Insurance Law: Principles And Regulations

Insurance law is the body of law that controls all the different parts of insurance, such as contracts, plans, claims, and disagreements. It’s a specialized field that spells out who has what rights and responsibilities in insurance deals. Insurance law covers things such as how insurance contracts are made and interpreted, what the roles and responsibilities of insurance companies and customers are, how claims are handled, how to follow rules, and how to solve problems that come up.

Insurance law is very important because it sets up a fair and organized environment for both insurance companies and people who buy insurance. Ensuring that insurance arrangements are clear and enforceable to protect everyone’s interests. Insurance law sets rules for figuring out how much a claim is worth, stopping scams, and keeping insurance companies’ finances stable. The legal system helps people and companies lower their risks by giving them a way to get back on their feet after something unexpected happens. Promoting economic stability and personal safety.

Insurance law applies across various jurisdictions, including the United Kingdom, where it is commonly referred to as “insurance law UK.” The principles of insurance law are relevant globally, as insurance is a universal concept. It impacts both individuals and businesses engaging in insurance contracts. Insurance law governs not just the formation and administration of insurance policies but also addresses legal issues related to claim denials, disputes over coverage, liability assessments, and regulatory compliance.

Insurance law operates by establishing a legal framework that guides the entire lifecycle of insurance transactions. Insurance lawyers, known as insurance claims lawyers, specialize in the field and assist clients in navigating the complexities of insurance-related matters. Helping clients understand their rights and responsibilities under insurance policies, providing guidance on filing claims, negotiating with insurance companies, and representing clients in cases of disputes or litigation. Insurance law ensures that insurance contracts are legally binding, claims are handled fairly and according to policy terms, and any conflicts are resolved through legal processes.

Table of Contents

- What Is Insurance Law?

- What Is The Importance Of Insurance Law?

- What Are The Principles Of “Insurance Law”?

- What Are The Regulations Of Insurance Law?

- 1. Licensing And Registration

- 2. Solvency And Capital Requirements

- 3. Policy Wordings And Disclosures

- 4. Premium Rates

- 5. Consumer Protection

- 6. Anti-Money Laundering (AML)

- 7. Investment Regulations

- 8. Reinsurance

- 9. Data Protection And Privacy

- 10. Market Conduct

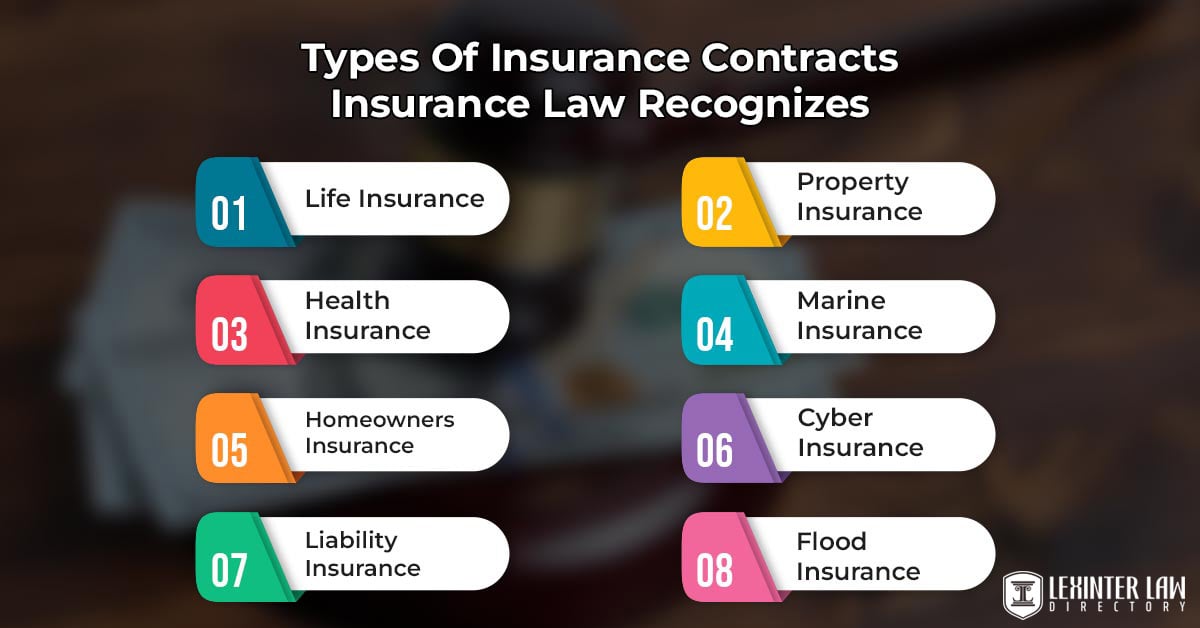

- What Types Of Insurance Contracts Does “Insurance Law” Recognize?

- What Happens If Insurance Companies Breach “Insurance Law”?

- What Are The Other Types Of Law Besides Insurance Law?

- How To Choose A Law School For Insurance Law?

What Is Insurance Law?

Insurance Law covers the body of legal principles, rules, and regulations governing relationships, transactions, and contracts within the insurance industry. Insurance law defines the rights, duties, and responsibilities of insurers, insured parties, and other stakeholders involved in insurance transactions. Insurance law falls into three major categories. The first category is when the insurance company hires lawyers to represent the insured in case the insured is sued for something related to the insurance contract. The people are known as “insurance defense attorneys.” The second category of insurance law helps insured people determine when an insurance company must pay a claim. The third category is that insurance companies hire attorneys to make sure the company complies with all applicable laws and regulations, which vary by state.

Insurance law plays a vital role in providing a legal framework that governs the intricate interactions between insurers and policyholders. Insurance law covers both substantive and procedural aspects of insurance, guiding the creation and enforcement of insurance contracts. The core principles within insurance law, such as utmost good faith, insurable interest, indemnity, proximate cause, subrogation, and others, lay the foundation for the entire insurance industry. The principles help establish the terms of insurance agreements, specify the obligations of both parties and define the scope of coverage.

Insurance law extends its reach to regulatory matters, ensuring that insurance companies adhere to legal standards, financial stability requirements, and consumer protection regulations. Setting the parameters for fair claims handling processes, preventing fraudulent activities, and ensuring that policyholders receive due compensation for legitimate losses. Insurance law provides the means for resolution through litigation, arbitration, or alternative dispute resolution methods in conflicts.

Given the global nature of the insurance industry, insurance law varies by jurisdiction, reflecting the legal traditions, cultural norms, and economic conditions of different regions. Insurance lawyers specializing in the field are crucial in navigating the complex landscape of insurance transactions, guiding clients through policy interpretation, claims procedures, negotiation with insurers, and representation in legal proceedings when disputes arise.

What Is The Importance Of Insurance Law?

Insurance law holds an important role in society, serving as the pin that upholds the integrity and functionality of the insurance industry. Insurance laws address a wide range of issues related to the industry, including the licensing of insurers, agents, brokers, and claims adjusters. The setting of appropriate rates and policy forms and the protection of consumers. Insurance law plays a fundamental role in risk management and financial protection. Offering a structured mechanism for individuals, businesses, and organizations to shield themselves from unforeseen risks and potential losses. Empowering entities to navigate uncertainties while safeguarding their financial well-being by providing avenues to obtain coverage against events such as accidents, natural disasters, or liabilities.

The economic stability of a nation is intricately tied to the insurance industry, and insurance law is instrumental in maintaining stability. The industry’s ability to distribute and manage risks across a diverse pool of policyholders ensures that unexpected events don’t result in widespread financial disorder. Insurance law’s role in establishing regulatory standards and ensuring insurers’ financial capacity fosters confidence in the market, contributing to economic growth and resilience. Insurance law is crucial for businesses on an individual level. Commercial enterprises rely on insurance policies to reduce the risks associated with their operations. Offering businesses the means to manage risks and ensure their continuity in the face of adversity, whether it’s protecting against property damage, liability claims, business interruptions, or employee injuries.

Consumer protection is another vital aspect of insurance law. Consumer protection ensures that insurance contracts are transparent and fair and that claims are handled ethically. Safeguarding the policyholders from unethical practices such as claim denials or misleading policy terms. Insurance law ensures that individuals receive the coverage they are entitled to by fostering consumer confidence and holding insurers accountable. Insurance law enhances legal certainty. Establishing clear guidelines for the terms and conditions of insurance contracts reduces uncertainty and potential disputes. Legal clarity benefits both insurers and policyholders, minimizing the risk of misunderstandings and conflicts.

Insurance law provides mechanisms for dispute resolution in times of disagreement. The framework ensures that conflicts are addressed in a structured manner, whether through legal processes, arbitration, or negotiation, preserving the integrity of insurance agreements and providing a path toward a fair resolution. Insurance law has a significant impact on social welfare beyond economic and legal considerations. Preventing individuals and families from facing severe financial distress by mitigating the financial burdens that arise from unexpected events. Contributing to the entire well-being of society by creating a safety net for those facing challenging circumstances.

Where Is The “Insurance Law” Applicable?

Insurance law is applicable within the context of insurance transactions, contracts, and related legal matters. Governing the relationships between insurers, insured parties, and other relevant entities, and the formation, interpretation, and enforcement of insurance agreements. The specialized branch of law is relevant to the insurance industry and the legal aspects surrounding insurance policies, claims, coverage, and regulatory compliance.

Insurance law has a global reach. The fundamental principles of insurance law apply universally, while the specific regulations, statutes, and legal frameworks vary from one jurisdiction to another. Insurance is a universal concept that operates across international borders, and the core principles governing the interactions between insurers and policyholders remain consistent. The global nature of insurance law ensures that insurance contracts and transactions are rooted in common principles, even as they are adapted to fit the legal traditions, cultural norms, and economic conditions of different regions.

Insurance law’s applicability extends beyond national boundaries, as insurers operate internationally, and policyholders have coverage for events occurring in various countries. Insurance contracts must be structured with an understanding of international legal considerations and the potential for cross-border claims. Global insurance regulations and treaties aim to harmonize certain aspects of insurance law to facilitate international trade and cooperation among insurers.

What Is The Role Of “Insurance Law” In Regulating Insurers?

The role of insurance law in managing insurance companies is to set up a complete legal system that controls how insurance companies work, how they act, and what their responsibilities are. Insurance law makes sure that insurers act responsibly, meet their responsibilities to customers, stay financially stable, and stay within the rules set by regulators.

Insurance law is important because it keeps an eye on insurance companies to ensure they run in a way that protects both clients’ interests and the security of the insurance industry in its entirety. Insurance law is very important for ensuring that insurance companies are honest and accountable. It does that by regulating things such as licensing and authorization, financial solvency and reserves, policy terms and conditions, claims handling, consumer protection, market conduct, compliance with regulations, dispute resolution, and risk management.

Insurance law sets the criteria for obtaining licenses and authorizations to operate as an insurer within a particular jurisdiction. Insurance law involves a thorough evaluation of an insurer’s financial strength, governance structure, and operational capabilities. Ensuring that reputable and capable entities are permitted to engage in insurance activities by requiring insurers to meet the necessary conditions. One of the important aspects of insurance law is the requirement for insurers to maintain sufficient financial solvency and reserves. Its mandate is in place to ensure that insurers have the financial capacity to fulfill their policy obligations, particularly in the event of unexpected or large-scale claims. Insurance law prevents insurers from becoming insolvent and unable to meet their commitments to policyholders by enforcing strict financial standards.

Insurance law controls how insurance plans are made, and it says that the terms and conditions must be clear, fair, and in line with the law. Keeping insurers from using terms that are hard to understand or unfair to customers. Insurance laws ensure that consumers know their rights, coverage boundaries, and responsibilities. Laws about insurance tell insurers how to handle and pay claims. The rules tell insurers how long they have to react to claims, look into them, and pay out compensation to customers. The aspect of insurance law that ensures that customers are treated fairly during the claims process and get the money they are owed on time.

Insurance law is a key instrument for safeguarding the interests of consumers. Insurance law prohibits insurers from engaging in unfair practices such as denying legitimate claims without proper justification, using deceptive marketing tactics, or misleading policyholders about their coverage. Insurance law helps maintain trust between insurers and policyholders by promoting ethical behavior and consumer-oriented practices. Insurance law prevents anti-competitive behavior and unethical practices in the insurance marketplace. It ensures that insurers compete fairly, provide accurate information to consumers, and refrain from collusive practices that distort market dynamics. Fostering healthy competition that allows consumers to make informed choices and obtain policies that truly meet their needs.

Insurance law mandates that insurers follow a range of regulatory standards and reporting requirements set by insurance authorities. Promoting transparency, accountability, and effective oversight of insurers’ activities, ensuring that they operate in a manner consistent with legal and regulatory expectations. Mechanisms for resolving disputes between insurers and policyholders are established within the realm of insurance law. The tools provide policyholders with a structured and fair process for addressing conflicts, promoting the efficient resolution of disagreements without resorting to costly and time-consuming legal action. Insurance law encourages insurers to adopt responsible risk management practices. Including diversifying their portfolios to reduce exposure to concentrated risks, practicing wise underwriting to accurately assess and price risks, and implementing strategies to manage the potential impact of catastrophic events.

What Is Insurance?

Insurance is a contract between a person or business, called a “policyholder,” and an insurance company. The policyholder pays the insurance company a set amount, called a “premium,” in exchange for the company’s promise to protect them financially against certain risks or events. The insurer decides to pay the client or their chosen heirs compensation or benefits in the event of a protected loss or event. Helping to lessen the financial effect of the unexpected event.

Insurance is a way for people, companies, and groups to put the financial burden of possible losses on someone or something that knows how to handle risk. The main idea is that money from many customers is pooled together to make a fund from which payments are made when covered events happen.

The risk-sharing approach is crucial in various aspects of life. Individuals purchase insurance to protect themselves against events such as accidents, illnesses, property damage, or even loss of life. Health insurance offers coverage for medical expenses, for instance, while auto insurance provides financial protection in the case of vehicle accidents. Business entities utilize insurance to safeguard their assets, operations, and liabilities, ensuring that unforeseen events don’t disrupt their activities or financial stability.

Insurance is based on the principles of probability and risk assessment. Insurers use actuarial analysis to determine the likelihood of different events occurring and their potential financial impact. Premiums are set based on assessments, with factors such as the insured’s risk profile, coverage limits, and deductible influencing the cost. Insured parties pay premiums in exchange for the peace of mind that if a covered event occurs, the insured receives financial support to help them recover and rebuild.

Insurance fosters a sense of financial security and stability in society. It encourages responsible risk management by motivating individuals and entities to take preventative measures, reducing the likelihood of claims. Risk mitigation benefits not just policyholders but communities and economies at large as well, as fewer unexpected losses contribute to total stability.

How Does Insurance Work?

Insurance is a way to control risks. People or businesses shift the possible financial burden of unplanned losses to an insurance company in exchange for regular monthly payments. The insurance promises to pay out compensation or benefits in the event of a protected event, reducing the financial impact of the event. Insurance works through a well-organized process with a few key steps. It lets people and businesses reduce the financial risks that come with unplanned events. The measures include finding and analyzing risks, making policies, paying premiums, sharing risks, submitting and handling claims, paying compensation, reducing risks, making sure finances are stable and safe, adjusting premiums, and keeping an eye on things from a legal standpoint.

Risk research and risk rating are the building blocks of insurance. Insurers use past data, statistical models, and mathematical methods to figure out how likely it is that certain events are going to occur and how much money those events cost. People who want insurance coverage, called policyholders, choose plans that fit their needs and level of risk. The plans spell out the terms and conditions of coverage, including the types of events or losses that are covered, the amount of the payment, the deductible, and any things that aren’t covered.

Policyholders pay the insurance company regularly to keep their coverage. The payments are the insurance company’s way of getting paid for protecting against protected events. The way insurance works is based on the idea of sharing risks. The fees paid by many members go into a single pool of money. The pool of funds is used to pay out claims when covered events happen. The result spreads the financial load across a larger group.

The policyholder submits a claim to the insurance company when a covered event transpires. The insurer evaluates the claim to verify its legitimacy, ensuring that it aligns with the terms of the policy and that the event is indeed within the scope of coverage. The insurer provides compensation or benefits to the policyholder or designated beneficiaries if the claim is approved. The terms of the policy, including any applicable deductibles and coverage limits, determine the amount of compensation.

Insurance pushes users to take precautions that make it less likely that they need to make a claim. Insurance companies reduce the risks they face by pushing safety rules and good behavior. It benefits both customers and the whole insurance pool. Insurance acts as a safety net that keeps people from losing a lot of money. The safety net is especially helpful when something unexpected happens, such as an accident, illness, or damage to property. It helps members get back on their feet without having to deal with severe financial difficulties.

Insurers look at and change payment rates regularly to keep the insurance system going. Changes in risk exposure, the economy, and the insurer’s claims history all affect the revisions. Government agencies are in charge of regulating how insurance works. The government makes sure that insurers follow the law, keep their finances in good shape, and act legally. The control protects the interests of clients and keeps the insurance business stable.

How Does Insurance Law Work?

Insurance law governs the legal framework that regulates relationships, transactions, and contracts within the insurance industry. Insurance law defines the rights, responsibilities, and obligations of insurers, policyholders, and other stakeholders involved in insurance-related matters. Insurance law operates by establishing principles, rules, and regulations that guide the formation, interpretation, enforcement, and dispute resolution of insurance contracts.

Insurance law operates as a comprehensive legal system that encompasses various aspects of the insurance industry. There are several explanations of how insurance law works, including legal principles, contract formation, premium payment, coverage and claim handling, regulatory compliance, consumer protection, dispute resolution, subrogation, legal recourse, and global application.

Insurance law is grounded in a set of fundamental legal principles, including utmost good faith, insurable interest, proximate cause, indemnity, subrogation, and others. The principles provide a foundation for how insurance contracts are formed, interpreted, and enforced. Insurance law dictates how insurance contracts are created. It establishes the requirements for a valid contract law, including offer, acceptance, consideration, and mutual intent. Insurance law governs the terms and conditions of the contracts, ensuring clarity, transparency, and compliance with legal standards.

Insurance law addresses the payment of premiums by policyholders in exchange for coverage. Ensuring that premiums are fairly determined and that insurers adhere to established practices for premium collection. The extent of coverage that insurance policies offer is defined by insurance law. Outlining the events or losses that are eligible for compensation. Insurance law sets the procedures for submitting claims when a covered event occurs, investigating claims, and processing claim payments.

Insurance law establishes regulatory standards that insurers must follow. The standards cover financial stability requirements, solvency ratios, reserve funds, and reporting obligations. Regulatory bodies oversee insurers to ensure compliance and maintain the stability of the insurance industry. Insurance law emphasizes consumer protection. It prohibits unfair practices such as unjust claim denials, misleading policy terms, or deceptive advertising. Ensuring that policyholders receive the coverage they are entitled to and are treated fairly.

Insurance law provides mechanisms for dispute resolution in cases of conflicts between insurers and policyholders. It involves negotiations, arbitration, mediation, or litigation. Insurance law ensures that disputes are addressed in a manner that upholds the principles of fairness and equity. Insurance law governs the principle of subrogation, allowing insurers to recover compensation paid to policyholders from responsible third parties. The mechanism prevents double recovery and ensures that the party responsible for the loss bears financial responsibility.

Insurance law provides a legal avenue for policyholders to seek an option if their legitimate claims are denied or if insurers act in bad faith. Legal remedies include seeking damages, specific performance, or other forms of relief. Insurance law is applicable internationally, although specific regulations vary by jurisdiction. It is adapted to the legal traditions, cultural norms, and economic conditions of different regions while upholding core principles of fairness, transparency, and accountability.

What Are The Principles Of “Insurance Law”?

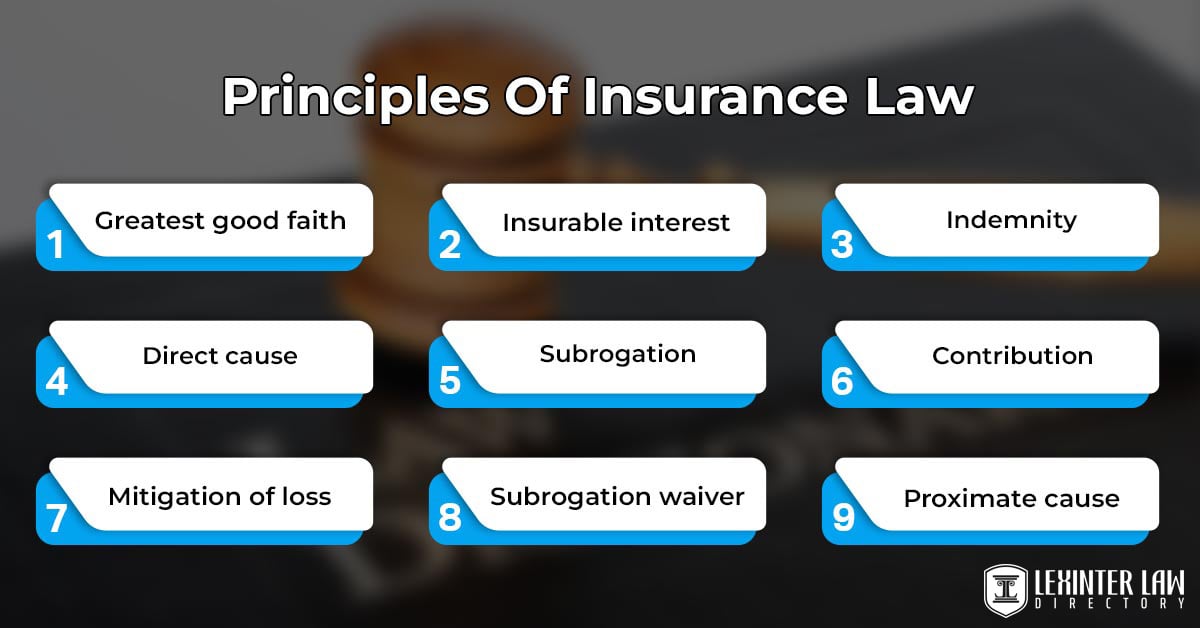

The basics of insurance deals are based on a set of basic ideas that make up the rules of insurance law. The concepts are the greatest good faith, insurable interest, indemnity, direct cause, subrogation, contribution, mitigation of loss, and subrogation waiver.

The insurer and the policyholder must be honest and open with all important information during the formation of the insurance contract. Making sure that both sides have a clear idea of the risks. The insured must have a financial or legal interest in the topic of the insurance contract. That means that if the insured event happens, they lose money. It keeps people from using insurance for things such as gambling. The goal of insurance is to guarantee that the insured receives compensation for the actual financial loss a covered event causes. Ensuring that the insured is neither underpaid nor overpaid.

The principle determines the primary or most immediate cause of loss or damage. The insurer is liable for the claim if the proximate cause is a covered peril, even if other contributing factors exist. The insurer assumes the insured’s right to recover damages from third parties responsible for the loss after paying a claim. Preventing the insured from receiving a double recovery. The principle of contribution allows insurers to share the cost of the claim based on their proportionate coverage limits when multiple insurance policies cover the same loss.

Causa proxima, known as the “Proximate Cause” principle, focuses on identifying the dominant and most immediate cause of a loss when multiple causes are involved. The insured must take reasonable steps to minimize the extent of the loss or damage once an insured event occurs. Failure to do so affects the amount of compensation received. Subrogation Waiver refers to a situation where the insured waives their right of subrogation against a third party responsible for the loss. It’s seen in contracts where the insured agrees not to seek damages from a liable party to preserve business relationships.

1. Utmost Good Faith

Utmost Good Faith, or uberrimae fidei in Latin, is a basic concept of insurance law that says both the insurer and the insured must act with the highest level of honesty, openness, and full disclosure when making an insurance contract. It requires both parties to give accurate and full information about all important facts that must be taken into account when the insurance company decides whether or not to accept the risk.

The trustworthiness of insurance arrangements depends on everyone acting in the best way possible. It makes sure that both sides have an equal understanding of the risks and keeps either side from taking advantage of a lack of knowledge. It helps build a relationship of trust when both the insurance company and the insured act in good faith, which is very important in an industry based on reducing risk.

Utmost Good Faith sets the foundation for a fair and equitable insurance contract. The insured’s disclosure of relevant information helps the insurer accurately assess the risk and determine appropriate terms and premiums. The insurer’s transparency about policy terms and conditions ensures that the insured fully comprehends the scope of coverage and obligations.

The purpose of Utmost Good Faith is to ensure that insurance contracts are based on accurate and complete information, minimizing the risk of disputes and fraudulent claims. The principle helps prevent misunderstandings between parties and supports the concept of insurance as a risk-sharing mechanism by promoting open communication and transparency. Utmost Good Faith reinforces ethical behavior and discourages intentional concealment, contributing to the stability and credibility of the insurance industry.

2. Insurable Interest

Insurable interest is a foundational concept in insurance law that signifies a legitimate financial or legal stake an individual or entity holds in the subject matter of an insurance policy. It indicates that the insured suffers a tangible financial loss if the insured event occurs, giving them a vested interest in the preservation or well-being of the subject matter.

Insurable interest is crucial for ensuring that insurance contracts are not used for speculative purposes or as a means of gambling. It helps maintain the principle of indemnity by linking coverage to a genuine potential loss. Insurance contracts lack the essential element of a party’s direct exposure to risk without insurable interest, undermining the concept of providing compensation for actual losses.

A legal and enforceable insurance deal is based on the fact that there is an insurable interest. It makes sure that insurance is bought to handle risks and not just to make money on speculation. Parties involved have a personal interest in the subject matter when there is an insurable interest. The result strengthens the contractual connection and stops insurance claims that aren’t valid or are made fraudulently.

The goal of insurable interest is to keep insurance policies honest and true to their purpose. It stops people from getting insurance on assets or interests in which they have no financial interest. It stops people from making false claims and encourages sensible risk management. The idea is in line with the main purpose of insurance, which is to protect people financially against real risks and losses.

3. Indemnity

Indemnity refers to the principle that an insurance policy aims to restore the insured to the same financial position they were in before the covered loss occurred. It entails compensating the insured for the actual monetary loss suffered due to an insured event, without allowing for overcompensation or financial gain.

The principle of indemnity prevents the insured from profiting from an insurance claim and ensures that insurance serves as a means of recovery rather than a source of financial advantage. It maintains fairness by offering compensation that corresponds to the financial setback experienced, thereby reducing the potential for moral hazard or excessive risk-taking.

Indemnity is the fundamental objective of insurance contracts. It establishes the basis on which claims are assessed and paid out, ensuring that the insured is not worse off financially due to a covered event. The principle encourages responsible risk management and discourages the intentional causing of losses to claim insurance benefits.

Providing genuine financial protection against unforeseen events while minimizing the potential for adverse incentives is the purpose of indemnity. Indemnity maintains the balance of risk and discourages situations where individuals or businesses seek to profit from insured events by reimbursing actual losses. The principle upholds the principle of fairness and aligns insurance contracts with their intended purpose of risk mitigation.

4. Proximate Cause

Proximate cause, or causa proxima in Latin is a principle in insurance law that identifies the primary, immediate, and most direct cause of a loss or damage. It determines whether the cause of the loss falls within the scope of coverage under the insurance policy. The insurer is liable for the resulting claim if the proximate cause is a covered peril, even if other contributing factors are present.

Proximate cause is essential in determining the extent of an insurer’s liability and whether a claim is valid under the policy terms. Preventing insurers from being held responsible for losses that are so remotely connected to the covered event. Ensuring that coverage is aligned with the cause that is directly responsible for the loss.

The role of proximate cause is to establish a clear link between the insured event and the resulting loss. It helps define the boundaries of coverage by identifying the dominant or most immediate factor that led to the loss. It guides the insurer’s assessment of claims and prevents disputes over whether a particular loss is covered by the policy.

The purpose of proximate cause is to provide clarity and certainty in insurance contracts. It helps avoid ambiguity in interpreting policy coverage by identifying the specific cause that triggered the loss. The principle ensures that insurance contracts are applied consistently and fairly, preventing disputes and ensuring that policyholders receive compensation for losses directly connected to the covered event.

5. Subrogation

Subrogation is a very important idea when a car, motorcycle, or boat accident happens. The subrogation principle says that once the insurance company pays the settlement for a destroyed or lost car, it owns the thing that was covered. It is called the insurance company’s reimbursement rights.

Subrogation is important because it keeps people from getting paid twice for the same loss. It lets insurers get the money they paid out back from the person or people who caused the loss. Keeping the insured from getting money from both the insurer and the person or people who caused the loss.

The role of subrogation is to help insurers maintain financial equilibrium by not shouldering losses that were caused by someone else’s negligence. Supporting the concept of indemnity by ensuring that the insured is made whole financially, without allowing them to profit from the loss.

The purpose of subrogation is twofold. It helps insurers recover their expenses and maintains the principle of fairness. Insurers are not burdened with the financial responsibility of claims that were caused by others, and insured parties are prevented from profiting from losses that were not their fault.

6. Contribution

Contribution is an insurance law concept that comes into play when more than one policy covers the same loss or event. It lets insurers share the cost of a claim in proportion to how much coverage each one has. The concept makes sure that when multiple plans are involved, no single insurer has to pay for a claim on its own.

Contribution keeps an insurer from paying more than its fair share for a loss that must be covered by more than one insurer. It makes sure that the cost of the claim is split fairly among all plans that cover the same event. It’s fair and keeps people from being overpaid.

A contribution is a way for insurers to share the cost of a loss or claim. It’s especially important when different plans from different insurers cover the same risk so that no one insurer has to pay for the whole thing.

The purpose of the contribution is to prevent the insured from receiving more than the actual amount of the loss by claiming under multiple policies for the same event. Ensuring that insurers collectively fulfill their obligations and that the insured is compensated without receiving a windfall. Contributions maintain the balance of risk distribution and support responsible risk management.

7. Mitigation Of Loss

Mitigation of loss is a principle in insurance law that requires the insured to take reasonable and appropriate steps to minimize the extent of a loss or damage once an insured event has occurred. It obligates the insured to make efforts to prevent further harm or loss from occurring.

Mitigation of loss is important because it ensures that the insured acts responsibly and reasonably in the aftermath of an insured event. The insured helps reduce the financial impact and potential severity of the claim by taking prompt and effective actions to mitigate the loss.

The role of mitigation of loss is to encourage the insured to be proactive in minimizing the consequences of a covered event. It prevents the insured from exacerbating the loss by neglecting opportunities to prevent further damage or expenses.

The purpose of mitigation of loss is twofold. One is that it reduces the financial burden on the insurer by preventing unnecessary additional expenses caused by inaction. Aligning with the concept of insurance as a risk management tool is the second, as it encourages responsible behavior on the part of the insured to minimize the total impact of the loss.

8. Subrogation Waiver

A subrogation waiver is a contract in insurance law where the insured gives up their right to subrogation against a third party who is responsible for the loss or damage covered by the insurance policy. The covered person agrees not to go after the person who caused the loss for money, even after the insurance company has paid for the loss.

Subrogation release is important for keeping business ties, partnerships, and other things that are more important than the chance of getting money back from a third party. It keeps the insured from having to go to court against the person who caused the problem, which hurts business or personal ties.

A subrogation release gives covered parties more freedom and lets them put certain interests ahead of possible subrogation rights. It recognizes that there are times when going after a third party for payment is not in the best interest of the covered, even though the insurance company has the right to do so.

The purpose of a subrogation waiver is to offer insured parties the option to avoid legal actions against third parties when other factors, such as maintaining a positive business relationship, are more important. It contributes to the preservation of professional connections and prevents unnecessary conflicts, even if it means foregoing potential subrogation recovery.

How Does “Insurance Law” Protect Insured Parties?

Insurance helps the person who buys it and helps lower risks in business and people’s lives. A policy protects the covered party from possible risks, dangers, and accidents. It has rules and methods for dealing with and preventing insurance scams. Using the law to identify, investigate, and stop fraudulent actions in the insurance business. Insurance lawyers are very important to the prosecution of insurance scam cases because they make sure that illegal actions are dealt with in the right way and within the law.

There are parts of insurance law that are meant to identify and prevent insurance scams. Include rules that force insurance companies to use strong anti-fraud programs, set up internal controls, and use cutting-edge technology to find fraud. Insurance companies are required to report any unusual behavior to the right officials. Insurance law gives insurance lawyers, law enforcement agents, and regulatory groups the power to do thorough investigations when insurance fraud is suspected. The investigation involves gathering proof, studying papers, talking to witnesses, and working with experts to build a case against the offenders.

Insurance law outlines the legal consequences of insurance fraud. Those found guilty of committing insurance fraud face severe penalties, including fines, restitution, imprisonment, and civil liability. The deterrence factor of the consequences plays a pivotal role in curbing fraudulent activities. Insurance law allows insurance companies to pursue civil actions against individuals or entities that engage in insurance fraud. It involves recovering fraudulent claims payments, damages, legal fees, and other losses incurred as a result of the fraud.

Insurance lawyers are legal professionals specializing in insurance-related matters, including fraud cases. Working closely with insurers, law enforcement, and regulatory agencies to investigate and prosecute insurance fraud. Insurance lawyers leverage their expertise in insurance law, evidence collection, and litigation to build strong cases against fraudsters. Insurance law protects whistleblowers who report instances of insurance fraud. Whistleblower provisions encourage individuals with knowledge of fraudulent activities to come forward without fear of retaliation.

Insurance law supports consumer education efforts to raise awareness about insurance fraud and its consequences. Educated policyholders are more likely to identify and report fraudulent activities, contributing to a proactive approach to combating fraud. Insurance law fosters collaboration between insurance companies, law enforcement, regulatory agencies, and insurance lawyers. The collaborative approach enhances the efficiency and effectiveness of fraud prevention, detection, and prosecution efforts.

Insurance law makes it easier for insurers to share information to find trends of fraud. Sharing information helps insurers find and stop fraud by letting them see patterns and outliers across many cases. Insurance law understands how important it is to stay on top of new fraud schemes. Insurance laws change to deal with new types of fraud as technology changes, such as online fraud and digitally manipulated claims.

What Are The Legal Requirements For Insurance Companies Under “Insurance Law”?

Listed below are the legal requirements for insurance companies under insurance law.

- Licensing and Authorization: Insurance companies must get the right licenses and permissions from governing bodies to properly do business in a given area. The licenses are given to those who meet financial, operational, and social standards.

- Financial Solvency: Insurance companies are required to keep a certain amount of money in the bank so that they are able to fulfill their commitments to customers. It means keeping enough reserves and cash to pay for possible claims.

- Reserve Funds: Insurance law mandates the creation and maintenance of reserve funds to ensure that insurers have sufficient funds available to pay out claims promptly and fairly.

- Fair Practices: Insurance companies are obligated to adhere to fair and ethical practices. Including transparent policy terms, honest marketing, and ethical handling of claims.

- Underwriting Standards: Insurers must establish responsible underwriting standards to assess risks accurately and set appropriate premium rates. Preventing insurers from engaging in discriminatory or unfair practices.

- Claims Handling: Insurance law dictates the proper procedures for processing and settling claims. Insurers must respond promptly, investigate claims thoroughly, and provide compensation under the policy terms.

- Consumer Protection: Insurance companies are required to protect the interests of policyholders. It includes providing clear and understandable policy documents, addressing policyholder concerns, and adhering to fair claims practices.

- Reporting and Disclosure: Insurers must submit regular reports to regulatory authorities, disclosing their financial condition, operations, and other relevant information. Transparent reporting helps regulatory bodies monitor the industry’s health.

- Anti-Fraud Measures: Insurance companies are expected to implement effective anti-fraud programs and mechanisms to detect, prevent, and address fraudulent activities within the insurance industry.

- Solvency Requirements: Insurance law sets minimum solvency ratios that insurers must maintain to ensure their financial stability and ability to meet obligations.

How Does “Insurance Law” Address “Insurance Fraud”?

Insurance law has some ways to deal with insurance fraud. The ways are meant to stop, find, investigate, and punish fraudulent activities in the insurance business. Insurance lawyers are very important because they interpret, enforce, and uphold the law to make sure that insurance fraud is dealt with successfully and within the law.

Insurance law uses a variety of tools and tactics to stop insurance fraud, which makes the insurance system less reliable and costs insurers and policyholders money. Insurance law requires that fraud is stopped and found, that regulations are followed, that claims are looked into, that there are legal consequences, that whistleblowers are protected, that consumers are educated, that people work together, and that technology is improved.

Insurance law requires insurance companies to implement robust anti-fraud programs and measures. The programs involve employing technology, data analysis, and investigative techniques to identify patterns indicative of fraudulent activities. Insurance lawyers work closely with insurers to develop and enforce the programs, ensuring that insurers are well-prepared to deter and detect fraud. Insurance regulators play a crucial role in addressing insurance fraud. Establishing rules and guidelines that insurers must adhere to to prevent fraudulent practices. Insurance lawyers collaborate with regulatory bodies to draft and enforce the rules, aligning the industry with legal and ethical standards.

Insurance lawyers lead or assist in investigations to gather evidence, analyze documents, and interview relevant parties in cases of suspected fraud. Ensuring that investigations are conducted fairly, respecting the rights of all parties involved. It outlines the legal consequences for individuals or entities found guilty of insurance fraud. Insurance lawyers play a pivotal role in prosecuting cases, representing insurers in court, and ensuring that justice is served. Legal consequences include fines, restitution, imprisonment, and civil liabilities.

Insurance law protects whistleblowers who report instances of insurance fraud. Insurance lawyers advocate for the rights of whistleblowers, ensuring that they’re shielded from retaliation and encouraging individuals to come forward with critical information. Insurance law promotes consumer education initiatives to raise awareness about insurance fraud and its consequences. Insurance lawyers work to inform policyholders about the risks of fraud, equipping them with the knowledge needed to identify and report suspicious activities.

Insurance lawyers work with insurance companies, regulatory groups, law enforcement agencies, and other interested parties to fight insurance fraud as a united front. Effective cooperation makes it easier for the industry to stop, find, and stop fraudulent actions. Insurance law and insurance professionals have to change as fraud schemes change. Using new tools and methods to keep up with new types of insurance fraud, such as cyber fraud and digital manipulation.

What Are The Regulations Of Insurance Law?

Policies, premiums, consumers, money laundering, reinsurance, data security, and market behavior are all covered by the insurance law. Promoting honesty, openness, and integrity in the insurance industry. State insurance departments are responsible for enforcing statutory insurance law through the issuance of regulations, rules, and directives, as authorized and directed by their respective state legislatures. A lot of what goes into regulating insurance is found in federal statutes, judicial rulings, and administrative decisions.

The framework of insurance law relies heavily on insurance regulation. Regulatory organizations that keep an eye on and enforce adherence to the rules are responsible for ensuring the smooth operation of the insurance market. Keeping an eye on how insurance firms treat their customers, how secure their finances are, and whether or not they follow laws meant to protect their clients. A well-regulated insurance industry is open to the public, looks out for policyholders’ best interests, and continues to function as a whole. Regulation in the insurance industry improves the quality and reliability of insurance law using supervision, enforcement, and cooperation with insurance attorneys and other stakeholders.

1. Licensing And Registration

Licensing and registration in the context of insurance law refer to the legal processes by which insurance companies obtain the necessary approvals and permissions from regulatory authorities to operate within a specific jurisdiction. It involves meeting specific criteria, demonstrating financial stability, and fulfilling legal obligations to ensure the company’s ability to provide insurance services. The journey from application submission to approval or denial covers several stages, including application submission, evaluation review, financial solvency assessment, compliance with laws, and approval or denial decision.

Insurance companies interested in operating within a particular jurisdiction apply for a license or registration with the relevant regulatory authority. The application requires detailed information about the company’s structure, management, financials, business plan, and compliance procedures. Regulatory authorities review the application to assess the company’s eligibility. It includes evaluating the company’s financial strength, management competency, risk management practices, and compliance with legal and ethical standards.

One crucial aspect of the evaluation process is assessing the company’s financial solvency. Regulatory bodies ensure that the insurance company has sufficient capital, reserves, and financial stability to fulfill its obligations to policyholders. The company’s adherence to insurance laws and regulations is scrutinized during the evaluation. It includes compliance with consumer protection measures, anti-fraud programs, and other legal requirements. The regulatory authority decides whether to grant the license or registration based on the evaluation. It receives approval to operate as a licensed insurance entity within the jurisdiction if the company meets all criteria and standards. The application is denied or subject to further review and improvements.

Licensing and registration are important to ensure that insurance companies are competent and financially stable, reducing the risk of policyholders being left without coverage due to insolvency. Having licensed and registered insurers in the market instills confidence among consumers, investors, and other stakeholders. It signals that the insurance companies have met stringent standards set by regulatory authorities. Licensing allows regulatory bodies to exercise oversight over insurers’ operations. Monitoring insurers’ ethical conduct, financial health, and compliance with regulations, thereby protecting policyholders’ interests.

Licensing and registration mandate insurance companies to comply with laws and regulations, fostering a culture of adherence to ethical and legal standards. Regulatory scrutiny helps prevent fraudulent or evil entities from entering the insurance market, safeguarding consumers from potential scams or substandard services. Licensing and registration uphold the entire integrity of the insurance industry by ensuring that reputable and capable entities are authorized to offer insurance services.

2. Solvency And Capital Requirements

The minimum amount of cash on hand and reserves that insurance providers must hold are called “solvency and capital requirements.” Ensuring insurers have enough money to pay out claims, fulfill their promises to policyholders, and stay in business. The process involves determining the required minimum capital, conducting an assessment, taking a risk-based approach, analyzing the results, and reporting the findings.

Regulatory authorities establish specific formulas and criteria to calculate the minimum amount of capital and reserves that insurance companies must hold. The calculations consider factors such as the type of insurance, the volume of business, the risk profile, and the jurisdiction’s regulatory framework. Regulatory bodies closely monitor insurance companies’ financial health and adherence to solvency requirements. They regularly review financial reports submitted by insurers to ensure that they maintain the required levels of capital and reserves.

Solvency and capital requirements follow a risk-based approach. Insurance companies with higher risk exposures must maintain higher levels of capital to mitigate potential losses. Insurance companies must balance the capital they hold with their operational needs. Excessive capital holdings hinder profitability and growth while maintaining adequate capital is essential for solvency. Regulatory authorities adjust capital requirements based on changing market conditions, economic factors, or emerging risks. Insurers are required to report their financial status regularly to ensure ongoing compliance.

Insurance providers must meet solvency and capital requirements so that they maintain their commitments to policyholders. Insurers have a responsibility to their policyholders to fulfill their promises in the face of unforeseen claims and economic downturns. Insurance firms’ steadiness is bolstered by maintaining sufficient capital and reserves. The result keeps the insurance market from becoming unstable due to company insolvencies and claims not being paid. Capitalization and solvency standards encourage conscientious risk management. Maintaining financial stability requires insurance companies to accurately assess and manage risks.

Demonstrating compliance with solvency and capital requirements enhances market confidence. Consumers, investors, and stakeholders are likely to trust and engage with insurers that adhere to robust financial standards. Solvency and capital requirements facilitate regulatory oversight. Regulatory bodies intervene if an insurer’s financial health deteriorates, mitigating potential systemic risks. Regulatory authorities ensure fair competition within the insurance industry by establishing uniform solvency and capital standards. All insurers operate on a level playing field, minimizing unfair advantages based on financial strength. Adequate capital prevents insurers from going into “run-off,” where they cease writing new policies and just manage existing ones due to financial constraints.

3. Policy Wordings And Disclosures

Policy wordings and disclosures pertain to meticulously crafted contractual documentation that outlines the terms, conditions, and intricacies of insurance coverage. The documents serve as the foundation of the insurer-policyholder relationship, explaining the scope of coverage, obligations, exclusions, and entitlements for both parties. Disclosures furnish additional information to policyholders concerning the nuances of policy terms and conditions. The process of establishing policy wordings and disclosures involves a strategic sequence of steps aimed at providing clarity, transparency, and comprehensive understanding. It includes drafting, clarity, material information, pre-contractual information, informed decision-making, avoiding misunderstandings, regulatory compliance, and agreement.

Insurance companies in collaboration with legal experts, undertake the drafting of policy wordings. The documents are meticulously formulated to articulately and precisely delineate the extent of coverage, potential limitations, and instances that fall outside the scope of the policy. The crafting of policy wording centers on transparency and clarity. The documents are meticulously composed to ensure that policyholders discern with ease what events or circumstances fall under the insurance policy’s umbrella and what remains excluded. An important aspect of policy wording and disclosures involves the obligation of insurance companies to disclose all material information. It covers information that has the potential to influence the policyholder’s decision to purchase the policy or the insurer’s judgment to extend coverage.

Insurers present pre-contractual information to potential policyholders before the acquisition of the policy. The information furnishes critical insights into key facets of the policy, including premium amounts, coverage duration, and other pertinent particulars. Insurance companies empower policyholders to embark upon informed decisions regarding their coverage choices by furnishing explicit and accurate policy wordings and disclosures. Armed with comprehensive information, policyholders evaluate whether the policy aligns harmoniously with their requirements and expectations.

The availability of comprehensive policy wordings diminishes the potential for misunderstandings between insurers and policyholders. Clarity in communication minimizes the likelihood of disputes arising from differing interpretations of policy terms. It is imperative for policy wordings and disclosures to align with specific regulatory standards, ensuring equity and transparency. Regulatory authorities necessitate certain information to be prominently presented within policy documents. Policy wordings and disclosures collectively forge a contractual agreement between the insurance company and the policyholder. The documents precisely outline the rights and obligations of both entities throughout the tenure of the policy.

The ability of policy wordings and disclosures to make understanding for policyholders simple emphasizes how important they are. They forestall misconceptions and unexpected revelations during claims by explaining the extent of coverage and exclusions. Transparent disclosures bolster transparency and empower policyholders to embark upon judicious decisions regarding their insurance coverage. Equipped with a comprehensive understanding, policyholders assess whether the policy harmonizes with their distinct requirements. The role of absolute policy wording is critical in reducing disputes and contentions between insurers and policyholders. Mutual understanding of the terms substantially diminishes the probability of conflicts arising from conflicting interpretations.

Policy wordings and disclosures, compliant with regulatory standards, function as shields safeguarding consumers from unfair or misleading practices. Policyholders are entitled to access accurate and complete information before formalizing a contract. The synergy of policy wordings and disclosures forges a legally binding structure that defines the responsibilities, privileges, and obligations of both parties. Serving as a foundation for resolving disputes that arise during the policy term. Amid claims processing, policy wordings emerge as guiding beacons. Aiding insurers and policyholders in ascertaining the applicability of coverage to specific events. Transparent disclosures curtail ambiguity, facilitating the seamless handling of claims.

4. Premium Rates

The cost that policyholders have to pay to insurers in return for insurance protection is known as the premium rate. The type of coverage, the level of risk that the insurer is willing to assume, and the policyholder’s risk tolerance are all factors that affect insurance premiums. Risk analysis, the underwriting procedure, actuarial analysis, market competitiveness, policyholder preferences, rating criteria, and premium calculation are all used to set premium rates.

Insurance companies conduct thorough risk assessments to evaluate the likelihood of claims for different policyholders. Age, health status, driving history, location, and occupation are considered to determine the level of risk associated with each policyholder. Insurance underwriters determine the appropriate premium rates based on the risk assessment. Policyholders with higher perceived risks are charged higher premiums to offset the potential costs of claims. Actuaries play a key role in analyzing data and statistical models to estimate the potential costs of claims for different groups of policyholders. The analysis informs the establishment of premium rates that reflect the expected claim experience.

Premiums are affected by market forces and rivalries. Insurance firms compete on price to win and keep customers, but they must earn enough money to pay for claims and keep the business running. Options for coverage and deductibles are available to policyholders. The options chosen have an impact on the premiums. Higher premiums are the result of increased coverage limits and decreased deductibles.

Many rating factors determine the premiums that insurance companies charge. Considerations include the applicant’s age, gender, marital status, driving record, and the make and model of their vehicle (for auto insurance), among other things. The final premium amount for each policyholder is calculated using proprietary algorithms and rating systems developed by insurance companies.

Premium rates are important for the financial sustainability of insurance companies. It ensures that insurers have the necessary funds to cover claims and operating expenses while maintaining profitability. Premium rates serve as a risk management tool. Insurers adequately manage potential claim payouts and maintain a balanced risk portfolio by charging higher premiums to higher-risk policyholders. Premium rates reflect the principle of equity within insurance. Individuals who present higher risks pay higher premiums, while lower-risk policyholders pay lower premiums. Ensuring fairness in distributing the financial burden.

A higher premium rewards responsible actions. Insurance companies reward good drivers with lower rates by rewarding them for not making claims. Reasonable premiums support the stability of the insurance market. Facilitating insurers’ ability to pay claims, stay in business, and maintain stable coverage for policyholders. Consumers are able to select plans that best suit their needs and budgets thanks to premium pricing. Possessing the freedom to tailor their insurance plan to their specific needs and budget.

5. Consumer Protection

Consumer protection refers to the regulatory measures and legal provisions designed to safeguard the rights, interests, and well-being of insurance consumers. It covers ensuring transparency, fairness, and ethical conduct in insurance transactions, policy terms, claims processing, and interactions between insurers and policyholders.

Regulatory authorities establish and enforce rules and regulations that govern insurance practices to ensure consumer protection. The regulations cover areas such as fair pricing, disclosure requirements, claims handling, and anti-discrimination measures. Insurance companies are obligated to provide clear and comprehensive information to consumers before and after purchasing insurance policies. Including pre-contractual information, policy wordings, terms, and conditions that are easy to understand.

Consumer protection laws prevent insurers from engaging in discriminatory practices based on factors such as gender, age, race, or disability. Policies must be underwritten and priced based on objective risk factors. Insurance law mandates fair and timely claim processing. Insurers must promptly investigate claims, provide transparent communication, and honor valid claims promptly and fairly.

Regulatory bodies and insurance companies engage in consumer education initiatives to inform policyholders about their rights, policy details, coverage options, and how to navigate the claims process effectively. Consumer protection includes mechanisms for resolving disputes between policyholders and insurers. Regulatory authorities or ombudsmen mediate and adjudicate disputes to ensure fair outcomes. Consumer protection extends to sales practices, ensuring that insurance products are sold ethically and without misrepresentation. Insurers are prohibited from employing aggressive or deceptive sales tactics.

Consumer protection is important to ensure that insurance transactions are conducted with equity and fairness, preventing discriminatory practices and ensuring that policyholders are treated justly. Regulatory requirements for transparent information and disclosures allow consumers to make informed decisions when purchasing insurance. Transparency prevents surprises and hidden terms. Consumer protection measures enhance policyholder confidence in the insurance industry. It bolsters the industry’s credibility when consumers trust that insurers fulfill their obligations and treat them fairly.

Robust consumer protection measures deter insurers from engaging in exploitative practices that potentially disadvantage policyholders. Consumer protection mechanisms provide avenues for policyholders to resolve disputes with insurers without resorting to lengthy and costly legal proceedings. Consumer protection prevents insurance companies from denying coverage based on discriminatory factors, ensuring that individuals access the insurance they need regardless of personal characteristics. A well-regulated insurance market with strong consumer protection measures contributes to market stability. It reduces the risk of consumer backlash, legal action, and reputational damage.

6. Anti-Money Laundering (AML)

Anti-Money Laundering (AML) is a set of rules, policies, and procedures that insurance companies and government agencies use to keep money from being laundered. Stopping insurance goods and services from being used for illegal things such as laundering money and funding terrorism.

Insurance companies must go through a series of steps called customer due diligence before doing business with a customer. It includes ensuring the customer is who they say they are, knowing their risk profile, and making sure they are legit. Insurers find out a lot about their customers, such as who they are, where they get their money, and what the insurance policy is for. The information is used to figure out how likely it is that someone is going to attempt to launder money or do something wrong. Insurance companies do risk assessments to find customers or deals that are high-risk. The investigation helps decide where money laundering is most likely to happen and where resources are going to be used.

They have to tell the right people about them if insurance companies find any suspicious deals or activities. Ensuring that any possible money laundering or terrorist support is looked into. Insurance companies have tools in place to keep track of transactions and look for patterns that point to money laundering. Transactions that are unusual or big set off alerts so that they are looked into further. Insurance companies teach their workers about Anti-Money Laundering (AML) rules, warning signs of suspicious activity, and how important it is to follow the rules. Having the staff be able to spot and report possible money laundering.

Insurance companies are expected to keep accurate and detailed records of customer transactions and take due diligence measures. The records are crucial for audit trails and investigations. Authorities make sure that insurance companies follow the rules about AML. Companies send in regular reports about their efforts to stop money laundering and any suspicious actions they find.

AML regulations play an important role in deterring criminals from using insurance products to launder money, finance terrorism, or engage in other illicit activities. Compliance with AML regulations helps insurance companies maintain a positive reputation and avoid the legal and financial repercussions associated with facilitating illegal activities. AML regulations promote international cooperation to combat money laundering and terrorist financing. Insurers contribute to global efforts to curb financial crimes by adhering to regulations.

Effective AML measures enhance the integrity and stability of the financial system. Insurers contribute to maintaining a transparent and trustworthy financial environment by preventing money laundering. Insurance companies are legally obligated to implement AML measures. Failure to do so results in severe penalties, legal action, and reputational damage.

Compliance with AML regulations is a requirement for insurance companies to obtain and maintain licenses to operate. Non-compliance leads to regulatory sanctions and business disruptions. AML measures reassure consumers that insurance companies are committed to preventing illegal activities within their operations. Enhancing consumer trust in the insurance industry. Effective AML practices contribute to national security by thwarting attempts to finance criminal or terrorist activities through insurance products.

7. Investment Regulations

Investment regulations refer to the legal guidelines and restrictions that govern how insurance companies invest their assets. The regulations are designed to ensure the prudent and responsible management of policyholders’ funds, safeguard financial stability, and prevent undue risks. Insurance companies navigate investment regulations through a series of carefully orchestrated steps, including prudent investment practices, asset allocation, risk management, solvency requirements, prohibited investments, reporting and transparency, and diversification.

Insurance companies are required to adhere to prudent investment practices that prioritize the safety and soundness of investments. The practices aim to minimize the risk of loss and maintain the stability of the insurer’s financial portfolio. Regulatory authorities provide guidelines on how insurance companies must allocate their investment assets. The rules say how much of an investment must be put into stocks, bonds, real estate, cash, and other types of assets. Insurance companies have to figure out how risky each investment choice is. They need to think about things such as market volatility, liquidity, credit risk, and possible returns when making investment choices.

Investment laws have requirements that insurance companies must meet to be financially stable. The rules make sure that insurance companies have enough money to pay their policyholders even if the market is bad. Some purchases are not allowed because they are risky or cause a conflict of interest. Insurance companies aren’t allowed to invest in highly risky assets that put clients’ money at risk.

Insurance companies are required to report their investment activities to regulatory authorities. Reporting ensures transparency and allows regulators to assess compliance with investments. regulations. Diversification is a key principle in investment regulations. Insurance companies are encouraged to diversify their investments to spread risk across different asset classes and minimize the impact of poor performance in a single investment.

Investment regulations are important for protecting policyholders’ funds. Regulations minimize the risk of losses that impact policyholders’ coverage and benefits by ensuring responsible investment practices. Investment regulations contribute to the entire financial stability of insurance companies. Prudent investment practices prevent excessive exposure to risky assets that lead to financial instability. Regulatory guidelines help insurance companies manage investment risks effectively. Regulations prevent insurers from taking on undue risks that jeopardize their financial health by establishing limits and requirements.

Investment regulations maintain the integrity of the financial markets by preventing insurers from engaging in reckless investment behaviors that distort market dynamics. Investment regulations prevent insurers from investing in entities that pose conflicts of interest or lead to unethical behavior. Compliance with investment regulations enhances consumer confidence in insurance companies. Policyholders trust that their premiums are being managed responsibly and ethically. Investment regulations allow regulatory authorities to monitor insurance companies’ investment activities and intervene if there are concerns about compliance or risk exposure. Investment regulations promote the long-term sustainability of insurance companies by setting solvency requirements and prudent investment guidelines.

8. Reinsurance

Reinsurance called “insurance for an insurance company,” is a business strategy in which insurance companies transfer some of the risks they face to other insurance companies, called “reinsurers.” The arrangement allows insurers to enhance their financial stability, manage their risk portfolios, and optimize their capacity to underwrite policies effectively. It includes risk transfer and diversification, type of reinsurance, treaty, financial stability, underwriting capacity, risk management, and catastrophe protection.

Insurance companies hand over a proportion of their insurance liabilities to reinsurers. Transferring the risk allows insurers to reduce potential losses from large and catastrophic events, ensuring their ability to fulfill policyholder claims. Reinsurance facilitates the diversification of risk across a broader spectrum. Insurers reduce the concentration of risk exposure and enhance their resilience against unexpected claim spikes by sharing risks with multiple reinsurers. Reinsurance covers all forms, including proportional and non-proportional arrangements. Premiums and payouts are divided between the insurer and reinsurer according to a set ratio under proportional reinsurance. Non-proportional reinsurance covers claims exceeding a predefined threshold, providing coverage against extreme events. Treaty reinsurance involves a standing agreement between the insurer and reinsurer to cover specific types of risks or a certain portion of policies. Facultative reinsurance is negotiated for individual high-value or complex policies, providing tailored risk solutions.

Reinsurance bolsters insurers’ financial stability by reducing the impact of substantial losses. Reinsurers share the financial burden in cases of catastrophic claims, allowing insurers to maintain their solvency. Insurance companies underwrite more policies and assume larger risks with reinsurance support. The expanded capacity allows insurers to cater to diverse customer needs and market segments. Reinsurers possess specialized expertise in managing intricate and high-risk exposures. Assisting insurers in managing complex risks that exceed their internal capabilities. Reinsurance offers a vital safety net against catastrophic events, such as natural disasters. Insurers respond promptly to a surge in claims without compromising their financial stability.

Reinsurance is important for reducing risk for insurance companies. It helps spread risk across multiple entities, reducing the potential impact of severe claims and enhancing risk management. Insurance companies fortify their financial resilience by sharing risk with reinsurers and honoring their claims even during challenging times. Reinsurance contributes to market stability by preventing a concentration of risk exposure within individual insurers, thus minimizing the potential impact of large-scale claims events. Reinsurance empowers insurers to diversify their portfolio, enter new markets, and offer comprehensive coverage to a broader customer base.

Reinsurance indirectly safeguards policyholders by ensuring insurers’ ability to meet claims obligations, even in the face of substantial losses. Reinsurance allows insurers to underwrite policies with higher coverage limits and accept larger risks, addressing the needs of both individual and commercial clients. Insurers have the flexibility to underwrite policies with confidence with reinsurance backing, knowing they have robust risk management support. Reinsurance promotes collaboration among insurers and reinsurers across international boundaries, fostering knowledge exchange and coordinated risk management strategies.

9. Data Protection And Privacy

Data protection and privacy refer to the laws and rules that are in place to keep policyholders, clients, and other people in the insurance industry’s personal and sensitive information safe. It involves ensuring that data is collected, processed, and used in compliance with relevant regulations to uphold individuals’ privacy rights.

Insurance companies gather various types of personal and sensitive data from policyholders and clients during the underwriting and claims processes. The information includes personal identifiers, financial details, health data, and more. Insurance companies must obtain explicit consent from individuals before collecting and processing their data. Consent must be informed, specific, and freely given, and individuals must be aware of how their data is used. Insurance companies are obligated to implement robust data security measures to prevent data breaches, unauthorized access, and cyberattacks. Including encryption, secure storage, access controls, and regular security audits. Underwriting, claims processing, and risk assessment are just a few legitimate and specified uses for the data that insurers collect. Data must not be used for other purposes without obtaining additional consent.

People are required to get privacy notifications from their insurance companies that are easy to read and explain how their data is used, who it is shared with, and what rights they have about their data. Insurers must make sure that the right data protection agreements are in place to protect the data and make sure that privacy laws are followed when sharing data with third parties such as reinsurers or service providers. Insurance companies aren’t allowed to retain personal information for a long time. Once the goal has been met, it must be deleted or made anonymous in a safe way. People have rights under data security laws, such as the right to see their data, fix any mistakes, ask for it to be deleted, or object to data processing in certain situations.

Data security and privacy laws are important because they protect private information about people and ensure that their personal information is not misused or given to people who mustn’t see it. Compliance with data protection rules makes insurance companies and their clients more likely to trust each other. People are more likely to give correct information and buy insurance when they know their data is safe. Data security rules are something that insurance companies have to follow by law. The consequences of noncompliance are serious, including fines, legal action, and harm to one’s image. Implementing strong data security steps helps insurance companies avoid cyberattacks, data breaches, and illegal access, which reduces the chance of financial and social loss.

Data protection regulations have international implications. Compliance allows insurance companies to operate seamlessly across jurisdictions without violating varying privacy laws. Prioritizing data protection and privacy demonstrates a customer-centric approach, where insurers prioritize the well-being and rights of their policyholders and clients. Insurance companies have an ethical responsibility to handle individuals’ data with care, respect their privacy rights, and use data for legitimate purposes. Proper data protection practices allow insurance companies to harness data for innovative purposes, such as personalized policies, improved risk assessment, and enhanced customer experiences while respecting individuals’ privacy.

10. Market Conduct

Insurance providers are held to a high standard of “market conduct,” which includes operating fairly, ethically, and transparently when dealing with policyholders, customers, and the general public. Consumers’ interests and rights are protected as the guideline for how insurance companies conduct themselves throughout the policy lifecycle, from marketing and sales through underwriting and customer support.