Become A Tax Lawyer?

It takes at least 7 years to become a tax lawyer. The period includes four years for an undergraduate degree and three years in law school to earn a Juris Doctor (JD). Aspiring tax lawyers must pass the bar exam to practice after earning a JD. Ambitious tax lawyers opt for another year to pursue a Master of Laws (LLM) in a tax law specialty.

The journey to becoming a tax lawyer is complex and takes longer than typical lawyer schooling years due to several unique factors. Each step in the process, from education to specialization, introduces complexities that elongate the timeline. The educational layer is a prime factor in the extended journey to becoming a tax lawyer. Most aspirants proceed beyond the Juris Doctor degree to acquire a Master of Laws (LLM) in Taxation. The degree offers detailed knowledge and specialization, demanding an extra year of full-time study.

A meticulous licensing and certification process elongates the timeline for tax law specialization. Tax lawyers pursue the Certified Public Accountant (CPA) designation beyond passing the bar exam. Achieving certification demands considerable preparation, including extra accounting coursework for non-accounting undergraduates. The endeavor adds several months or years to the professional journey, depending on the candidate’s prior education.

The complexity and evolving nature of tax law requires continuous education and specialization, extending tax lawyer’s career timelines.

Practitioners must continually engage with new laws, regulations, and tax court decisions. The commitment, involving seminars, courses, and self-study, surpasses typical law license education needs.

Real-world experience and networking influence the pace of career advancement in tax law. Aspiring tax lawyers invest in internships, clerkships, and mentorship programs tailored to tax law to develop essential practical skills. The stage is vital for building a professional reputation and a network within the tax law community. The need for extensive experience and networking lengthens the path to establishing a tax law specialty.

How Much Does It Cost To Become A Tax Attorney?

The amount it costs to become a tax attorney or tax lawyer is approximately $140,000 to $400,000. The estimate includes the cost of obtaining a Bachelor’s degree, which ranges from $10,000 to $75,000 per year over four years, and the cost of a JD degree, which ranges from $30,000 to $100,000 per year over three years.

Becoming a tax attorney involves costs for school tuition, textbooks, living expenses, bar exam fees, licensing, association dues, and ongoing education, all adding to the total financial investment. Becoming a tax attorney begins with obtaining a Bachelor’s degree. Education costs vary widely, with in-state public universities offering lower tuition rates of around $10,000 annually. Private universities and out-of-state tuition escalate, reaching up to $75,000 annually. The costs of books and supplies for undergraduate and law school add up to several thousand dollars throughout a tax lawyer’s education.

Pursuing a career as a tax attorney involves attending law school after undergraduate studies. Law schools, especially public ones, offer tuition starting at $30,000 annually. Prestigious private schools charge more than $100,000 each year. The education phase spans three years, adding to the financial strain. Students must invest in expensive textbooks related to tax law. Additional academic supplies increase the costs of law education for aspiring tax lawyers.

Living expenses represent a substantial part of the cost of becoming a tax lawyer. Living expenses include housing, food, transportation, and personal expenses. Annual living expenses range from $10,000 to over $20,000, depending on the university’s city. Cities with higher living costs, like New York or San Francisco, see even higher living expenses. Prospective tax attorneys must budget for living costs throughout their educational journey.

Aspiring tax lawyers face initial licensing fees and costs associated with joining professional associations after passing the bar exam. Tax attorneys must engage in continuing legal education (CLE) to stay current with legal practices and maintain their licenses. CLE costs vary, with attorneys spending between $500 and $1,500 annually. The ongoing expenses are critical for professional development and legal compliance but add to the total cost of becoming a tax attorney.

Law school costs vary significantly from state to state, reflecting differences in tuition rates, cost of living, and available financial aid. Students in California, known for the prestigious law schools and high cost of living, face higher expenses than students in other states. Texas, however, offers affordable living costs and lower tuition rates, making the state a cost-effective option for aspiring tax lawyers. New York, with the city’s metropolitan allure, presents high living and tuition costs, especially in NYC. Ohio, on the other hand, offers a balance of reputable law programs with more manageable living expenses. Financial aid opportunities and scholarships influence the educational costs, with states or schools providing more generous support. The state-by-state variation necessitates careful planning by prospective law students to manage their educational finances effectively.

What Is The Best Major To Become A Tax Lawyer?

The best major for becoming a tax lawyer is economics. Economics majors gain a deep understanding of how tax policies influence economies.

Pursuing a major in economics uniquely enriches the path to becoming a tax lawyer. A critical component of the education journey is the involvement in a tax lawyer course, which builds upon the foundational knowledge acquired through economics.

The study of economics equips students with strong analytical skills, essential for evaluating economic trends and policy impacts. The skills prove invaluable in analyzing legal statutes and understanding tax law’s broader implications. The economic perspective prepares tax lawyers to tackle tax issues with legal and economic insight, fostering versatility.

The approach is key for policy development, legislative analysis, and strategic planning across client sizes.

Studying economics offers an in-depth exploration of public finance and tax policy. Students examine how governments raise revenue through taxation and how government funds are allocated and spent from the tax lawyer course. The perspective is invaluable for tax lawyers involved in policy advocacy or public sector work. Students gain insights into the rationale behind tax laws and the objectives of various fiscal policies.

The economic analysis of tax law is a specialized field that demands a strong foundational knowledge of economics. Economics majors are well-prepared for the specialization, with the skills to apply economic principles to tax issues. Students excel in assessing the tax system’s efficiency and equity, essential for tax-related advice. Economics as a major furnishes aspiring tax lawyers with a blend of economic insight and analytical prowess. The skill set is invaluable for navigating tax law complexities, positioning Economics as the ideal major for a successful career.

What Are The Best Law Schools For Tax Lawyers?

The 7 best law schools for tax lawyers are listed below.

- New York University School of Law (NYU Law): NYU Law stands as a leader in tax law education, offering an unmatched curriculum depth. The Graduate Tax Program is recognized as the premier program for tax lawyers in the United States. The program features a comprehensive selection of courses encompassing all aspects of tax law. The school’s New York City location provides unmatched opportunities for internships and employment in leading law firms, corporations, and government agencies.

- Georgetown University Law Center: Georgetown Law’s Taxation LLM program offers a comprehensive approach to tax law education. Aspiring tax lawyers customize their studies to match specific interests with over 70 tax courses available. The school’s Tax Policy Center enhances the learning experience by hosting conferences and workshops with leading tax experts.

- University of Florida Levin College of Law: The University of Florida Levin College of Law’s Graduate Tax Program is renowned for its rigorous academic standards. The program attracts aspiring tax lawyers globally, creating a diverse learning environment. The school hosts a Tax Moot Court competition for practical legal experience. The law school’s Low-Income Taxpayer Clinic offers hands-on preparation for tax law practice.

- Stanford Law School: Stanford Law School’s tax law program emphasizes interdisciplinary study, integrating legal principles with economics, business, and policy. Stamford Law School is the best law school for tax lawyers, equipping students with a holistic understanding of tax law. Stanford’s small class sizes foster an intimate learning environment where students receive personalized attention from faculty. The school’s California location offers unique tax law and technology opportunities. Students gain access to internships and jobs at leading tech companies and startups.

- Harvard Law School: Harvard Law School’s tax program blends traditional legal education with interdisciplinary opportunities. The school’s tax clinic allows aspiring tax lawyers to represent low-income taxpayers in disputes with the IRS. Harvard’s global alumni network and academic excellence pave the way for graduates. Students secure positions in prestigious law firms, academia, and government worldwide.

- Marquette University Law School: Marquette University Law School is renowned for focused training in tax law. The institution stands out among the top law schools in Wisconsin due to the law school’s extensive tax law curriculum and expert faculty. Students at Marquette immerse themselves in advanced tax law seminars and take advantage of internships at local tax firms. The opportunities equip aspiring tax lawyers to navigate the complexities of tax litigation and policy effectively, preparing them for high-impact careers in the field.

- University of Nebraska College of Law: The University of Nebraska College of Law offers a robust curriculum for aspiring tax lawyers and is recognized as one of the top law schools in Nebraska. The school provides specialized courses in tax law, including estate planning and corporate taxation. Students gain practical experience through clinics and internships that prepare them for successful careers in tax law.

Is It Hard To Become A Tax Attorney?

Yes, it is hard to become a tax attorney. Becoming a tax lawyer or attorney involves a demanding journey requiring significant time, effort, and dedication. The path is paved with rigorous academic requirements, competitive exams, and continuous education to stay abreast of ever-changing tax laws.

Becoming a tax lawyer or attorney starts with obtaining a Bachelor’s degree in a relevant field. Accounting, finance, or business lay the groundwork for understanding tax law principles. Aspiring tax attorneys must navigate the challenging path of law school, aiming for a Juris Doctor (JD) degree. The law school curriculum is demanding, heavily emphasizing critical thinking, legal writing, and a comprehensive understanding of the law. The complexity and demanding nature of the educational pathway set a high barrier to entering the tax law profession.

The next major hurdle is passing the difficult bar examination. The exam tests a broad spectrum of legal knowledge beyond tax law. The bar exam format includes multiple-choice questions, essays, and performance tests, demanding practical application skills. Pass rates for the bar exam vary by state, with many aspiring tax lawyers failing on their first attempt.

Tax law’s complexity requires attorneys to possess extensive knowledge of federal, state, and local codes, regulations, and case laws. Staying current with legislative updates is crucial for understanding their impact on clients. Ongoing education through Continuing Legal Education (CLE) courses is essential for licensure maintenance and knowledge updating. The need to stand out in a competitive postgraduate program adds another difficulty to becoming a tax lawyer.

The role of a tax attorney involves meticulous and analytical legal tasks. Tax lawyers must draft legal documents, negotiate with tax authorities, and advocate for clients in disputes. The tasks require keen attention to detail and analytical acumen. The field of tax law is competitive, with many attorneys vying for a limited number of positions in top law firms. The competitive nature of tax law and the high stakes involved make the field both stressful and demanding.

Is It Required To Be An Accountant To Become A Tax Lawyer?

No, it is not required to be an accountant to become a tax lawyer. Tax lawyers must master the intricacies of tax laws and regulations, not necessarily accounting. The specialization is developed through law studies and refined in postgraduate courses like a Master of Laws in Taxation. Regulatory and licensing distinctions between accountants and tax lawyers highlight their professional separation. Accountants must clear a uniform exam and fulfill state-specific educational and experiential criteria. Aspiring tax lawyers need a law degree, pass the bar exam, and comply with additional state bar association requirements. Different training allows lawyers to address tax legal issues without an accounting background.

The distinct skill sets required for accounting and tax law highlight another reason why being an accountant is not a prerequisite for a career in tax law. Accountants and tax attorney accountants operate in related but fundamentally different realms of the tax field. Accountants prepare tax documents and ensure financial compliance, focusing on financial reporting. Tax lawyers, on the other hand, are experts in the legal implications of tax laws, representing clients in disputes with tax authorities. Tax lawyers advise on tax issues and structure deals for optimal tax compliance and efficiency. Tax lawyer’s legal argumentation and negotiation expertise stems from law education rather than accounting training.

How Much Is The Salary Of A Tax Lawyer?

The average salary of a tax lawyer in the United States is approximately $113,389. Salaries for tax attorneys vary widely, ranging from $69,000 to $202,000 per year, and bonuses contribute an extra $3,000 to $49,000 to their total compensation package. Tax lawyers charge from $150 to $325 per hour for standard cases. Highly experienced lawyers charge more than $500 per hour for complex cases. Several specific factors influence the salary of a tax lawyer, each contributing in unique ways to the overall compensation package.

Experience and seniority significantly influence a tax lawyer’s salary. Tax lawyers gain a wealth of knowledge and expertise as they progress.

The accumulation of experience allows lawyers to tackle complex cases effectively. A tax lawyer with over a decade of experience earns a significantly higher salary, especially in international tax laws. Newcomers in the field typically earn less due to their limited experience.

The geographical location of a tax lawyer significantly affects their salary. Lawyers earn more in major metropolitan areas or financial hubs. New York City, San Francisco, and London offer higher compensation for tax lawyers, while smaller cities or rural areas offer lower salaries. The discrepancy arises from the different economic dynamics in the locations.

Another crucial salary determinant is the size and type of employer. Lawyers working for large, multinational firms earn more than lawyers in small practices or government positions. Large firms have the resources to offer competitive salaries and benefits, attracting top talent. Tax lawyers handle substantial, complex cases requiring highly paid specialists’ skills. Tax lawyers in government roles or working for the IRS have lower salaries but enjoy job benefits, stability, and pension plans.

How To Choose A Tax Lawyer?

To choose a tax lawyer, assess the legal needs and seek a lawyer with relevant expertise, such as an LL.M. in Taxation. Check the tax lawyer’s reputation through legal directories and client testimonials. Ensure clear communication and compatibility, and understand their billing practices to avoid surprises.

Determine Needs: Start by assessing the complexity of the tax situation. Complex issues in business taxes or international tax matters demand a tax lawyer with specialized expertise. Identify whether assistance is needed with litigation, estate planning, corporate structuring, or tax dispute resolution. The clarity guides the search for tax lawyers experienced in specific areas of need.

Research Qualifications and Experience: Look for a lawyer with a strong educational background in tax law, ideally holding an LL.M. (Master of Laws) in Taxation. Verify the tax lawyer’s licensure and any certifications specific to tax law. Seek professionals with a proven track record of handling similar cases. Review the lawyer’s published articles, case studies, and testimonials to gauge their expertise and outcomes achieved for clients.

Consider the Lawyer’s Reputation: A tax lawyer’s reputation within the legal community and among past clients offers valuable insights into their success rates. Legal directories, peer reviews, and client testimonials are reliable sources of information. Recognition by reputable legal organizations or awards indicates a tax lawyer’s standing and expertise in tax law.

Assess Communication and Compatibility: Effective communication is crucial in any attorney-client relationship. Ensure the tax lawyer chosen is approachable, responsive, and willing to explain complex tax concepts in understandable terms. A face-to-face meeting helps assess whether their communication style aligns with their preferences. Compatibility with the tax lawyer facilitates a smoother collaboration and positive outcome.

Compare Fees and Billing Practices: Understanding how tax lawyers bill for their services is essential to avoid surprises. Lawyers charge by the hour, offer flat rates for specific services, or, in rare cases, work on a contingency basis. Request detailed information on their billing practices, including retainer fees, hourly rates, and any additional costs that arise. Comparing cost details among top choices helps find a tax lawyer who offers transparent pricing and value for their expertise.

How In Demand Are Tax Lawyers?

Tax lawyers are in high demand due to their specialized knowledge and expertise in handling tax-related issues for individuals and organizations.

The legal profession, including tax lawyers, is expected to grow by 8% from 2022 to 2032, quicker than the average growth for all jobs.

Tax lawyers are in high demand due to the intricate nature of tax law and the law’s constant evolution. The frequent changes in tax legislation require the specialized knowledge tax lawyers possess. Tax lawyers stay abreast of legal changes, ensuring compliance and leveraging laws to benefit their clients. The continuous flux makes tax lawyers valuable and indispensable for effectively navigating the legal landscape.

The globalization of business has amplified the demand for tax lawyers. Companies operating across borders face a maze of tax treaties, international tax laws, and cross-border transaction regulations. Tax lawyers with expertise in international tax law help entities optimize their tax positions. Tax lawyers ensure businesses benefit from the available treaties and avoid double taxation. Tax lawyers are vital in making international operations tax-efficient, highlighting their global significance.

Tax disputes with governmental authorities contribute to the demand for tax lawyers. Tax lawyers represent clients when individuals or companies disagree with tax assessments or face audits. Tax lawyers possess the skills to negotiate with tax authorities and, if necessary, litigate in court. The lawyer’s expertise is crucial in resolving disputes favorably, saving their clients substantial money.

Technological advancements and the digitalization of tax systems pose another reason for the growing reliance on tax lawyers. Digital goods and services, cryptocurrency, and remote work arrangements have created uncharted tax territories. Tax lawyers guide how existing tax laws apply to new economic activities. Tax lawyers ensure that the tax reporting and payment processes comply with new electronic requirements.

The lawyer’s ability to adapt and apply traditional tax principles to the digital age further underscores their indispensability.

How Can Lexinter Help In Choosing The Right Tax Lawyer?

Lexinter can help in finding the right tax lawyer by providing a specialized directory that connects clients with professional tax lawyers.

Lexinter simplifies the search for legal expertise by offering a wide-ranging list of tax lawyers. Clients navigate through options effortlessly, making the selection process easy and simple.

The Lexinter directory is an invaluable tool for clients. The directory lists detailed information, including law firms’ names, addresses, contact details, and the specific credentials of tax lawyers. The details facilitate informed decisions by allowing clients to evaluate a lawyer’s expertise in tax law. Lexinter provides operational hours and simplifies scheduling consultations with lawyers, making the initial engagement seamless. Lexinter’s premium listings offer enhanced visibility for law firms and tax lawyers. The listings are directly linked to Google My Business profiles, social media pages, and firm websites. The linking boosts the online presence of tax lawyers, making the search process easier for potential clients. Tax lawyers gain a strategic advantage by being part of Lexinter’s directory. Lexinter exposes tax lawyers to a relevant audience, bridging the gap between legal specialists and clients who need their services.