12 Best Tax Law Schools To Get Tax Law Degree

The 12 best tax law schools to get a tax law degree are recognized nationally for their specialized concentration in tax law. The 12 best law schools offer specialized programs for obtaining a tax law degree, notably through tax LLM programs. Earning a tax law degree from a top law school significantly enhances career prospects in the field of tax law. Top programs provide comprehensive education and practical training in tax law, preparing students for various professional opportunities. Tax law schools deliver a complete education that qualifies students for upcoming designations in law and the problems of the legal profession. The primary purpose of a tax law school is to teach and train individuals to be competent and ethical legal practitioners regarding tax. The law schools provide a comprehensive curriculum and unequaled networking, internship, and experiential opportunities, ensuring graduates are well-prepared for diverse careers in tax law.

Choosing the finest law school for tax law entails considering various aspects, including program offerings, tax law curriculum, practical opportunities, and graduate outcomes. Prospective students must consider the school’s curriculum, Bar passage rates, alumni success, and networking opportunities. The best tax law schools design their curriculum to provide a comprehensive legal education while allowing students to tailor their studies based on specific interests. The J.D. program and tax LLM programs help nourish the logical and ethical development of the next generation of legal professionals.

Table of Contents

- 1. New York University Law School

- 2. Georgetown University Law Center

- 3. Northwestern University Pritzker School Of Law

- 4. University Of Florida Levin College Of Law

- 5. University Of Virginia School Of Law

- 6. Columbia Law School

- 7. Harvard Law School

- 8. UCLA School Of Law

- 9. University Of California, Irvine School Of Law

- 10. University Of Michigan Law School

- 11. Duke University School Of Law

- 12. Stanford Law School

- How To Choose Law Schools To Study Tax Law?

- What Do Tax Lawyers Major In?

- How To Find A Good Tax Lawyers Near Me With Lexinter?

1. New York University Law School

New York University Law School is a private research university notable for its commitment to providing excellent legal education. The law school, established in 1835, is one of the oldest law schools in the U.S. The tuition for the law school is $79,954 for the academic year of 2024-25. The total cost of attending the school is high, $118,137, including books and supplies costing $1,600 and housing costing $20,930. The financial aid opportunities at NYU Law, however, are robust, with approximately 60.79% of students receiving grants or scholarships. NYU Law’s acceptance rate is notably competitive, at 16.76%, reflecting its high academic standards. The enrolled student generally boasts a median LSAT score of 172 and an undergraduate GPA of 3.9, underscoring the school’s rigorous admission criteria. NYU School of Law, renowned for its exceptional academic reputation, consistently ranks among the top law schools globally. The institution currently ranks 9th among the best law schools, according to U.S. News and World Report. The law school ranks 1st in international law and criminal law, 2nd in clinical training, and 3rd in intellectual property law. The school’s tax LLM rankings are 1st nationally, reflecting the school’s notable tax programs.

New York University School of Law offers a premier Graduate Tax Program, established in 1945, renowned for its rigorous curriculum and extensive course offerings. The program includes over 50 graduate-level courses annually, covering areas including business taxation, international taxation, estate planning, and tax policy. One of the notable specialized programs is the Advanced Certificate in Taxation, which is a 12-credit specialized program on corporate tax, estate planning, and international tax. The faculty at NYU Law’s tax program consists of ten full-time professors and over forty adjunct faculty members who are distinguished practitioners and scholars in the field. Faculty members have expertise in various areas of tax law, including partnership transactions, tax policy, and international taxation. Lily Batchelder, a distinguished professor in tax law, worked as the chief tax counsel for the US Senate Committee on Finance (2010-2014). Professor Harey D. Pale is another renowned professor who is an expert in international tax law.

NYU Law offers robust, practical training opportunities through clinics, externships, and internships. The Tax Clinic provides students with hands-on experience in representing low-income taxpayers in disputes with the IRS. Externship programs at the tax law school allow students to work with government agencies, non-profits, and law firms, gaining practical skills and professional connections. The NYU School of Law Tax Program hosts various lectures, panel discussions, and colloquia, providing students with opportunities to engage with leading scholars and practitioners. Events like the Tillinghast Lecture on International Taxation and the NYU/KPMG Lecture on Current Issues in Taxation bring experts to campus to discuss contemporary issues in tax law.

New York University (NYU) School of Law offers extensive networking opportunities for students pursuing tax law. The law school’s robust alumni network, consisting of over 10,000 graduates, includes leaders in major law firms, accounting firms, government positions, and academia. NYU Law provides a comprehensive range of tax law courses among the top law schools in New York. Course offerings cover business taxation, international taxation, estate planning, and tax policy. Foundational courses include income taxation and corporate tax, while advanced electives include specialized topics like partnership taxation, survey of international tax, and tax policy. Employment outcomes for NYU Law’s tax law graduates are impressive. The law school boasts a Bar passage rate of 94.9% for first-time exam takers. The school’s employment rate within ten months of graduation is 97.5%. Graduates primarily work in private practice at law firms (59%) and public accounting firms (26%), with several holding judicial clerkships at the Tax Court (17%). Major geographic markets for graduates include the New York metro area, Washington, DC, the Southeast, and California.

2. Georgetown University Law Center

Georgetown University Law School, located in Washington, D.C., is a prestigious institution known for its rigorous academic programs and esteemed faculty. The private research institute was founded in 1870 and is the largest law school in the U.S. by enrollment. The full-time tuition for the Juris Doctor (JD) program is $79,672, with additional costs for books, living expenses, and different personal expenses bringing the total cost of attendance to approximately $113,450. Part-time students pay $2,812 per credit hour. Financial aid is available, with around 64.13% of full-time students receiving grants or scholarships, averaging $35,000 per student. Georgetown Law has an acceptance rate of 19.57%, reflecting its highly competitive admissions process. The average LSAT score for admitted students is 171, and the average undergraduate GPA is 3.91. The statistics highlight the high academic standards maintained by the law school.

Georgetown Law consistently ranks among the top law schools in the United States, known for its comprehensive curriculum. The law school is ranked No. 14 among the best law schools and ranked No.1 in part-time law, according to U.S. News and World Report. The law school offers a wide range of specialized programs, including clinical training (ranks 1st), tax law (ranks 2nd), and international law (ranks 5th nationally). Georgetown University Law Center offers one of the most comprehensive and distinguished tax law programs in the country. The Taxation LL.M. program at Georgetown provides students with an extensive curriculum, including over 65 courses and seminars that cover all aspects of tax law. Students pursue specializations in corporate, partnership, and international taxation and more niche areas, including state and local taxation and employee benefits law.

The Georgetown Law faculty includes eight full-time professors who are internationally recognized experts in tax law. The faculty members regularly consult for multinational businesses, the U.S. government, and international organizations like the IMF and OECD. In addition, 100 adjunct professors who are leading practitioners from major law and accounting firms contribute to the program. Professor Dorothy Brown, an expert in tax law, is an award-winning teacher in the U.S. Georgetown Law offers extensive practical training opportunities through its clinics, externships, and internships. The Federal Legislation Clinic, for example, allows students to work on real tax policy issues, while externships at organizations like the IRS, Treasury Department, and U.S. Tax Court provide hands-on experience. The practical experiences enhance students’ understanding of tax law and lead to permanent job offers after graduation. The tax law and public finance workshop enable students to engage with current research and develop critical analytical skills. The practical programs in tax law at Georgetown Law include certificates in employee benefits law, estate planning, international taxation, and state and local taxation. Georgetown Law’s community of 44,000 is a human resource for fellow alumni and current students. The school’s “Hoya Lawya Gateway” is a searchable online database that lets one access that resource and connect with members of the Georgetown Law community. Students are allowed to search by location or expertise and connect with fellow alumni in their area.

Georgetown Law’s strategic location in Washington, D.C., provides students with unique opportunities to engage with the nation’s tax laws. The proximity to federal agencies, international organizations, and leading law firms enhances the learning experience and provides unmatched networking opportunities. Georgetown University Law Center offers an extensive range of tax law courses designed to provide students with a comprehensive understanding of the field. The Taxation LL.M. program includes more than 65 courses and seminars covering foundational subjects such as corporate, partnership, and international taxation. Specialized courses address areas like estate planning, state and local taxation, and employee benefits law. The program allows students to pursue certificates in specific areas of tax law, either alongside their LL.M. degree or as standalone credentials. Employment outcomes for Georgetown Law’s tax law graduates are exceptionally strong. 96.1% of graduates secured full-time employment within ten months of graduation for the academic year 2023-24. Graduates find positions in various sectors, including law firms, accounting firms, government agencies, and academia.

3. Northwestern University Pritzker School Of Law

Northwestern University Pritzker School of Law, established in 1859, is the first law school located in Chicago. The school was named Northwestern University Pritzker School of Law after Mr. J.B. Pritzker and his wife, who gave $100 million to the school. The tuition for the full-time Juris Doctor (JD) program for the 2024-2025 academic year is $76,704, while the JD-MBA program costs $108,606 annually. LLM in Taxation degree costs around $76,704, whereas part-time students pay $3,688 per credit hour. Additional mandatory fees include health services and insurance, adding significant expenses to the total cost of attendance. Northwestern Pritzker Law has an acceptance rate of approximately 15.5%, reflecting its competitive nature. The average LSAT score for admitted students is 172, and the median undergraduate GPA is around 3.92. The statistics highlight the high academic standards and selectivity of the law school.

Northwestern Pritzker School of Law consistently ranks among the top law schools in the United States. The law school is ranked 9th among the best law schools, highlighting its strong emphasis on experiential learning, interdisciplinary education, and global engagement. The school is nationally ranked for tax law (ranks 3rd), clinical training (ranks 5th), and dispute resolution (ranks 7th). Northwestern University Law offers a comprehensive and specialized tax program that is recognized as one of the best in the field. The program provides a solid foundation in the four principal areas of tax law: corporate taxation, partnership taxation, international taxation, and the taxation of property transactions. Students are allowed to pursue the Taxation LL.M. degree full-time or part-time, requiring the completion of 24 credits from required and elective courses. The elective courses cover various specialized tax topics, allowing students to tailor their education to their career goals.

Northwestern Pritzker School of Law’s faculty expertise in tax law is exceptional. The program includes seven full-time residential faculty members who are leading scholars and experts in various areas of taxation. The professors are dedicated to providing students with an in-depth understanding of tax law and its practical applications. The program, in addition, features 33 adjunct faculty members who are prominent practitioners from top law and accounting firms, offering students valuable insights from their professional experiences. Northwestern Law emphasizes practical training opportunities through clinics, externships, and internships. The Bluhm Legal Clinic provides hands-on experience in various legal fields, including tax law. Students are allowed to participate in externships at leading law firms, government agencies, and non-profit organizations, gaining practical skills and professional connections. The program’s location in Chicago offers access to a vibrant legal market, enhancing the practical training experiences available to students. The Joint JD-LLM in Taxation program allows students to earn degrees concurrently, optimizing their time in law school. Students complete degrees in six to seven semesters, in total, depending on their course load and schedule. The law school boasts an alumni network of over 18,000 working in various prestigious law firms globally. The school’s “Law School through Life” objective is to serve alumni throughout their professional lives with extraordinary resources.

Northwestern University Law offers various tax law courses through its highly regarded Tax Program. The program includes foundational courses, including corporate taxation, partnership taxation, international taxation, and the taxation of property transactions. Students must complete 24 credits, with 12 credits from required courses and 12 credits from electives. Elective courses cover specialized topics like estate planning, state and local taxation, and advanced partnership taxation. The diverse curriculum allows students to tailor their education to specific interests and career goals, providing a comprehensive understanding of tax law. Employment outcomes for graduates of Northwestern Pritzker School of Law’s Tax Program are exceptional. Graduates find positions at top law firms, accounting firms, corporations, and government agencies. The school’s employment rate within ten months of graduation is approximately 98.5%. The program’s strong emphasis on practical training, combined with its rigorous academic curriculum, ensures that students are well-prepared for the job market.

4. University Of Florida Levin College Of Law

The University of Florida Law School, established in 1909, is the oldest operating law school in the state. The public law school is committed to providing legal education in an affordable and accessible way. The tuition for the 2024 academic year is $21,804 for Florida residents and $38,040 for out-of-state students. Additional costs, including room, board, books, and personal expenses, bring the total estimated cost of attendance to $48,164 for in-state students and $64,400 for out-of-state students. The majority of students receive financial aid, with 87.14% of full-time students obtaining grants or scholarships. Levin College of Law maintains a selective admissions process with an acceptance rate of 17.0%. The average LSAT score for admitted students is 169, and the median undergraduate GPA is 3.91. The high standards reflect the school’s commitment to academic excellence. Levin College of Law is renowned for its robust academic programs and faculty expertise and ranked 21st among law schools in 2023-24. The law school is ranked 3rd in tax law, 17th in dispute resolution, and 22nd in business law. The law school is ranked the No. 1 public institution by the Wall Street Journal. The strong performance underscores the quality of education and preparation students receive, positioning the school as a leading institution for legal studies.

The University of Florida Levin College of Law offers a specialized Graduate Tax Program, which ranks among the best law schools in Florida. The program provides a comprehensive education in tax law, covering areas including corporate taxation, partnership taxation, and international taxation. Students are allowed to pursue an LL.M. in Taxation or International Taxation, which requires 26 credits to complete. The school’s tax law ranking is No. 3 among the tax programs for the past 20 years. The program offers flexibility, allowing students to switch between full-time, part-time, and online formats on a per-semester basis. The faculty at Levin College of Law includes esteemed experts in tax law who bring a wealth of academic knowledge and practical experience. Full-time faculty members are recognized scholars and practitioners, contributing to leading textbooks and treatises used nationwide. The expertise ensures that students receive top-tier education and mentorship. Faculty members like Charlene Luke, Yariv Brauner, and Steven J. Willis play significant roles in the program, fostering a close-knit academic community.

Practical training opportunities at Levin College of Law are extensive and integral to the tax law program. The school launched a Low-Income Taxpayer Clinic with a $100,000 grant from the IRS, providing students with hands-on experience in tax controversy litigation and community outreach. Students, in addition, participate in externships and internships through the Office of Career and Professional Development, gaining practical skills and professional connections. The University of Florida Levin College of Law boasts a robust network of over 22,000 alumni worldwide, including more than 4,000 specifically in tax law. The extensive alumni network provides students and graduates with valuable networking opportunities and mentorship. The Law Alumni Council (LAC) plays a crucial role in fostering connections by organizing events and initiatives that promote engagement between the college and its alumni. The curriculum includes foundational courses, including corporate taxation, partnership taxation, international taxation, and advanced electives, like estate planning and state and local taxation. The courses are designed to equip students with a deep understanding of tax law and its applications. The flexibility of the program allows students to switch between full-time, part-time, and online formats, catering to diverse needs and schedules. Employment outcomes for graduates of Levin College of Law’s tax law program are impressive. The school’s graduation rate within ten months of graduation is 96%. Graduates find positions in top law firms, accounting firms, corporations, and government agencies across the United States and internationally. The Office of Career and Professional Development (OCPD) provides robust support through job postings, on-campus interviews, and job fairs, ensuring that students are well-prepared for the job market.

5. University Of Virginia School Of Law

The University of Virginia School of Law, located in Charlottesville, is known for its rigorous academic programs and distinguished faculty. The ABA-accredited law school was founded in 1819. The law school’s tuition fee for the academic year of 2024-25 is $71,010 (in-state) and $73,328 (out-of-state). Including additional costs such as fees, living expenses, and books, the total cost of attendance is approximately $105,334 for residents and $108,348 for non-residents. UVA Law has an acceptance rate of around 15%, making it highly selective. The median LSAT score for admitted students is 171, and the median undergraduate GPA is 3.94. The high admission standards reflect the school’s commitment to enrolling academically outstanding students. The University of Virginia School of Law is consistently ranked among the top law schools in the United States. The law school is ranked 4th nationally according to U.S. News and World Report. The institution is renowned for its strong emphasis on tax law (ranked 5th), contracts/ commercial law (ranked 5th), criminal law (ranked 7th), and constitutional law (ranked 7th). The school ranks among the top ten law schools nationwide, offering students excellent academic and professional opportunities.

The University of Virginia School of Law offers a robust and comprehensive Tax Law Program through the Virginia Center for Tax Law. The specialized curriculum includes core courses like corporate taxation, international taxation, and tax policy, along with advanced electives that cover specialized topics, including estate planning and state and local taxation. The UVA Law faculty includes leading tax law experts who are recognized for their scholarly contributions and practical expertise. Professors like Ruth Mason and Andrew Hayashi are renowned for their work on tax policy, international tax law, and the intersections of tax law with other fields, including economics and public policy. UVA Law emphasizes practical training through various clinics, externships, and internships. The law school offers 24 clinics, including the Low-Income Taxpayer Clinic, where students gain hands-on experience in tax controversy and litigation. Externships with government agencies, nonprofit organizations, and law firms provide additional practical training. Externship opportunities allow students to apply their knowledge from law school to real-world situations.

The University of Virginia School of Law offers a robust network and alumni base in tax law. The alumni network includes over 20,000 graduates across all 50 states and more than 60 countries, providing students with ample networking opportunities. The Virginia Center for Tax Law facilitates connections through events, conferences, and seminars, ensuring students and alumni remain engaged with the latest developments in tax law. The extensive network is crucial for professional growth and career advancement in the tax law field. Course offerings in tax law at UVA Law are comprehensive and designed to provide a deep understanding of the field. Core courses include Corporate Taxation, International Taxation, and Tax Policy, complemented by advanced electives like Estate Planning and State and Local Taxation. The curriculum is structured to allow students to specialize in various areas of tax law, providing a well-rounded education that prepares them for diverse career paths. Employment outcomes for tax law graduates from UVA Law are impressive. The law boasts an employment rate of 99.1% within ten months of graduation. The majority of graduates secure positions in prestigious law firms, accounting firms, corporations, and government agencies. The Office of Career Services supports students through job postings, on-campus interviews, and career counseling, ensuring high employability. The strong employment statistics reflect the quality of education and practical training provided by the law school, making UVA Law a top choice for aspiring tax lawyers.

6. Columbia Law School

Columbia University School is a nationally recognized Ivy League University located in New York City. The law school, established in 1858, was known for its legal scholarship from the 18th century. The law school’s tuition fee for 2024-25 is $81,888. The total university charge, including student activity fees, health, and related fees, stands at $89,775. Total living expenses for the 9-month period stand at approximately $28,867. The high cost reflects the significant investment required for a top-tier legal education at Columbia Law School, situated in New York City, which has a high cost of living. Columbia Law School maintains a highly competitive admissions process. The acceptance rate of Columbia Law School stands at approximately 12.2%, demonstrating its selective nature. Applicants generally present strong academic credentials, with an average LSAT score of 169-175 (25th-75th percentile) and a GPA range of 3.81-3.97 (25th – 75th percentile).

Columbia Law School enjoys an exceptional reputation and high rankings in various assessments. The school is placed 8th in the United States, according to U.S. News and World Report. Columbia excels in specific areas, including contract and commercial law (ranked 1st), corporate law (ranked 2nd), and international law (ranked 4th), securing top spots in the specialties. The school’s strong placement record in prestigious law firms and its high Bar exam pass rate of 93.72% for first-time exam takers solidify its standing as a leading institution for legal education. Graduates from Columbia Law are well-regarded in the legal field and beyond. Columbia Law School offers a robust program specializing in tax law, providing students with comprehensive education and training. The school’s curriculum includes courses on U.S. and international tax law, corporate taxation, and tax policy. Students pursue an LL.M. in Taxation, which offers an in-depth study of complex tax issues. The specialized program equips students with the necessary skills to excel in various tax-related careers, including positions in law firms, corporate legal departments, and government agencies.

Columbia Law School boasts a faculty with significant expertise in tax law. Notable professors include Michael Graetz, a leading expert in national and international tax law, who has authored several influential books and articles on tax policy. David Schizer, another prominent scholar at the law school, has extensive experience in tax law and has served as the dean of Columbia Law School. The faculty’s depth of knowledge and practical experience enriches the educational experience for students. Practical training opportunities at Columbia Law School are extensive and diverse, encompassing clinics, externships, and internships. The Davis Polk & Wardwell Tax Policy Colloquium offers students a platform to engage with contemporary tax issues through discussions led by distinguished scholars and practitioners. Students participate in the school’s numerous clinics, including the Entrepreneurship and Community Development Clinic, which involves tax-related matters.

Columbia Law School provides robust networking opportunities and boasts an impressive alumni network in tax law. The school’s network includes over 27,000 alumni across 119 countries, fostering connections with influential legal professionals worldwide. Alumni frequently engage with current students through various events, mentorship programs, and career panels, facilitating invaluable networking opportunities. The course offerings at Columbia Law School in tax law are comprehensive and diverse. The curriculum includes foundational courses in U.S. tax law, corporate taxation, and international tax law, along with advanced seminars and specialized classes like the Tax Policy Colloquium. The courses are designed to provide students with a deep understanding of tax law principles and contemporary issues. Employment outcomes for Columbia Law School graduates specializing in tax law are exceptional. 98.3% of graduates secure employment within ten months of graduation, with many obtaining positions at top law firms, corporate legal departments, and governmental agencies. The rigorous training and extensive networking opportunities provided by the school contribute to the strong employment outcomes. Columbia Law School’s reputation for producing highly skilled tax law professionals ensures that its graduates are in demand and well-prepared to excel in their careers.

7. Harvard Law School

Harvard University, ranked 4th among the best law schools, is a prestigious institution that provides an unparalleled experience of studying legal education in an engaging environment. The law school, a private research university in Cambridge, Massachusetts, was founded in 1817. The school’s tuition fee is $77,100 for the academic year of 2024-25. The total estimated cost of attendance is $116,000, including health insurance, books, supplies, and living expenses. Harvard Law School maintains a highly competitive admissions process. The acceptance rate of Harvard Law is approximately 9.6%, making it one of the most selective law schools. Successful applicants generally present strong academic credentials, with median LSAT scores around 174 and median undergraduate GPAs around 3.93. Harvard Law’s rigorous admissions standards ensure that only the most qualified candidates are admitted.

Harvard Law School enjoys an exceptional reputation and high rankings globally and is among the top law schools in Massachusetts. The law school is ranked 4th in the United States by U.S. News & World Report. Harvard Law, in addition, holds a strong global position, ranked number one by QS World University Rankings. The tax law of Harvard Law lies within the top 5 in the nation. Harvard Law School is nationally recognized for constitutional law (ranked 1st), criminal law (ranked 2nd), health care law (ranked 7th), and tax law (ranked 10th). Harvard Law School’s faculty includes leading experts in tax law, offering students unparalleled academic guidance. Professors like Alvin Warren and Howard Abrams bring decades of experience and extensive publication records in tax law and policy. The faculty’s expertise covers various tax-related subjects, from the fundamentals of tax law to complex issues in tax policy and administration. Practical training opportunities in tax law at Harvard Law School are extensive and diverse. Students participate in the Federal Tax Clinic, assisting low-income taxpayers and gaining practical experience in tax litigation and policy. Various clinical programs and externships provide hands-on legal practice under the supervision of experienced attorneys. The opportunities enable students to apply theoretical knowledge to real-world scenarios, preparing them for successful careers in tax law.

Harvard Law School’s clinical programs provide students with extensive practical experience, including clinics, externships, and internships. Students engage in various legal practice areas, including tax law, through the programs. The Tax Litigation Clinic, for example, allows students to represent clients in disputes with the IRS, providing valuable courtroom experience. Harvard Law School boasts a robust network and a large alumni base, offering significant advantages for students and graduates. The alumni network includes over 40,000 members worldwide, many of whom occupy prominent positions in law firms, corporations, government, and academia. Networking opportunities abound through events, mentorship programs, and the Harvard Law School Association, which fosters connections among alumni. Course offerings in tax law at Harvard Law School are extensive and designed to provide a comprehensive understanding of the field. Core courses include federal income taxation, corporate taxation, and international taxation, each covering critical aspects of tax law and policy. Advanced seminars and specialized courses such as the Tax Policy Seminar and the Tax Litigation Clinic allow students to delve deeper into specific areas of interest. Employment outcomes for Harvard Law School graduates specializing in tax law are impressive. Graduates are highly sought after by top law firms, corporations, and government agencies. The school boasts a Bar passage rate of 98.5% for first-time exam takers, reflecting the school’s great employment outcome. The comprehensive education and practical training provided by Harvard Law equip graduates with the skills needed to excel in various tax-related roles. The school’s strong placement record is reflected in the high employment rate of graduates, which is 95.3% within ten months of graduation.

8. UCLA School Of Law

The University of California, Los Angeles (UCLA) School of Law stands out as one of the premier law schools in the United States. UCLA Law, established in 1949, enjoys a reputation for academic excellence and a dynamic, interdisciplinary approach to legal education. UCLA Law’s tuition varies for residents and non-residents. California residents pay approximately $59,132 annually, while non-residents pay about $71,377 for the 2024-2025 academic year. Additional costs include health insurance and living expenses, which bring the total cost of attendance to around $32,923 annually. UCLA Law has an acceptance rate of 16.8%. Applicants generally need a strong academic background, with the median LSAT score for the incoming class being around 171 and a median undergraduate GPA of 3.92. The University of California, Los Angeles (UCLA) School of Law enjoys a prestigious reputation and consistently ranks among the top law schools in the United States. UCLA Law is positioned 13th nationally by U.S. News & World Report, highlighting its rigorous academic environment and innovative approach to legal education. The law school is ranked 4th in trial advocacy, 5th in environmental law, and 6th in tax law.

UCLA Law offers specialized programs in tax law, which are highly regarded and comprehensive. The J.D. specialization in Taxation includes foundational courses such as federal income taxation, business associations, and taxation of business enterprises. Advanced courses cover areas like estate and gift taxation and U.S. international taxation. The LL.M. program provides a Business Law – Tax Track, ensuring students receive specialized training essential for careers in tax law. Faculty expertise in tax law at UCLA Law is formidable, with several professors recognized for their significant contributions to the field. Professor Jason Oh, a notable figure in tax law, holds the Lowell Milken Chair in Law and has testified before the U.S. House of Representatives on tax-related matters. The faculty members’ work underscores the high scholarly impact and practical relevance of the tax law education provided at UCLA.

The University of California, Los Angeles (UCLA) School of Law boasts an extensive alumni network, particularly strong in tax law. The UCLA Law Alumni Association fosters connections among its over 22,000 members, providing networking opportunities and support for career advancement. Alumni engaged in tax law frequently participate in events and conferences, including the Western Conference on Tax-Exempt Organizations, highlighting their continued involvement and influence in the field. UCLA Law offers a robust curriculum in tax law, covering foundational and advanced topics. The J.D. specialization in Taxation includes courses like Federal Income Taxation, Business Associations, and Taxation of Business Enterprises. Students further specialize by taking courses in estate and gift taxation, U.S. international taxation, and executive compensation. The comprehensive offerings ensure students receive a thorough grounding in theoretical and practical aspects of tax law, preparing them for diverse career paths within the field. Employment outcomes for UCLA Law graduates specializing in tax law are notably strong. 97% of graduates secure positions within ten months of graduation, with many entering prestigious law firms, public interest roles, or government positions. The Office of Career Services and the Office of Public Interest Programs provide comprehensive support, including career counseling, job placement assistance, and networking events.

9. University Of California, Irvine School Of Law

The University of California, Irvine (UCI) School of Law is a public law school in California, established in 2006. The law school is an innovative law school that received ABA accreditation in 2011. The law school charges $55,945 in tuition for California residents and $68,190 for non-residents for the 2023-2024 academic year. Living expenses average $24,291 annually, making the total cost of attendance approximately $92,481 for non-residents. Full-time students generally receive grants or scholarships, with an average grant amount of $27,500, which covers about 40.33% of tuition and fees. UCI Law has an acceptance rate of 18.2%, reflecting its competitive nature. The law school’s LSAT requirement stands between 164 and 169 (25th-75th percentile), and GPA requirements stand between 3.49 and 3.84 (25th-75th percentile).

UCI Law is ranked 42nd nationally, according to U.S. News and World Report. The school is particularly noted for its legal writing program, ranked 7th, and its strong emphasis on practical skills. The school excels in tax law and clinical training programs, ranked 8th and 12th, respectively. The law school’s innovative approach to legal education and commitment to diversity contribute to its esteemed reputation. The University of California Irvine (UCI) School of Law offers a specialized Graduate Tax Program that equips students with doctrinal depth and practical skills. The program includes core courses, including Corporate Taxation, and elective courses that focus on practical tax skills. Practical skills are developed through externships, tax clinics, and classes designed to simulate real-world tax issues, ensuring students are well-prepared for careers as tax professionals. Faculty at UCI Law are renowned experts in tax law, contributing significantly to the field. Professors like Joshua Blank, Victor Fleischer, and Omri Marian bring extensive expertise in tax administration, international taxation, and tax policy. The scholarly work and involvement in significant tax law developments ensure that students receive top-tier education and insights into the latest tax law trends.

Practical training opportunities at UCI Law are extensive and varied. The school offers numerous clinics, including the International Justice Clinic and the Startup and Small Business Clinic, which provide hands-on legal experience. Students, in addition, participate in externships with leading law firms and governmental agencies, gaining practical skills and professional connections. The opportunities allow students to apply their classroom knowledge to real-world legal problems, enhancing their practical skills and employability. The school maintains a robust network of alumni actively engaged in tax law. The alumni association organizes events such as reunions and networking receptions, fostering connections among graduates. The events provide current students and alumni with opportunities to exchange professional insights and explore job opportunities in the tax law sector.

Core courses of the law school include corporate taxation, international taxation, and partnership taxation. Elective courses allow students to specialize further, with practical tax skills developed through clinics and externships. The curriculum emphasizes a blend of theoretical knowledge and practical application, preparing students for the complexities of tax law practice. The Tax Policy Colloquium, in addition, provides a platform for students to engage with leading experts on current issues in tax policy. Employment outcomes for UCI Law graduates specializing in tax law are strong. 90.1% of graduates secure employment within ten months of graduation. Graduates secure positions in prestigious law firms, government agencies, and public interest organizations. The median salary for graduates entering the private sector is $130,000, while graduates in public sector roles earn a median of $70,578. The school’s focus on practical training and its robust career services contribute to high employment rates and competitive salaries for its graduates.

10. University Of Michigan Law School

The University of Michigan Ann Law School, established in 1859, is a public research university in Michigan. The law school is renowned for its comprehensive curriculum, interactive learning environment, and research facilities. Tuition at the University of Michigan Law School for the 2023-2024 academic year is $69,584 for Michigan residents and $72,584 for non-residents. The tuition makes it one of the more expensive public law schools in the country. Students incur average living costs of approximately $24,144 per year, bringing the total attendance cost to around $96,728. The acceptance rate at Michigan Law is 12.6%, making it highly selective. Successful applicants generally present strong academic credentials, with an average LSAT score of 171 and a median undergraduate GPA of 3.85. The rigorous admissions process ensures that the student body is composed of highly capable and motivated individuals. Michigan Law’s yield rate, or the percentage of admitted students who choose to enroll, stands at 34.03%.

The University of Michigan Law School, ranked 10th nationally by U.S. News & World Report, stands as one of the top law schools in Michigan. The school excels in criminal law, international law, and tax law programs, ranked 5th, 6th, and 8th, respectively. Specialized programs in tax law at Michigan Law offer a robust curriculum designed to provide students with a deep understanding of tax policy and practice. Courses cover a wide range of topics, including corporate taxation, international tax, and tax policy. The program integrates practical experiences through clinics and externships, enabling students to apply their classroom knowledge in real-world settings. The holistic approach ensures that graduates are well-equipped to handle complex tax issues in their professional careers. Faculty expertise in tax law at Michigan Law is exceptional, with several renowned scholars contributing to the field. Professors like Reuven Avi-Yonah, a leading expert in international and corporate tax law, offer students invaluable insights through their extensive research and practical experience. The faculty’s commitment to teaching and mentorship plays a crucial role in fostering a rigorous academic environment.

Practical training opportunities at Michigan Law include a variety of clinics, externships, and internships. The school offers 18 clinical programs, including the Entrepreneurship Clinic and the International Transactions Clinic, where students gain hands-on legal experience. Externships provide additional opportunities for students to work with leading law firms, government agencies, and non-profit organizations. The University of Michigan Law School boasts a robust network of alumni, particularly in the field of tax law. The Michigan Law Connect platform and the Alumni Directory facilitate networking and mentorship between current students and graduates. The alumni community, exceeding 22,000 members globally, provides valuable professional connections, insights, and opportunities for mentorship. Michigan Law offers comprehensive courses in tax law, covering a broad spectrum of topics essential for tax professionals. Core courses include corporate taxation, international tax, and partnership tax. The program, in addition, features specialized courses, including Tax Planning for Real Estate Transactions and the Low-Income Taxpayer Clinic. Employment outcomes for tax law graduates from Michigan Law are exceptionally strong. 96.9% of graduates frequently secure positions at top law firms, accounting firms, government agencies, and academic institutions. The median salary for graduates entering private practice is notably high, reflecting the value of a Michigan Law degree in the job market. The school’s Office of Career Planning offers extensive support, including job placement assistance and career counseling, contributing to high employment rates and successful career trajectories for graduates.

11. Duke University School Of Law

Duke University is a private research university situated in Durham, North Carolina. The law school, established in 1868, is renowned for its students, who established the first chapter of the International Criminal Court Student Network. Duke University School of Law charges $77,100 for tuition in the 2024-2025 academic year. Additional costs, including medical insurance, books, and living expenses, bring the total estimated cost of attendance to approximately $109,398 annually. LLM program tuition fee costs around $89,950, and the total cost is approximately $122,248. The financial aid office, however, offers significant resources to support students. Duke Law’s acceptance rate is 10.51%, reflecting its highly competitive admissions process. Applicants generally present strong academic credentials, with a median LSAT score of 170 and a median undergraduate GPA of 3.87. The law school received over 6,200 applications for the latest class of 2023, admitting 652 students with an enrollment yield of 35.43%.

Duke Law consistently ranks among the top law schools in the United States, holding the 4th position according to U.S. News & World Report. The school is renowned for its rigorous academic programs, distinguished faculty, and strong emphasis on interdisciplinary studies. The law school is constantly ranked among the top 14 law schools and is one of the members of the “T-14” law school. The law school’s specialized programs include criminal law (ranks 7th), tax law (ranks 10th), and business law (ranks 11th). Duke University School of Law offers a specialized Tax Law program, integrating theoretical and practical components to provide a comprehensive education. The tax law program includes specialized courses on international tax, LLM, partnership taxation, etc. Faculty expertise in tax law at Duke Law is notable, with several distinguished professors contributing significantly to the field. Professors like Lawrence Zelenak and Richard Schmalbeck bring extensive experience and scholarship, covering topics such as federal income taxation and estate planning. The professor’s research and teaching help students gain deep insights into tax policy and its practical applications.

Practical training opportunities at Duke Law are extensive, with numerous clinics, externships, and internships available. The Low-Income Taxpayer Clinic allows students to represent clients in disputes with the IRS, providing invaluable real-world experience. Externships with law firms, government agencies, and non-profit organizations, in addition, offer students the chance to apply their classroom knowledge in professional settings, enhancing their practical skills and employability. Duke University School of Law offers a strong network and active alumni community, particularly in the field of tax law. The Duke Alumni Association supports the network by organizing events, reunions, and mentoring programs that connect current students with experienced graduates. Alumni in tax law participate in the events, sharing their insights and experiences, which help students build relationships and explore job opportunities in the tax sector.

Duke Law provides tax law courses designed to give students foundational knowledge and specialized expertise. Core courses include federal income taxation, corporate taxation, and international taxation. Advanced seminars and clinics, including the Low-Income Taxpayer Clinic, offer hands-on experience dealing with real tax issues. The curriculum is designed to ensure students are well-prepared for careers in various tax-related fields, combining theoretical knowledge with practical application. Graduates from Duke Law enjoy excellent employment outcomes, with 99.1% securing jobs within ten months of graduation. The median starting salary for graduates entering the private sector is $215,000. The Bar passage rate for first-time test takers stands at 94.44%, reflecting the school’s strong academic preparation. Graduates entering the private sector enjoy high starting salaries, reflecting the strong demand for Duke Law alumni. The school’s Career & Professional Development Center provides extensive support, including job placement assistance and networking opportunities.

12. Stanford Law School

Stanford University, established in 1893, is a top-quality private research university near Palo Alto, California. The law school is renowned for its commitment to interdisciplinary studies and a dynamic curriculum. Tuition at Stanford Law School for the 2024 academic year is $74,475. Additional expenses, including housing, food, books, and personal expenses, bring the total estimated cost of attendance to approximately $116,814 for on-campus students. Financial aid is available, with a significant portion of students receiving grants or scholarships, approximately $25,000 to $28,000 annually. Stanford Law School’s acceptance rate is highly competitive, standing at 7.3% for the most recent admissions cycle. Applicants generally present strong academic credentials, with an LSAT score between 171 and 175 and a median undergraduate GPA of 3.92.

Stanford Law School is highly regarded, ranking consistently among the top law schools in the United States. The school is currently ranked 1st nationally by U.S. News & World Report. Stanford Law is ranked 1st in business/corporate law, 2nd in criminal law, 3rd in constitutional law, and 4th in contracts/commercial law. The law school’s specialized program in tax law is ranked 15th nationally. Stanford Law offers a comprehensive array of specialized programs in tax law, including LLM, which includes courses on international tax, partnership taxation, and tax policy. The program aims to equip students with theoretical knowledge and practical skills necessary for tax law practice. The faculty at Stanford Law includes renowned experts in tax law, including Professor Joseph Bankman, who specializes in tax policy and planning. Jeff Stnrd is another notable faculty member in tax law who contributes to the school’s rigorous courses on tax law.

Practical training opportunities at Stanford Law are abundant. The school offers numerous clinics, externships, and internships, allowing students to gain real-world legal experience. The Low-Income Taxpayer Clinic, for example, provides hands-on training by enabling students to represent clients in tax disputes. The practical experiences are integral to Stanford Law’s curriculum, preparing students for the complexities of legal practice and ensuring students are well-equipped for their professional careers. Stanford Law School’s alumni network is extensive and particularly strong in the field of tax law. The Stanford Alumni Directory and LinkedIn groups provide platforms for current students and graduates to connect, facilitating mentorship and professional opportunities. Regular alumni events, including reunions and networking receptions, further strengthen the connections. Stanford Law offers a comprehensive range of courses in tax law, providing students with a robust foundation and advanced knowledge in the field. Key courses include Taxation I, Corporate Taxation, and International Taxation. Specialized seminars and clinics, including the Low-Income Taxpayer Clinic, allow students to apply theoretical knowledge in practical settings. Employment outcomes for Stanford Law graduates specializing in tax law are outstanding. 95.2% of graduates find full-time, long-term employment requiring Bar passage within ten months of graduation. Graduates generally secure positions in top law firms, government agencies, and corporate legal departments. The first-time Bar exam pass rate for Stanford Law graduates is an impressive 94.41%. The median starting salary for graduates entering private practice is approximately $225,000.

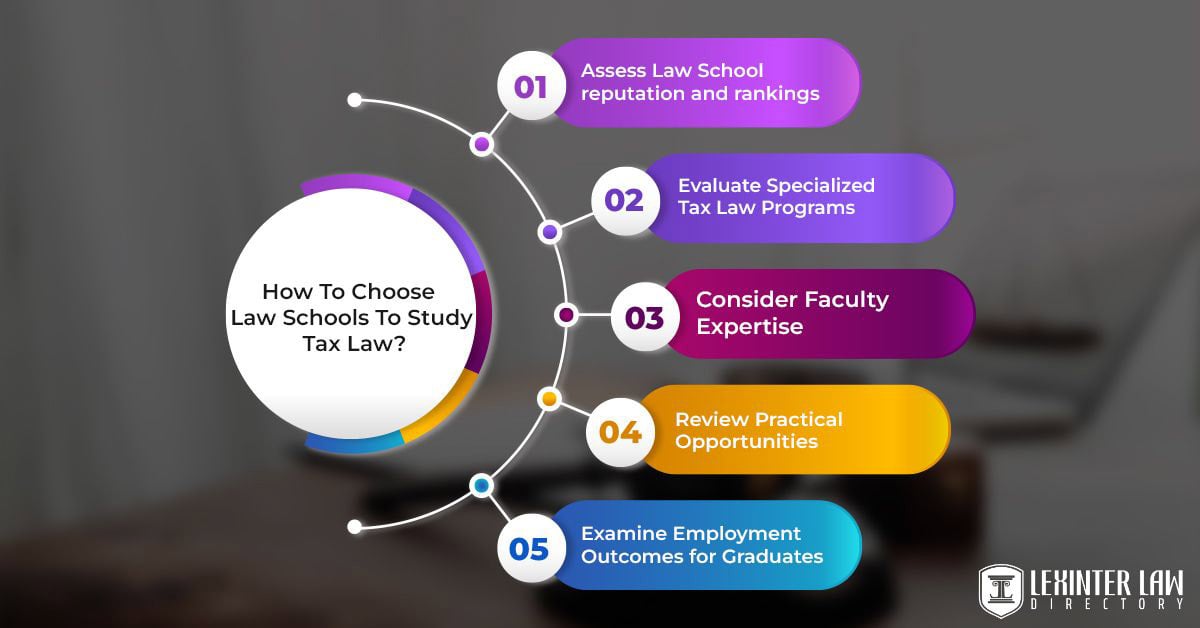

How To Choose Law Schools To Study Tax Law?

To choose law schools to study tax law, follow the five steps listed below.

- Assess Law School reputation and rankings. Research the reputation and rankings of law schools with strong tax law programs. Rankings from U.S. News & World Report and different reputable sources provide insights into academic quality and employer perceptions. Consider schools that consistently rank high in overall law school rankings and tax law specializations.

- Evaluate Specialized Tax Law Programs. Examine the specific tax law courses and programs offered by each law school. Look for schools offering practical experience through clinics and externships, which provide hands-on learning opportunities. Schools with renowned tax law faculties and diverse course offerings better prepare students for various careers in tax law.

- Consider Faculty Expertise. Investigate the expertise and reputation of the tax law faculty at prospective law schools. Professors who are recognized scholars and practitioners bring valuable real-world experience to their teaching. Faculty expertise greatly influences the quality of education and mentorship available to students.

- Review Practical Opportunities. Explore the practical training opportunities provided by law schools, including clinics, externships, and internships. Practical experience is crucial for developing the skills needed to succeed in tax law practice. Look for schools that emphasize experiential learning and provide access to diverse legal settings.

- Examine Employment Outcomes for Graduates. Review the employment outcomes for graduates specializing in tax law from prospective law schools. Top programs generally report high employment rates and competitive starting salaries for their graduates. Employment statistics and alumni success stories provide insights into the career prospects associated with each law school.

What Is Tax Law?

Tax law is the rules and regulations governing the collection of taxes by public authorities. Governments impose tax laws to finance their operations and provide public services. The power to levy taxes is generally recognized as a fundamental right of governments, enabling them to demand a portion of income or property from individuals and entities. The administration of tax law involves the processes and institutions responsible for implementing tax policies. Tax authorities, like the Internal Revenue Service (IRS) in the United States, oversee the collection of taxes, conduct audits, and enforce compliance. Tax law, in addition, highlights the legal aspects of taxation, focusing on the creation, administration, and enforcement of tax policies. The law includes determining tax liabilities, collecting taxes, and resolving disputes between taxpayers and the government.

Tax law covers various critical areas, including personal and corporate income taxation, estate and gift taxation, and international taxation. Tax law, in addition, addresses direct taxes and indirect taxes. Personal income tax laws dictate how individuals report earnings and claim deductions. Corporate tax laws govern how businesses calculate profits and tax obligations. Estate and gift taxes apply to transfers of wealth, ensuring that large transfers are appropriately taxed. International tax laws address the complexities of cross-border transactions and the prevention of double taxation, facilitating global business operations while ensuring tax compliance.

What Do Tax Lawyers Major In?

Tax lawyers major in various fields, including political science, economics, business administration, and finance. Political Science is a popular major, offering insights into government functions, legislative processes, and public policy. The major helps future tax lawyers understand the legal framework and regulatory environment in which tax laws operate. A major in political science enhances critical thinking and analytical skills, which are essential for interpreting and applying complex tax regulations. Economics is another excellent major for aspiring tax lawyers. Major in economics blends quantitative and qualitative analysis and covers topics like market behavior, economic policy, and financial systems, providing a thorough understanding of the economic context of tax laws. Business Administration and Finance are strong choices that focus on financial management, accounting principles, and corporate governance. The majors offer practical knowledge of how businesses operate, which is crucial for tax lawyers who work with corporate clients. An undergraduate major in Accounting provides a direct pathway to tax law. The major covers tax accounting, auditing, and financial reporting, all of which are directly applicable to tax law practice. Accountants are well-versed in tax regulations and compliance, making the transition to tax law relatively seamless.

Choosing the right major for a career in tax law involves considering fields that offer a strong foundation in law, economics, finance, or accounting. Economics is considered the best major for tax law due to its comprehensive coverage of financial systems and its analytical approach to understanding markets and policies. The major equips students with the ability to interpret complex financial data, which is crucial for tax lawyers who need to advise clients on tax planning and compliance. Economics provides a deep understanding of how taxes influence behavior and economic decisions, a critical aspect of tax law practice. Understanding economic principles helps tax lawyers grasp the broader implications of tax legislation and policy changes.

How To Become A Tax Lawyer?

To become a tax lawyer, follow the six steps listed below.

- Earn a Bachelor’s Degree. Start by earning a Bachelor’s degree in a relevant field, including accounting, finance, economics, or business administration. The majors provide a strong foundation in financial principles and analytical skills, which are essential for understanding tax law. Courses in the fields cover key topics, including financial accounting, macroeconomics, and corporate finance, which are directly applicable to tax law practice.

- Prepare for and take the LSAT. Prepare thoroughly for the Law School Admission Test (LSAT), which assesses reading comprehension, logical reasoning, and analytical thinking. Achieving a high score on the LSAT is crucial for admission to top law schools. A high score on LSAT, in addition, increases chances of getting scholarships.

- Enroll in Law School. Gain admission to an ABA-accredited law school and pursue a Juris Doctor (JD) degree. Choose a law school with a strong tax law program that offers courses like federal income tax, corporate tax, and international tax. Participate in relevant clinics and internships to gain practical experience.

- Pass the MPRE exam. Pass the MPRE (Multistate Professional Responsibility Examination) to meet the professional responsibility requirements for legal practice. The MPRE tests knowledge of ethical standards and professional conduct required of lawyers. Study the ABA Model Rules of Professional Conduct and take practice exams to become a tax lawyer.

- Pass the Bar Exam. The candidate must prepare for and pass the Bar exam in the state where he intends to practice. The Bar exam tests knowledge of general legal principles and specific state laws. Use Bar review courses, study materials, and practice exams to prepare thoroughly. Passing the Bar exam is mandatory to obtain a license to practice law and is one of the final steps to becoming a tax lawyer.

- Consider an LLM in Tax Law. Consider pursuing a Master of Laws (LLM) in Tax Law to deepen the expertise and enhance career prospects. An LLM program offers advanced coursework in tax legislation, policy, and practice, providing specialized knowledge that is highly valued by employers. The additional degree opens up opportunities in prestigious law firms, corporations, and government agencies.

How Long Would It Take To Study Tax Law?

It would take approximately eight years to study tax law. Studying tax law generally involves completing a Juris Doctor (JD) degree followed by a Master of Laws (LLM) in Taxation. The JD program generally requires three years of full-time study. Students must first complete an undergraduate degree, which generally takes four years. The total duration of the JD degree is around seven years, from the start of undergraduate education to the completion of law school. The JD program covers various areas of law, providing a broad legal foundation necessary for specialized studies in taxation. Aspiring tax lawyers pursue an LLM in Taxation after completing the J.D. degree. The specialized program generally takes an additional year of full-time study.

The timeline for becoming a tax lawyer varies depending on several factors, including the pace of study and the chosen path. Full-time students who follow a traditional route—four years of undergraduate study, three years for a JD, and one year for an LLM—must expect to spend approximately eight years in academic training. Part-time programs and work commitments generally extend the timeline to ten or more years. Students, in addition, must prepare for and pass the LSAT exam before entering law school, which adds up to a year of preparation time.

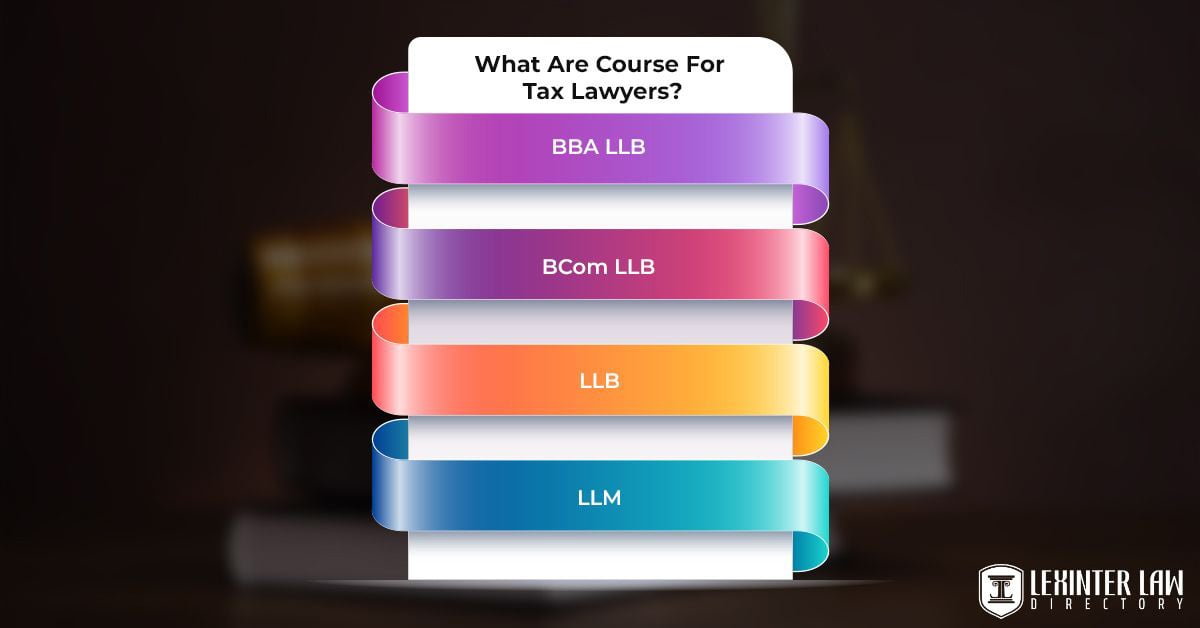

What Are Courses For Tax Lawyers?

The four courses for tax lawyers are listed below.

- BBA LLB: BBA LLB is an integrated undergraduate degree combining Business Administration and Law, lasting five years. The curriculum covers business management, accounting, and financial principles, providing a solid foundation for understanding corporate finance and taxation. Tax lawyers need a comprehensive understanding of how tax laws impact businesses, and BBA LLB provides the knowledge through its interdisciplinary approach.

- BCom LLB: BCom LLB is a five-year integrated degree that merges commerce and law. The program focuses on subjects like Accounting, Finance, Economics, Business Law, and Taxation Law. The course is ideal for students aspiring to become tax lawyers as it covers in-depth financial and commercial aspects of the law. Courses in taxation law, corporate taxation, and financial regulations are fundamental to the program.

- LLB: LLB, or Bachelor of Legislative Law, provides the foundational legal education necessary for any specialized legal practice, including tax law. The program includes core legal subjects, including Constitutional Law, Criminal Law, and Civil Law, and offers elective courses or specialized tracks in areas like Tax Law. The foundational knowledge is crucial for tax lawyers, who need to understand various legal frameworks.

- LLM: LLM, or Master of Laws, is a postgraduate degree generally completed in one to two years. The advanced law degree allows for specialization in areas including Taxation Law, International Law, Corporate Law, and Human Rights Law. An LLM in Taxation provides advanced, specialized training in tax law, covering topics such as international taxation, corporate taxation, and tax policy. The program is designed to deepen the understanding of tax laws and regulations.

Is The Tax Law Hard?

Yes, the tax law is hard due to various reasons. Tax law is complex and constantly evolving. Tax law requires a deep understanding of various statutes, regulations, and case law. Tax lawyers must stay updated with frequent changes in tax codes, which adds to the challenge. The intellectual demand in the field is high, as tax lawyers deal with intricate legal principles and detailed financial information. Tax law, in addition, involves substantial research and analysis. Tax lawyers spend a considerable amount of time interpreting tax legislation and regulations. Tax lawyers must understand the implications of tax laws on different transactions and provide accurate advice to clients. The necessity for detailed and thorough research makes tax law a challenging practice area. Junior tax lawyers face a steep learning curve, needing to master complex concepts quickly.

Tax lawyers need excellent analytical and problem-solving skills. Lawyers must identify potential tax issues in transactions and develop strategies to mitigate tax liabilities. The ability to think critically and creatively is essential for success in tax law, adding to its difficulty. Work in tax law is demanding and requires significant dedication. Tax lawyers, in addition, handle high-stakes matters where mistakes are costly. Lawyers must manage intense workloads and tight deadlines. Keeping up with the ever-changing tax landscape requires continuous learning and professional development as well.

What Is The Difference Between Tax Law And Bank Law?

The difference between tax law and bank law is that tax law governs the rules, policies, and laws related to the taxation process, whereas bank law regulates the operations and governance of banks and financial institutions. Tax law covers income tax, corporate tax, property tax, estate tax, and various forms of taxes. Bank law includes laws on the establishment, operation, and supervision of banks. Bank law, in addition, highlights regulations on financial products and services, lending practices, and customer protections.

Comparing tax law and banking law includes identifying the differences and similarities between the two laws. Tax law primarily focuses on the government’s collection of revenue. Tax lawyers deal with issues including tax compliance, tax planning, and tax disputes. Tax lawyers help individuals and businesses navigate complex tax regulations, optimize tax obligations, and resolve conflicts with tax authorities. The primary goal of tax law is to ensure fair and efficient tax collection to fund public services and infrastructure. Bank law, on the other hand, focuses on the regulation and supervision of banking institutions. Bank law covers areas including bank formation, operations, lending practices, and compliance with financial regulations. Banking law ensures the stability of the financial system by establishing rules for risk management, capital requirements, and consumer protection. A banking lawyer assists financial institutions in adhering to regulatory requirements, drafting contracts, and managing legal risks associated with banking operations.

Tax law and bank law share several similarities as well. The two fields require a thorough understanding of complex regulations and the ability to interpret and apply the laws to real-world situations. Tax and banking lawyers must stay updated on legislative changes and evolving legal standards. The two areas of law, in addition, play a critical role in ensuring compliance, mitigating risks, and protecting the interests of their clients. Tax lawyers and banking lawyers work for individuals, businesses, or financial institutions.

How To Find A Good Tax Lawyers Near Me With Lexinter?

To find a good tax lawyer near me with Lexinter, individuals must follow the simple guidelines described on the website. Individuals must first visit Lexinter.net, the official website of the Lexinter Law Directory. Accessing the site directly ensures accurate and detailed information. Explore the “about us” section to understand the directory’s objectives and mission, highlighting Lexinter’s commitment to reliable attorney listings.

Start the search by entering relevant details into the search bar on the homepage. Enter the city, desired radius in miles, and select the desired type of lawyer. Click the submit button to generate a list of available tax attorneys based on the criteria. The tailored search helps in finding specialized legal professionals within a specific vicinity.

Review each attorney’s profile to assess qualifications, experience, and suitability for specific legal needs. Lexinter provides comprehensive profiles, including the lawyer’s photo, the firm the lawyers represent, and their office address. Contact options, including phone numbers and “schedule an appointment” buttons, are available. The detailed information allows for a brief background check, ensuring an informed decision about the attorney’s capability to handle tax issues. Lexinter distinguishes itself by conducting thorough background checks on attorneys before listing them, ensuring the information provided is accurate and up-to-date. The platform’s user-friendly interface simplifies navigation through different specializations and locations.